An interest rate swap is a legal contract entered into by two parties to exchange cash flows on an agreed upon set of future dates. The interest rate swaps market constitutes the largest and most liquid part of the global derivatives market. At the end of June 2014, the total notional amount of outstanding contracts was $563 trillion, representing 81% of the over-the-counter global derivatives market, and the gross market value of interest rate derivatives totaled $13 trillion.

Each stream of cash flows is referred to as a “leg.” A plain vanilla interest rate swap has two legs: a fixed leg and a floating leg. The fixed leg cash flows are set when the contract is initiated, whereas the floating leg cash flows are determined on “rate fixing dates,” which occur close to the beginning of the payment period and are specified as part of the contract terms and conditions.

The current market value of an interest rate swap is determined by the prevailing interest rate environment on the valuation date, represented by the set of current interest rate curves. There are two important curves for valuing interest rate swaps – the overnight curve and the floating rate index curve relevant to the jurisdiction, which for plain vanilla swaps is the Interbank Offered Rate (IBOR).

| Jurisdiction |

Relevant Overnight Curve |

Overnight Day Count |

| USD |

U.S. Federal Reserve (federal

funds rate) |

ACT/360 |

| GBP |

Sterling Overnight Index

Average (SONIA) |

ACT/365 |

| JPY |

Tokyo Overnight Average Rate

(TONAR, also called MUTAN) |

ACT/365 |

| EUR |

Euro Overnight Index Average

(Eonia®) |

ACT/360 |

| CHF |

Swiss Average Rate Overnight

(SARON®) |

ACT/360 |

A crucial difference between the overnight rates and IBOR indices is that overnight rates are averages of uncollateralized overnight lending rates that actually transact in the market, not averages of hypothetical funding rates that do not transact. The market tends to show that the overnight rates are more representative of the lowest credit risk; therefore, the overnight rate is the closest proxy to the risk-free rate.

Furthermore, since the overnight rate is representative of an actual market transaction, it is less prone to manipulation by the participants that determine the rate. LIBOR rates are set by a polling procedure at 11:00 a.m. GMT each day. USD LIBOR rates are determined by asking 18 of the member banks what rate they could receive to borrow uncollateralized funds in the interbank market. The calculation agent collects the quotes and removes the top four and bottom four. The average of the remaining 10 quotes defines LIBOR and is then published by market data providers.

The overnight rate curve is constructed using a bootstrapping and interpolation process based on the liquidly traded market instruments that reference the overnight rate, usually Overnight Index Swaps (OIS) instruments.

The IBOR curve is constructed using a bootstrapping and interpolation process based on the prices of liquidly traded contracts that reference the IBOR rate. In order of maturity, these instruments are cash deposits up to around one year, followed by Eurodollar futures with maturities up to two years, and interest rate swaps with maturities from two years to 30 years. FactSet obtains these market data quotes daily from Tullett Prebon.

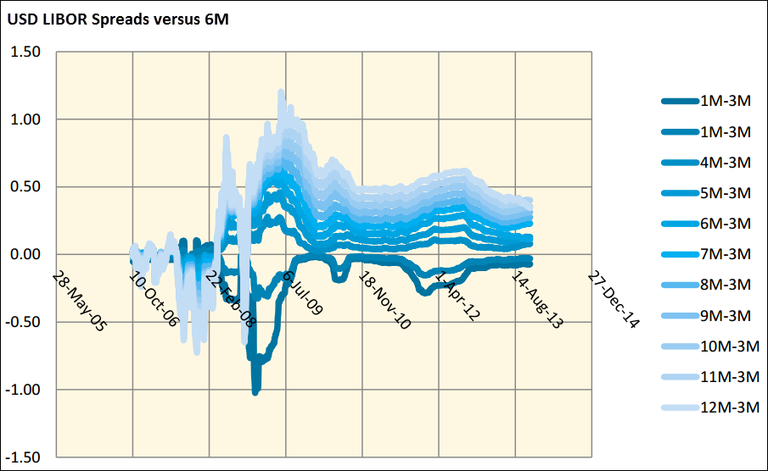

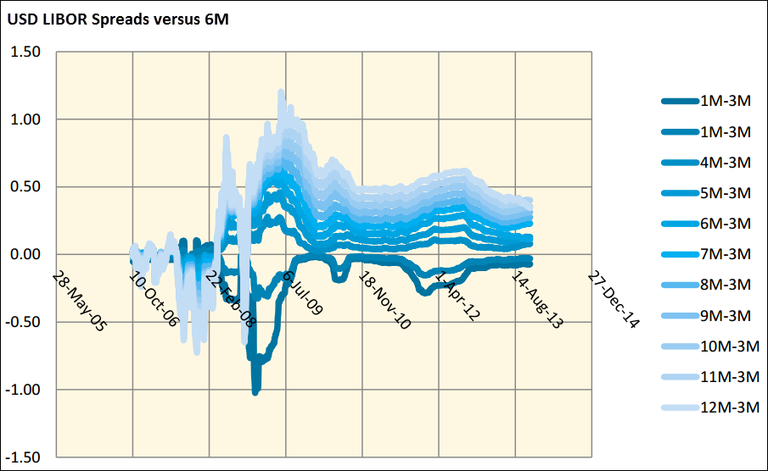

In my latest white paper, I summarize the important aspects of swap valuation, from the calculation of the cash flows to the determination of market value from swap initiation to maturity. While there are many similarities to pricing bonds, the subtle differences can lead to mispricing, incorrect attribution, and counterparty disputes. Furthermore, this paper highlights the importance of incorporating non-zero LIBOR spreads that appeared in the LIBOR quotes after the financial crisis of 2008.