How do you know which analysts on your team are outperforming others? Can you separate those with skill from those with luck? How are you accounting for gaps in communication or thinking between your analysts and PMs? How well are you linking compensation with performance?

The answer lies in integrating a comprehensive research management system (RMS) with your firm's portfolio analytics platform, which will give decision makers key insights into the behavior and results of their analysts. Here’s how to construct an effective APM solution that can help you quantify the impact of analyst research and answer questions like the ones above.

1. Establish the Framework

What is your recommendation scheme, and is it uniform across analysts, sectors, and regions? How is an analyst’s investible universe determined? What is the appropriate benchmark for each analyst? Answer these kinds of questions to create a straightforward solution that consistently measures your team.

2. Invest in Technology

Make sure the tools are in place to help you turn data aggregation and performance analysis into an automated process, free from the risk of human error.

You’ll need a research management platform, like FactSet RMS, where your analysts can store, retrieve, and share their research, notes, ideas, and recommendations. This platform should boost cross-firm collaboration and ensure continuity even when an analyst leaves the firm. This is where your APM solution will begin mining data.

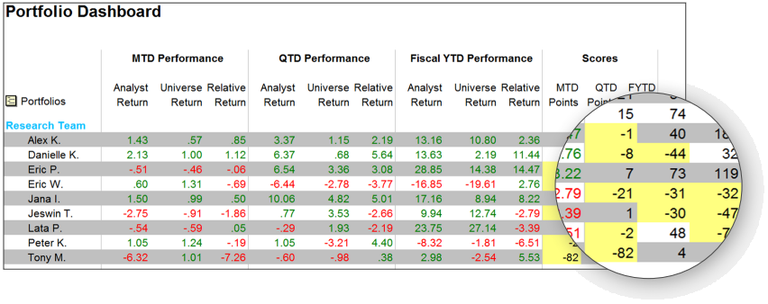

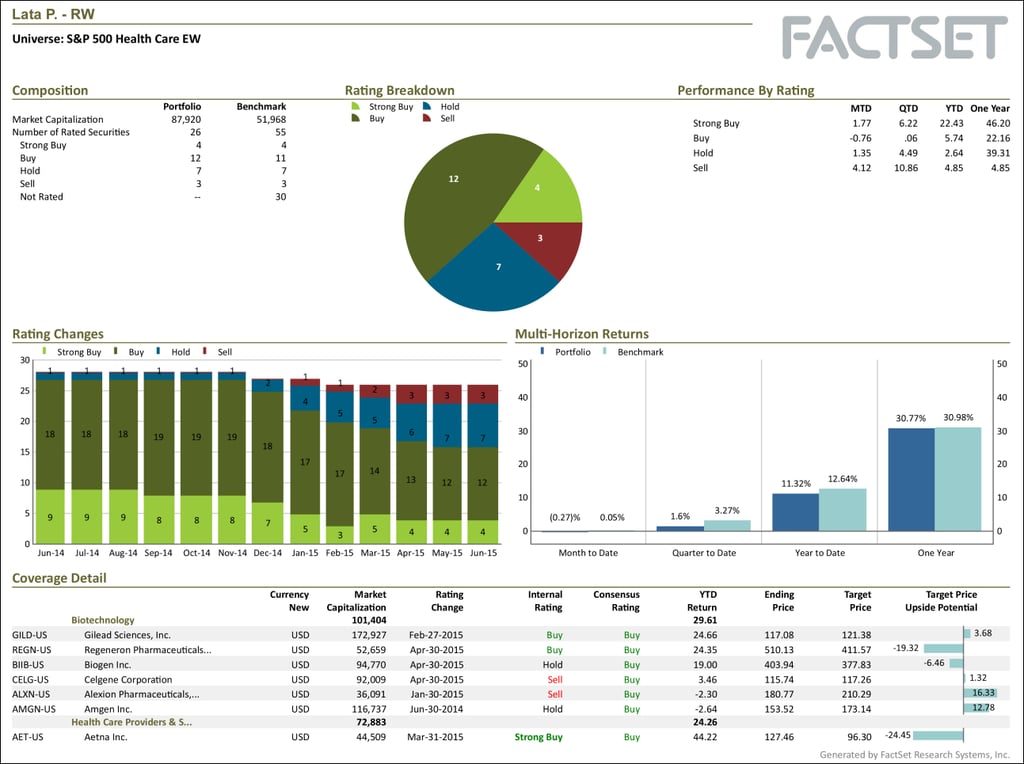

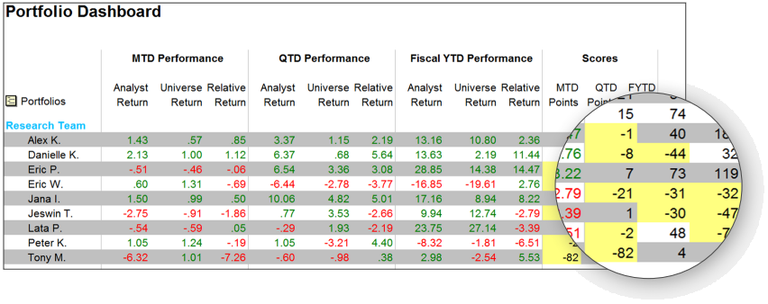

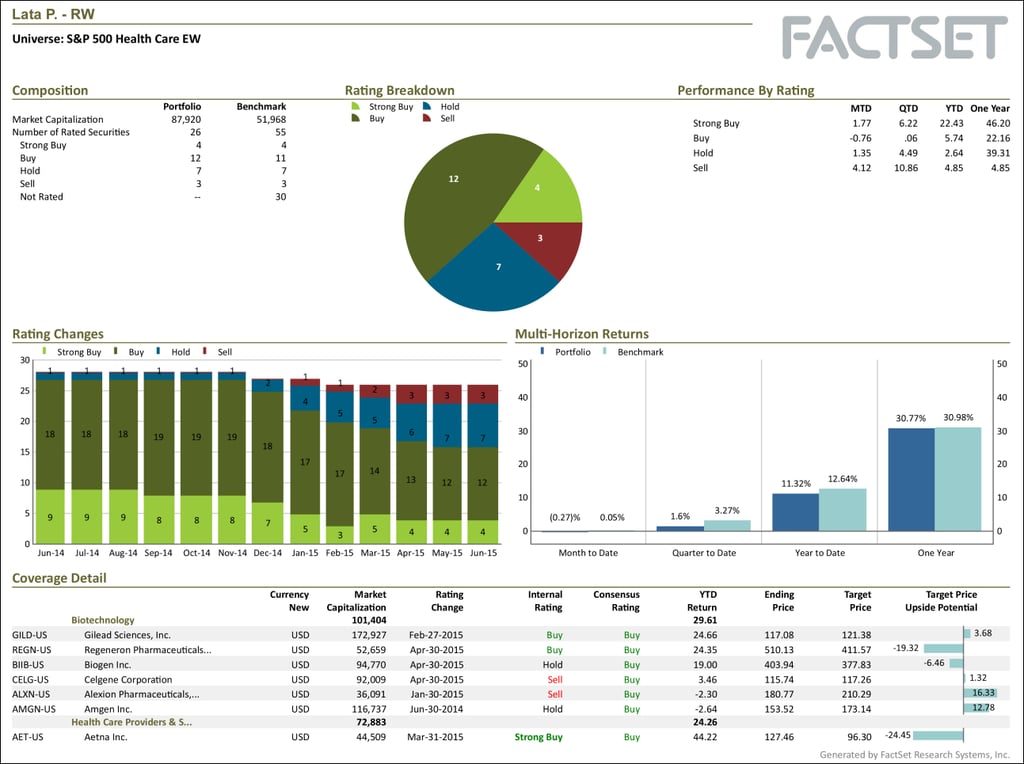

You’ll also need a strong, flexible analytics engine that will allow you to review your research data and identify key, decision-driving insights. Analysis could include the absolute and relative performance of your analysts’ decisions, which analysts had the best returns, and how often your portfolio managers took the advice of your analysts.

3. Involve the Right People

It will be critical that your analysts make consistent use of your RMS platform. An explanation of how the data will be used—to help give analysts credit for their work and ensure compensation is commensurate with individual performance —will be more than enough incentive.

4. Build Meaningful Metrics

Metrics should be quantifiable, and must directly impact your firm’s performance. Start with these questions:

