The Basics

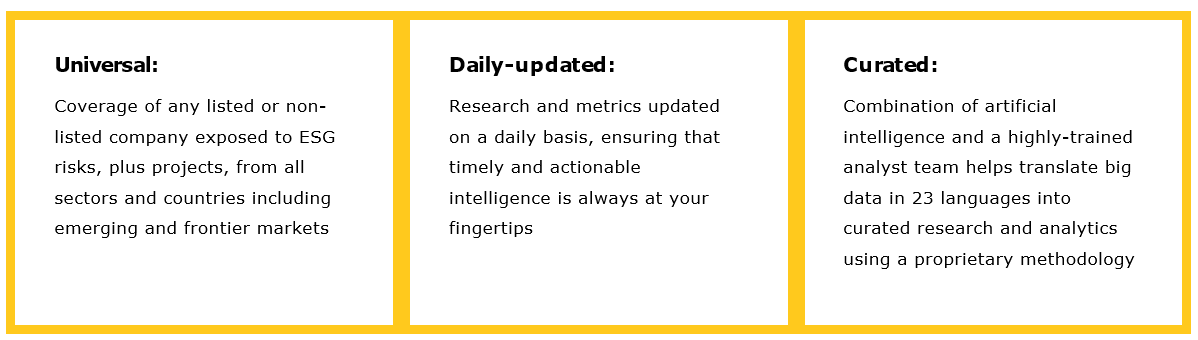

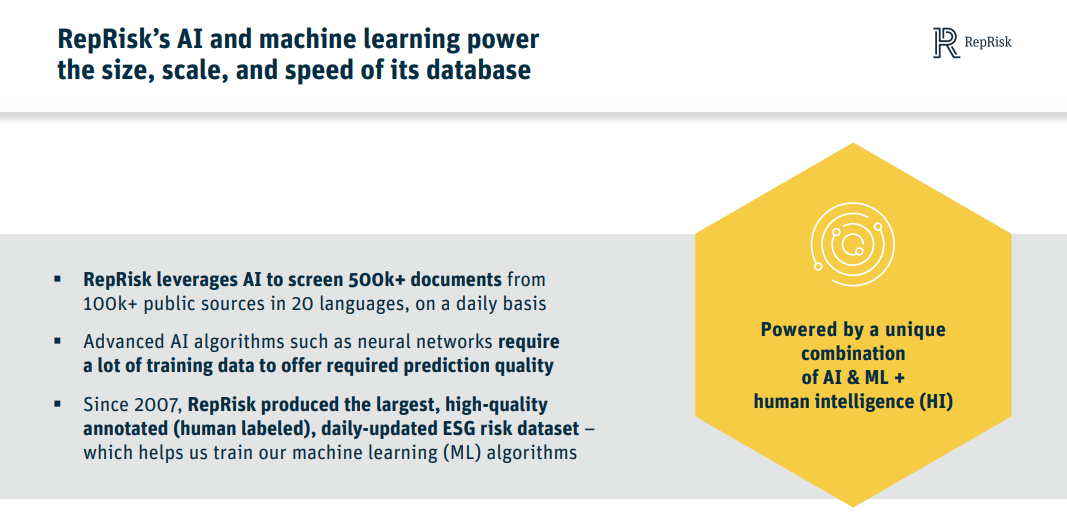

RepRisk is a pioneer in ESG data science that leverages the combination of artificial intelligence (AI) and machine learning with human intelligence to systematically analyze public information and identify material ESG risks. Within the landscape of ESG research, RepRisk exclusively focuses on risks; it systematically captures and analyzes adverse ESG and business conduct information that can have a reputational, compliance, and financial impact on a company. RepRisk translates big data into actionable research, analytics, and risk metrics in 23 languages on a daily basis. With detailed breakouts of the environmental, social, and governance factors as well as a proprietary ESG risk metric, the RepRisk Index (RRI) makes it easy to quantify a company or portfolio’s exposure to ESG-related risks.

Data is collected, aggregated, and analyzed from over 100,000 media, stakeholder, and other third-party sources. This outside-in perspective helps you assess whether a company’s policies and processes are translating into actual performance on the ground.

