Via FactSet StreetAccount

Global bond yields have seen a notable fall in recent days, with US treasury yields at their lowest levels since February, and the German Bund and UK Gilts hovering around record lows. From policy issues to geopolitical risks, the contributing factors leading to current bond performance are wide ranging, yet imperative to understand. In an effort to illuminate the overall issue and distill the contributing factors into succinct intelligence, our market analysts at StreetAccount summarized the points.

Overview

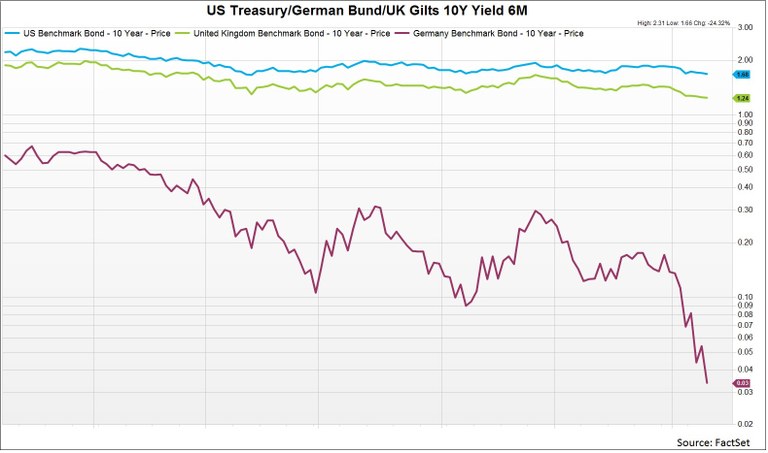

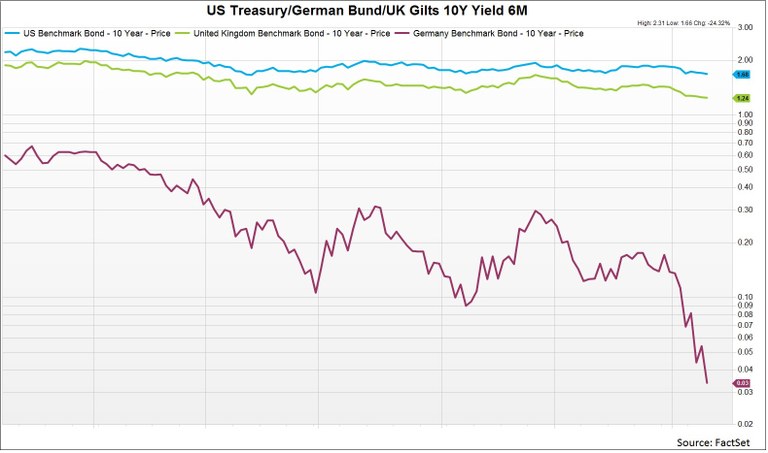

One of the notable features of the market since the recent US payrolls miss has been a broad-based fall in global bonds yields. US Treasuries are stronger across the curve, with 10-year yields moving to the lowest levels since February at ~1.66%, while the German Bund and UK Gilts have also hit record lows at ~0.03% and ~1.22%, respectively, before steadying.

There are number of factors cited behind the recent fall in bond yields. These include ongoing central bank policy stimulus and expectations of lower-for-longer rates, ongoing reach-for-yield, weak global growth and low inflation expectations, China concerns, and geopolitical risks. Below, we take a look at some of the highlights.

Central Bank Policy Accommodation

Since the disappointing May payroll reports, there has been a marked shift in Fed rate hike expectations. The market priced out expectations of a June hike and the futures market is now showing ~24% chance for a July move, rising to ~36% in September and ~43% risk for a December hike. Note that market expectations were above 50% for a July move prior to the employment report. Meanwhile, there are also an increasing number of reports arguing that the European Central Bank (ECB) will be forced to expand its quantitative easing program later this year in order to meet its price stability mandate. Furthermore, market expectations for more Bank of Japan (BoJ) stimulus by July picked up after the BoJ unexpectedly left policy unchanged in April. In addition, the Bank of England (BoE) is also expected to leave rates on hold for an extended period due to weak fundamentals and also left the option of further easing on the table in the event of Brexit last month.

Reach-For-Yield

There has been more attention on investor reach-for-yield as the ECB started its corporate bond buying program this week. A number of reports have pointed to the increased demand for US Treasuries and UK Gilts as the average yield on investment grade euro-denominated debt moved under 1% and a number of benchmarks in the Eurozone core moved towards zero in the belly of the curve. Several reports have highlighted that ~$10T worth of global bonds trade with negative yields. There are some thoughts that the relative attractiveness of US yields was a factor in yesterday's US T-Note auction, which saw indirect bidders take a record 73.6%. In addition, several reports have noted investors positioning for capital gains in some benchmarks despite some concerns of crowded positioning.

Related: The Hunt for Alpha in Fixed Income

Weak Global, Inflation Outlook

The World Bank was the latest leading institution to revise down its global growth outlook this week, cutting it by 0.5% to 2.4%, due to potential for a weaker-than-expected slowdown in emerging markets and diminished confidence in the effectiveness of central bank policies. Additionally, inflation expectations also remain weak globally despite the recent recovery in oil prices to the strongest levels since July 2015. Note that Fed Chair Yellen has noted the decline in inflation expectations and the ECB also warned of downside risks and potential for second round effects. Recall that it made a slight upward revision to its 2016 HICP forecasts from 0.1% to 0.2% last week. A number of reports have pointed out that the very modest ECB inflation projections against a backdrop of oil price rises suggests it will not meet its inflation target without further stimulus.

China Concerns

China's May inflation data received some attention overnight after it unexpectedly slowed to 2% year-over-year after April's 2.3% increase, which was below the 2.2% consensus, following a drop in food price inflation. Producer prices showed some improvement, declining by 2.8% year-over-year compared with April's 3.4% drop, and better than the expectations for a 3.3% fall. There were some thoughts that this could provide China with room for easing after People's Bank of China assistant governor Ying said earlier this week that there was room for further stimulus. However, other economic indicators have been relatively stable. Of note, China exports have benefited from the weakening in trade-weighted yuan and there was notable depreciation vs the dollar in May, which revived concerns over another wave of deflationary pressure.

Geopolitical Risks

An ongoing feature of the market has also been geopolitical risks, with the UK voting on EU membership on June 23 and Spain holding its second general election in less than a year on June 26. Brexit has been cited as one of the biggest near-term risks for markets and the global economy. The growing tide of populism was also recently highlighted in the ECB's financial stability report and there are concerns that a vote for Brexit could result in political contagion across the EU. Meanwhile, the US election is also another event risk that could cause turbulence for the market later this year. Given Donald Trump's performance in the Republican nomination process, the possibility of a Trump presidency has heightened concerns over protectionism and policies that would weaken the US's fiscal position.

Related: In Search of the Brexit Hedge

This synopsis highlights the complex, disparate factors contributing to bond yields and global market performance. Understanding these individual factors allows you to react to their shifts, and position yourself intelligently.

Learn more about FactSet StreetAccount.