- Which analyst had the best absolute returns? Which one had the best returns relative to their benchmark?

- How frequently did strong buys and buys outperform sells?

- How frequently and by what deviation were internal ratings consistent with broker forecasts?

- How do analyst rating changes compare to price fluctuations; specifically, do rating changes lead or lag price changes?

5. Create and Automate High-Level Reports

Combine summary information for multiple portfolios so that all key data points such as holdings, returns, and predicted risk analysis are easy for even the busiest CIO or Director of Research to monitor. These overview reports can be designed to your firm’s specifications (including your brand’s logo, colors, and disclaimers) and display summary information for multiple analysts so that key data points are easy for senior management to review.

6. Turn Insight into Action

By this time, you’ve built a seamless solution that allows you to review the impact your analysts’ research has on your firm’s results. Now what do you do with this information?

- More accurately and holistically provide performance evaluations. You now have quantitative information to supplement the traditional qualitative information you may have relied on in the past. Leverage these findings to make sure you’re appropriately compensating your best performers.

- Look for analysts who consistently outperform the rest of the team. Work with them to understand what has contributed to their results, and apply these learnings to weaker performers. Take note of their future recommendations to make sure successful ideas don’t go unnoticed.

- Use this data to recognize whether there are sectors or industries that aren’t being as thoroughly researched as others, or for aggregations in any one area.

- Address gaps in communication. Do you have an analyst that’s made consistently good recommendations that your portfolio manager hasn’t acted on? Make sure divergences in thinking are resolved.

- Recruit! When speaking with desirable candidates, showcase the fact that their performance will be evaluated on an individual basis. This can be incredibly compelling for an analyst that’s confident in their own abilities and would like recognition for their contributions.

Insight/Author%20Bios/Lata%20Prabhakar%20Insight.jpg)