The Applications

Use Case

|

Description

|

|

Quantitative Research

|

New source of alpha for quantitative investment models

|

|

Asset Allocation

|

Overweight / underweight regions or sectors based on aggregated ESG factors

|

|

Negative/ Exclusionary Screening

|

Exclude certain companies from your fund or portfolio to meet your internal policies on certain sectors, companies, or practices based or on specific ESG criteria

|

|

Norms-Based Screening

|

Screening of investments against minimum standards of business practice based on international norms

|

|

Event Detection

|

Identify risk incidents related to negative ESG events

|

|

Discretionary Managers

|

Create screens for a given sector to identify desirable and undesirable companies based on ESG values

|

|

Compliance and Portfolio Management

|

Monitor risk incidents over time and assess ESG compliance of your portfolio, including identifying laggards or companies with consistently high ESG risk exposure that needs further action. RepRisk's data feed also gives you the ability to track momentum of RRI changes over time

|

The Coverage

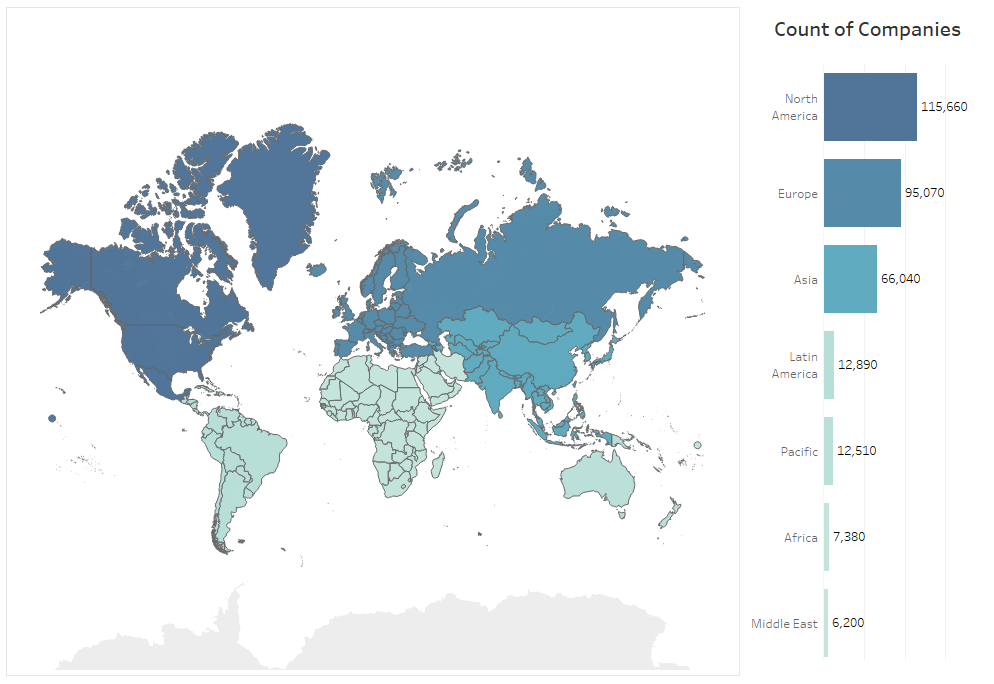

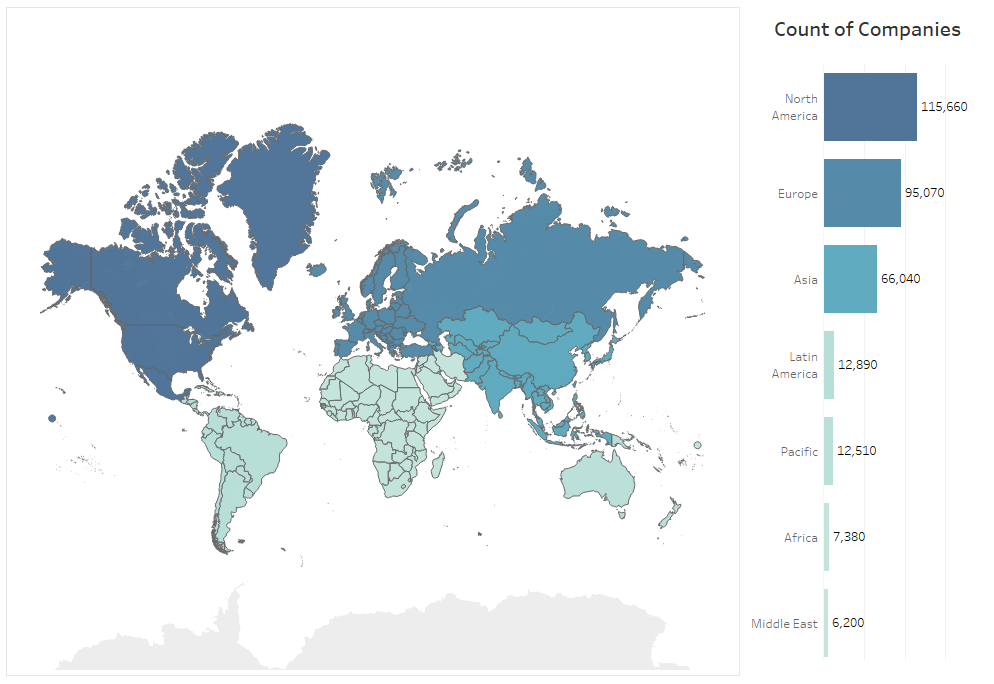

Thanks to its unique event- and issues-driven research approach, RepRisk offers universal coverage and captures any company exposed to ESG risks—regardless of size, sector, or country of headquarters or operations, or whether the company is public or private.

As of July 2022, RepRisk has identified over 200,000 companies with risk incidents; this number will continue to grow as new incidents captured and updated daily. RepRisk provides summaries of the risk incidents across the globe as well as proprietary, company-specific RRI scores. A rules-based research methodology helps ensure consistent data over time—with data history from January 2007 onward.

Figure 1 highlights this detail, showing the number of companies with risk incidents based on the location and region of their headquarters.

