At the start of 2015, analysts were projecting earnings growth of 7.4% and revenue growth of 2.7% for the year. However, after two straight quarters of earnings declines and three straight quarters of revenue declines (and with earnings and revenue declines predicted for Q4 as well), analysts are now calling for year-over-year declines for both earnings and revenues for all of 2015.

Here we summarize the expected earnings declines for the S&P 500 for 2015, with a focus on the top and bottom performing sectors, industries and companies for the year, and analyze some of the factors that are contributing to the projected declines for the index in 2015.

First Annual Decline in Earnings (-0.7%) For S&P 500 Since CY 2009

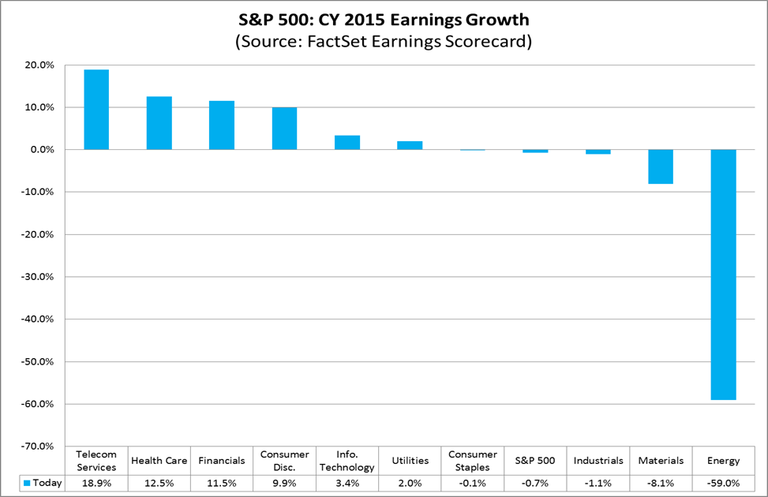

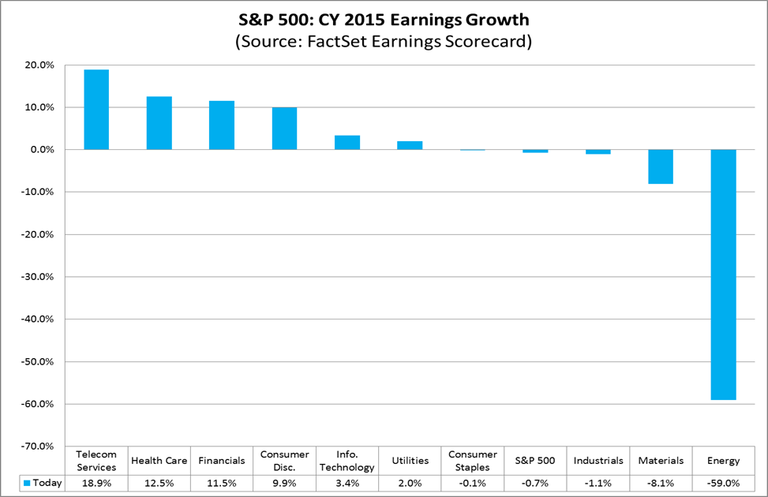

The estimated earnings decline for CY 2015 is -0.7%. If this is the final earnings decline for the year, it will mark the first time the index has seen a year-over-year decline in earnings on an annual basis since CY 2009 (-8.0%). Six sectors are projected to report year-over-year growth in earnings, led by the Telecom Services, Health Care, Financials, and Consumer Discretionary sectors. Four sectors are projected to report a year-over-year decline in earnings, led by the Energy and Materials sectors.

Earnings Growth Sectors

Of the sectors projected to report year-over-year growth in earnings The Telecom Services sector is expected to report the greatest earnings increase at 18.9%, followed by the Health Care sector which saw 12.5% growth. The Financial and Consumer Discretionary sectors also posted strong earnings growth of 11.5 % and 9.9% respectively.

