Opening the mortgage underwriting box has been a key policy focus since the financial crisis. Early post-crisis easing efforts were aimed at refinancings, leading to the creation of HARP and “FHA-HARP.” More recently, policy efforts have shifted towards purchase originations and drawing more first-time homebuyers into the market. But progress has been impeded by lenders’ concerns over loan putback risk stemming from the Government Sponsored Enterprises' (GSE) reps and warrants.

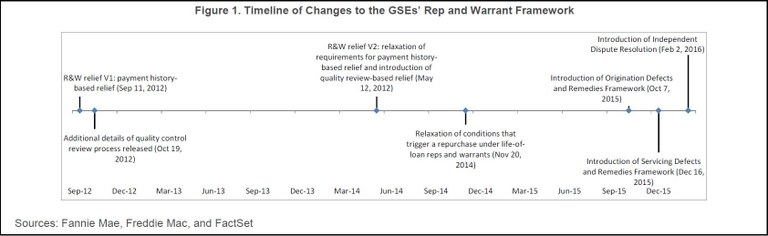

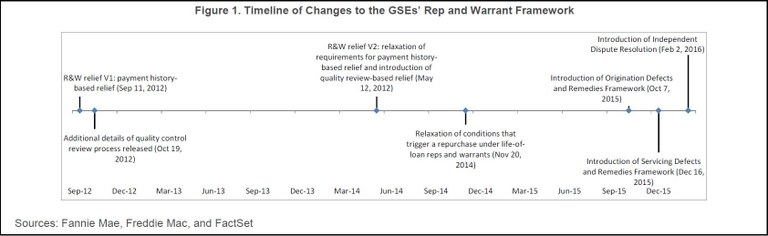

Over the past several years, the GSEs and FHFA have worked closely with mortgage lenders to revamp the rep and warrant framework with the goals of reducing uncertainty for lenders, increasing clarity and transparency, and encouraging lenders to loosen mortgage underwriting standards. Change has been gradual, as shown in the timeline below, but the GSEs recently completed the development phase of the framework. With all of the elements finally in place, it’s a good time to review the new framework in its entirety and examine its impact so far. The new framework has implications on the flow of mortgage credit and, therefore, has the potential to impact not just the housing market and agency mortgage backed security (MBS) fundamentals, but the broader economy as a whole.

Representations and Warranties Explained

Representations and warranties, or reps and warrants, are the set of assurances that lenders make to the GSEs regarding the quality of the loans that they originate and sell to the GSEs. Reps and warrants relate to factors including mortgage underwriting, borrower eligibility, the mortgage product, the property, and the project in which the property is located. The Lender Contract gives the GSEs the right to put back to lenders loans that violate any of the reps and warrants. Reps and warrants allow the GSEs to purchase and guarantee loans without having to perform a thorough credit evaluation on each loan, and, as such, they play an important role in the US housing finance market.

Following the housing market crash, mortgage default rates increased dramatically, and the GSEs became more aggressive in terms of enforcing the reps and warrants. In some cases, lenders were required to repurchase loans from the GSEs for relatively minor breeches with little obvious impact on credit risk. Lenders were also forced to repurchase loans because of changes in borrowers’ financial situations that occurred several years after origination. Furthermore, there were inconsistencies in the timing of enforcement, leading to greater uncertainty for lenders. Lenders responded by applying credit overlays (i.e., much stricter credit thresholds than the GSEs require) in order to minimize default rates and losses. As such, reps and warrants and loan putback risk have inadvertently hampered the flow of credit in the post-crisis period. Policymakers recognize the role that putback risk has played in preventing mortgage lending standards from normalizing and have made many changes to the rep and warrant framework to address lenders’ concerns.

Key Elements of the New Framework and Their Impact

Broadly speaking, the new framework incorporates four key changes:

- Relief from repurchase requirements on loans that satisfy specified criteria

- Relaxation of life-of-loan rep and warrant enforcement

- Formalization of alternatives to repurchase

- Independent dispute resolution (IDR)

The first set of rep and warrant changes that went into effect in 2013 and 2014 appear to have had only a modest impact so far. But some of the more recent changes could spur additional easing. The broader availability of alternative remedies (announced on October 7, 2015) could encourage a loosening of standards, especially on the part of smaller, more cash-constrained lenders who will now have the opportunity to cure a significant defect without repurchasing the loan. The new IDR process (announced on February 2) is another positive step which should provide some reassurance to lenders.

Furthermore, the GSEs will continue to gather feedback from mortgage lenders and work to refine the framework in the months ahead. The GSEs and FHFA are also working on a complementary initiative to grant appraisal-related rep and warrant relief. Ongoing incremental policy changes, combined with a more stable housing and labor market, should support continued gradual easing in the medium to longer term and should help to steer the market towards an equilibrium.

Read the White Paper: The FactSet Prepayment Model.