Figure 1: Company Coverage

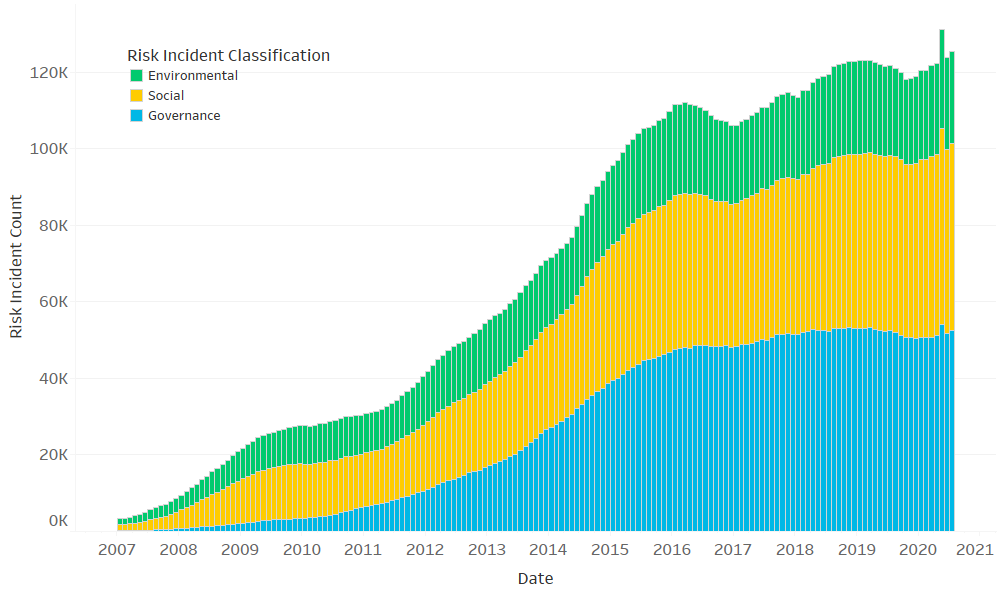

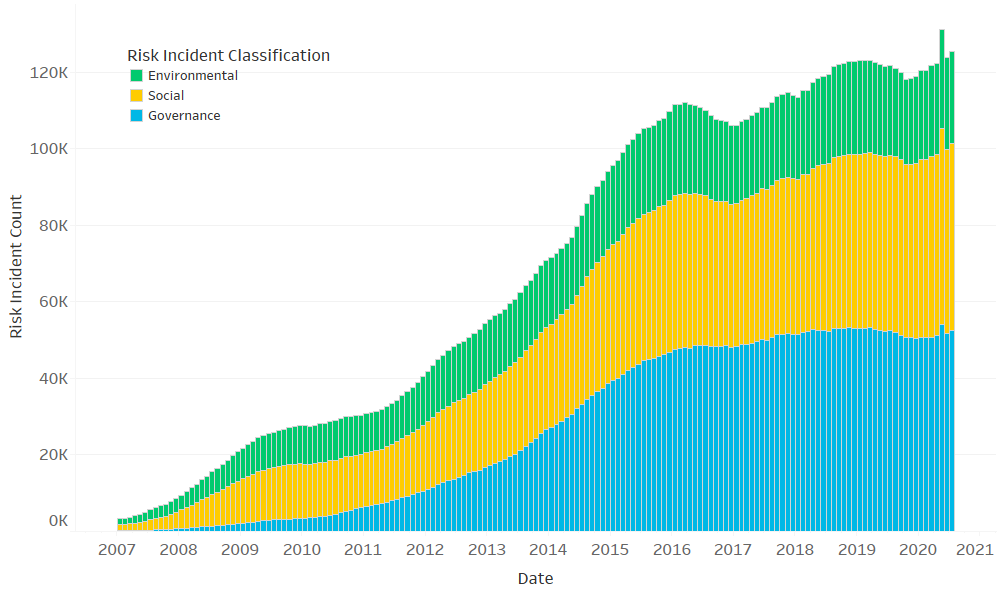

In order to calculate the RepRisk Index (RRI) risk metric, risk incidents must be identified and analyzed appropriately. Figure 2 highlights not only the volume of these risk incidents, but the sheer amount of information tracked and tagged going back to 2007. Currently RepRisk pre-processes over 500,000 risk incidents from 100,000+ sources on a daily basis thanks to its advanced machine learning capabilities and AI aggregation, and in combination with human analysis and curation. RepRisk then calculates the RRI risk metric and categorizes incidents into ESG Topic Tags, ESG