In most of these cases, sector growth was often correlated to strong growth within handful of companies in a given sector.

For example, AT&T is predicted to be the largest contributor to Telecom Services earnings growth, with a 2015 EPS estimate of $2.69, compared to last year’s EPS of $2.51. Absent the AT&T’s success, overall Telecom Services sector earnings growth would fall to 12.1%.

Similarly, Bank of America and Citigroup are projected to be the largest contributors to earnings growth for Financial. While litigation and regulatory issues pushed the EPS of these organizations down in 2014, both saw a considerable rebound in 2015. If these two companies were excluded from overall growth rates, the expected earnings growth for the Financials sector would dip to 1.2%.

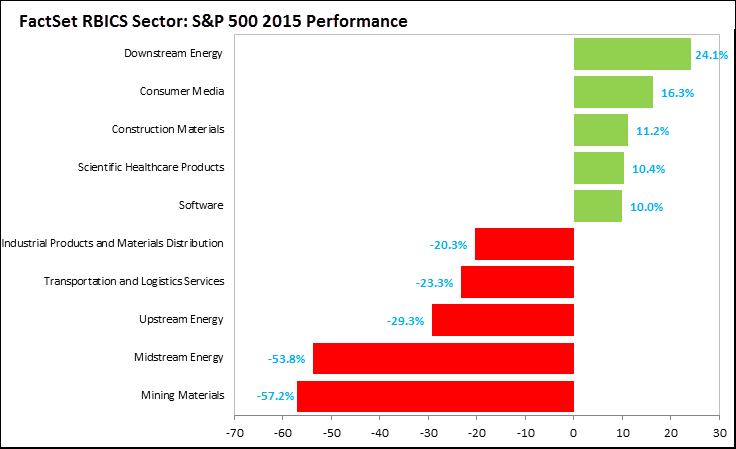

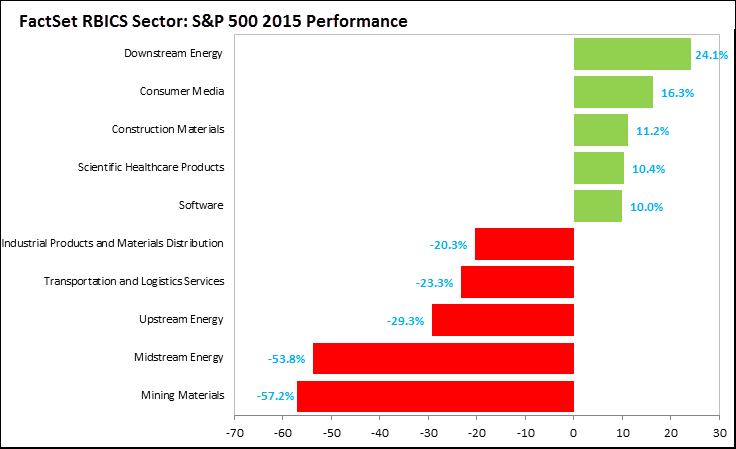

Coupled with strong earnings growth for Auto Manufactures, Amazon and Netflix lead the charge for the Consumer Discretionary sector. Both companies saw their stock prices more than double by the end of the year. According to the FactSet Revere Business Industry Classification System (RBICS), the Consumer Media sector was the second best performing RBICS sector and the top performing sector out of the Consumer Production and Consumer Sales economies (Economy represents the most general level in the RBICS). The Consumer Media RBICS sector gained 16.3% during the year led by the Consumer Web Navigation and Consumer Print and Electronic Media sub-sectors. The heavily weighted Alphabet and Facebook drove the gains in these sub-sectors.

Earnings Decline Sectors

Despite positive gains in the sectors outlined above, overall earnings growth was derailed by considerable declines stemming from two sectors; Energy and Materials.