Issues, and the UN Global Compact Principles. RepRisk’s ESG Topic Tags and ESG Issues are highlighted in the figures below.

Figure 2: Risk Incident Classification

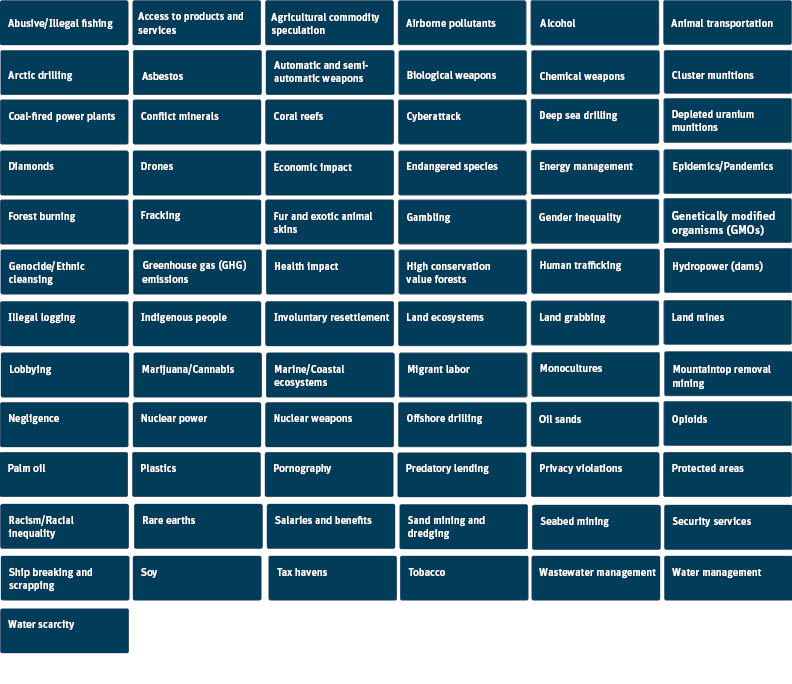

RepRisk’s core research scope is comprised of 28 ESG Issues that drive the entire research process, as every risk incident is linked to at least one of these Issues. When RepRisk screens media and stakeholder sources, it screens for any risks linked to these Issues (shown in Figure 3).

Figure 3: Issues

These 28 Issues can be specifically mapped to the 10 Principles of the UN Global Compact, which are also tracked in the data feed, with the number of linked risk incidents per principle.