The Energy sector is predicted to report the largest year-over-year decline in earnings (-59.0%) of all 10 sectors. Six of the seven Energy sub-industries are expected to report a year-over-year drop in earnings: Coal & Consumable Fuels (-135%), Oil & Gas Exploration & Production (-115%), Integrated Oil & Gas (-57%), Oil & Gas Equipment & Services (-54%), Oil & Gas Drilling (-30%), and Oil & Gas Storage & Transportation (-23%). On the other hand, the Oil & Gas Refining & Marketing sub-industry (27%) is the only sub-industry expected to report earnings growth for the year.

However, despite a considerable slowing of overall Energy Sector growth, there were still pockets of the Energy sector that performed very well throughout the year.

According to the FactSet Revere Business Industry Classification System (RBICS), the Downstream Energy sector was the best performing RBICS sector in 2015. The RBICS is a comprehensive structured taxonomy that offers a single sector mapping of publicly traded companies based on their primary lines of business. RBICS offers a high level of precision through a bottom-up approach of classifying companies first according to the products and services they sell.

The RBICS Downstream Energy sector increased 24.1% in 2015 as petroleum refineries, like Valero and Tesoro, saw their stocks post double-digit gains (42.8% and 41.7%, respectively). Contrastingly, Midstream and Upstream Energy companies were two of the worst performing RBICS sectors. During the year, these sectors declined 53.8% and 29.3% respectively. The only RBICS sector that performed worse was the Mining Materials sector, which fell 57.2% on aggregate in 2015.

In addition to Energy, The Materials sector is projected to report the second largest year-over-year decline in earnings (-8.1%) of all 10 sectors. At the industry level, two of the four industries are expected to report a year-over-year decrease in earnings: Metals & Mining (-60%) and Chemicals (-3%). The Metals & Mining industry is also the largest contributor to the projected earnings decline for the sector. If this sector is excluded, the estimated earnings growth rate for the Materials sector would increase to -0.1%.

Likely Factors

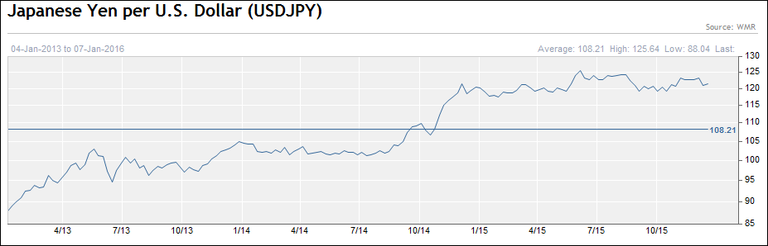

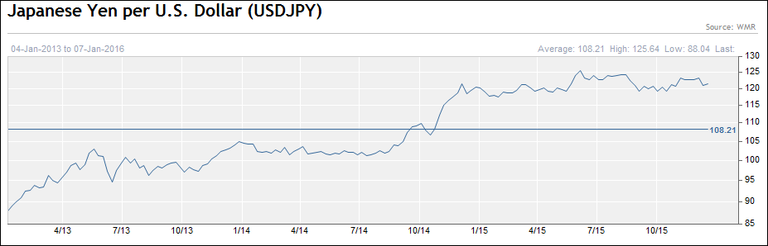

One factor cited by a number of S&P 500 companies as contributing to weaker year-over-year earnings and revenues is the stronger U.S. dollar. The dollar was stronger in 2015 relative to 2014 for the euro, the yen, and a number of other currencies. In 2014, one dollar was equal to $0.75 euros on average. For 2015, one dollar was equal to $0.92 euros on average. In 2014, one dollar was equal to $105.85 yen on average. For 2015, one dollar was equal to $121.06 yen on average.

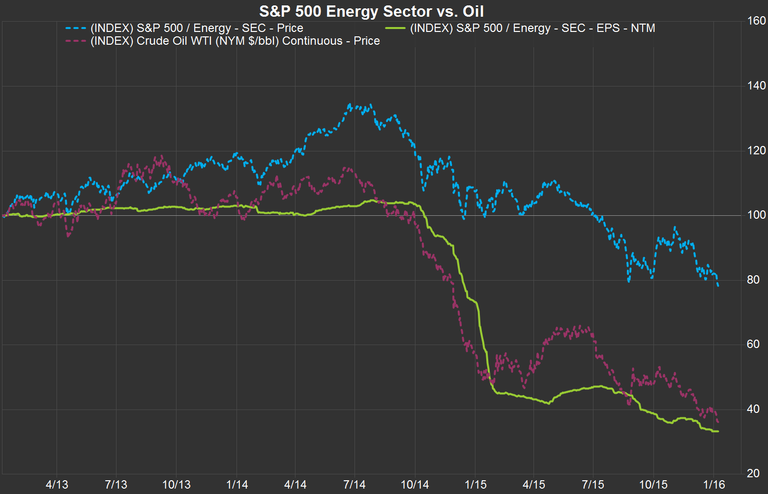

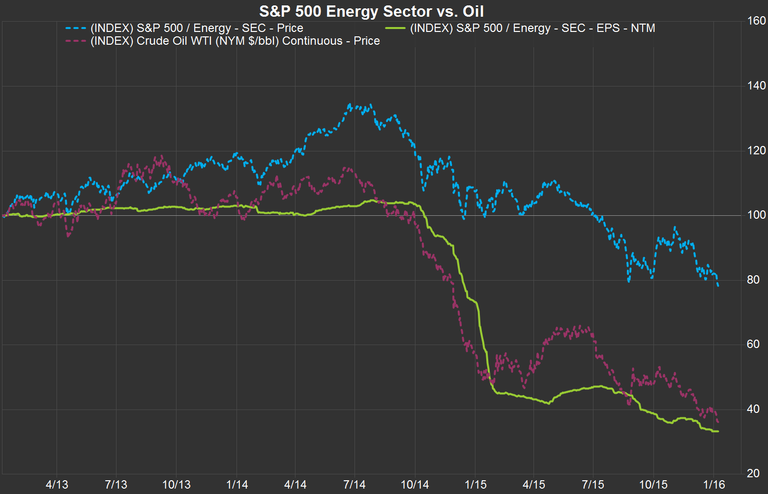

Another factor contributing to the expected year-over-year decline in earnings and revenues for the S&P 500 for 2015 is lower oil and gas prices. During 2015, the price of crude oil decreased by 30.8% (to $37.04 from $53.27). As a result, the average price of oil for 2015 ($49.71) was more than 46% lower than the average price in the year-ago quarter ($73.19).

Downstream Energy Outperforms

While The Energy sector fell 23.6% as large natural gas producers, like Chesapeake and CONSOL, felt the effects of plunging oil prices, there were still pockets of the Energy sector that performed very well throughout the year.

According to the FactSet Revere Business Industry Classification System (RBICS), the Downstream Energy sector was the best performing RBICS sector in 2015. The RBICS is a comprehensive structured taxonomy that offers a single sector mapping of publicly traded companies based on their primary lines of business. RBICS offers a high level of precision through a bottom-up approach of classifying companies first according to the products and services they sell.

The RBICS Downstream Energy sector increased 24.1% in 2015 as petroleum refineries, like Valero and Tesoro, saw their stocks post double-digit gains (42.8% and 41.7%, respectively). Contrastingly, Midstream and Upstream Energy companies were two of the worst performing RBICS sectors. During the year, these sectors declined 53.8% and 29.3% respectively. The only RBICS sector that performed worse was the Mining Materials sector, which fell 57.2% on aggregate in 2015.

Analysts See Earnings and Revenue Growth Returning in 2016

Although earnings and revenue declines are projected for the S&P 500 for 2015, analysts do predict earnings growth (7.5%) and revenue growth (4.3%) to return in 2016. For more details on these 2016 projections, see our 2016 preview.

Insight/Author%20Bios/JohnButters2.jpg)