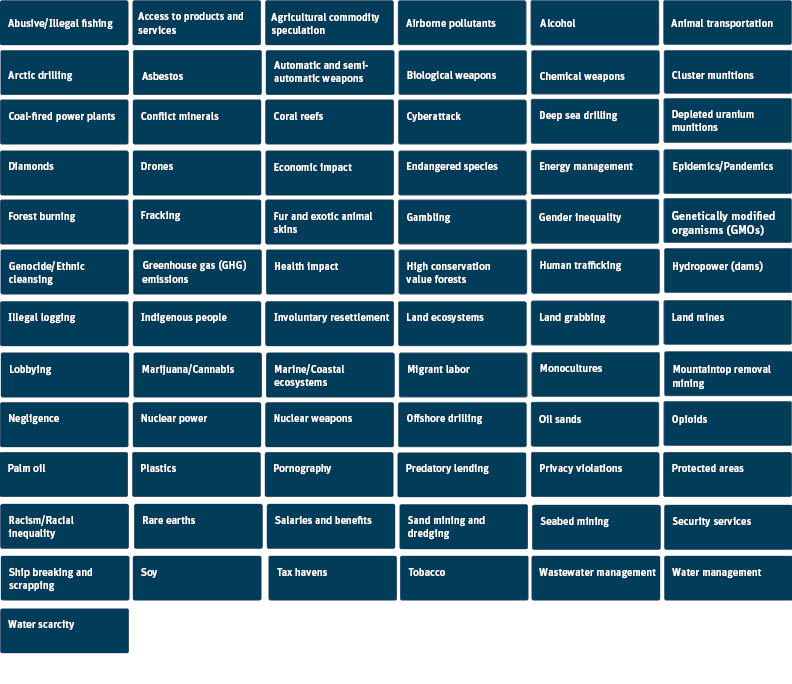

RepRisk also covers over 73 additional Topic Tags, which are designated ESG “hot topics,” or extensions of RepRisk’s core ESG Issues research scope. Topic Tags are specific and thematic, and one Topic Tag can be linked to multiple ESG Issues. They are a dynamic concept, with the list expanding over time in accordance with topic developments and client feedback. Figure 4 highlights the list of Topic Tags.

Figure 4: Topic Tags

The Differentiators

There are several ways RepRisk provides a unique take on ESG data:

- Updates on a daily basis—RepRisk allow users to respond to risk incidents as they unfold with actionable data and to understand the far-reaching impacts of risk incidents through several easy-to-understand metrics

- Offers more than just ESG risk metrics—RepRisk assigns volume of risk incidents to more granular categories of 28 Issues, the 10 UNGC Principles, and 73 Topic Tags

- Tracks the severity (i.e., harshness) of risk incidents. The severity is determined as a function of three dimensions:

- What are the consequences of the risk incident (e.g., with respect to health and safety, is there injury or death)?

- What is the extent of the risk incident (e.g., did it impact one person, a group of people, a large number of people)?

- Was the risk incident caused by an accident, by negligence, or intent, or even in a systematic way?

- Tracks the reach of risk incidents (i.e., the influence based on readership/circulation as well as by importance in specific country). All sources are pre-classified by reach:

- Low influence sources would include local media, smaller NGOs, local governmental bodies, blogs, internet sites, etc.

- Medium influence sources include most national and regional media, international NGOs, as well as state, national, and international governmental bodies

- High influence sources are the few international media that reach global audiences (e.g., The New York Times, BBC, and others)

Example Use Case

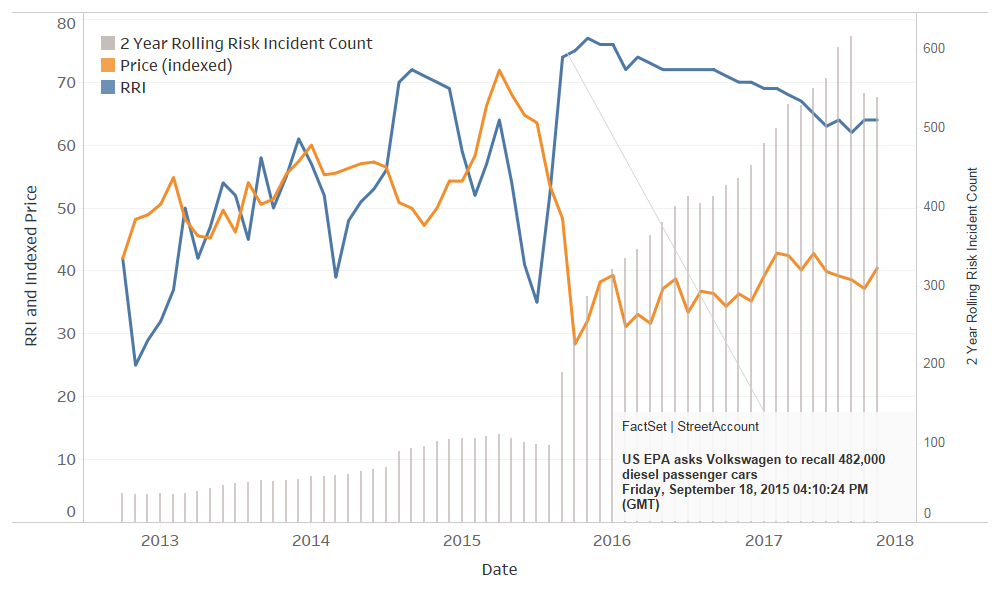

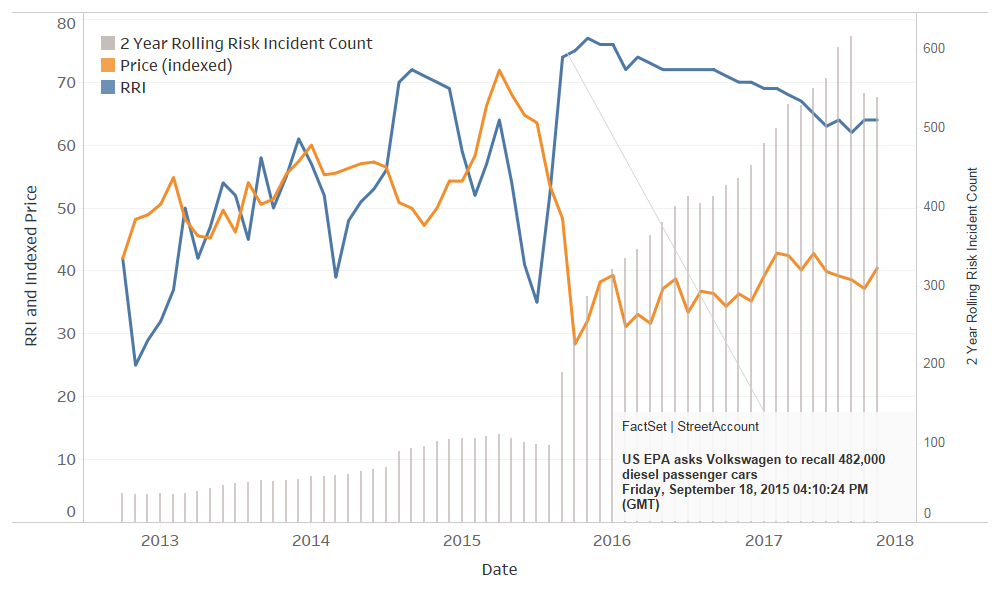

There are a number of ways to utilize ESG data, but one way involves tracking an individual company and looking for deviations in their risk exposure or identifying systematic exposure ESG risk and issues over time. Volkswagen is an interesting example, as it has historically had higher levels of risk, averaging in the 40s-60s for its RRI score, as shown in Figure 5. It was not until the diesel scandal was unveiled when the company hit its peak RRI score of 77.

As the transparency and number of systematic controls put in place increased at Volkswagen, its RRI began to regress, though the company is still considered to have very high-risk exposure. The risk incident counts for Volkswagen show an interesting pattern as well—a 5x increase after the diesel scandal was unveiled. RepRisk has captured more than 500 risk incidents on a rolling two-year basis for Volkswagen, helping its users sift through noise and produce valuable output.

Figure 5: Volkswagen Example

Whether you are trying to take a systematic approach to an ESG-related investment strategy or simply trying to get a feel for your portfolio’s exposure to specific ESG factors, RepRisk can help you fill a crucial data void.

The details provided above are as of July 2022.

If you have any questions or would like to learn more about any of the content mentioned above, please contact us at sales@factset.com.

For more information on RepRisk, including case studies, white papers, and additional research, please visit the RepRisk ESG Business Intelligence product page on the Open:FactSet Marketplace.