We often hear of the importance of rebalancing, but how important is it really? The answer isn’t as simple as more frequent rebalancing is better; you must also consider the costs (turnover and trading costs). Instead we need to ask: when do the benefits of rebalancing outweigh the costs of implementation? What market conditions call for portfolio allocations to be managed more frequently? And under what conditions are the marginal costs greater than the benefits?

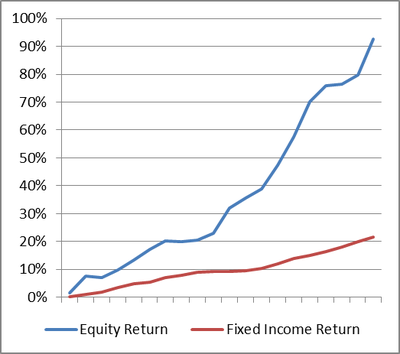

In general, a portfolio will have a higher return without rebalancing (buy-and-hold) during a trending upmarket. This concept is relatively simple. When one asset class (e.g., equities) is consistently outperforming, your weight will increase and thus capture more of the subsequent outperformance.

| Trending Market (Equity Outperforming) |

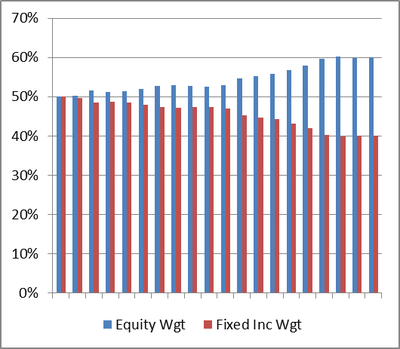

Buy and Hold Weights in Trending Market |

|

|

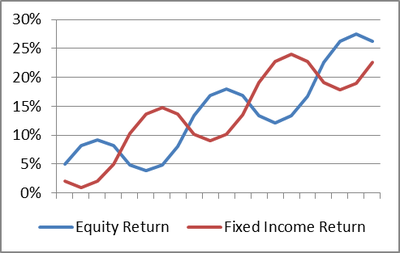

On the contrary, a portfolio will have a higher return with high frequency rebalancing during an oscillating market. By rebalancing during an oscillating market, additional funds are reallocated to sectors or asset classes whose weights have drifted lower but are set to outperform on the rebound.

| Oscillating Market |

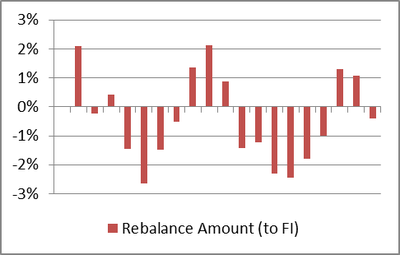

Weight Shift for Rebalancing |

|

|

The concepts above are great if our only concern is total return and if we know exactly where the market is headed. However, some may argue that if we KNOW with certainty that equities will outperform fixed income, we should invest 100% in equity and 0% in fixed income and maximize return.

Because we don’t know the future with certainty, a big piece of any asset allocation strategy is hedging against that uncertainty. If a portfolio’s long-term strategy calls for a particular asset allocation split, then we should focus less on trying to time the market and more on the observable trends that may justify more frequent rebalancing. For example, take a strategy with a mandate of 75% equity/25% fixed income. How do we quantify the effect of rebalancing a 75/25 portfolio monthly vs. quarterly vs. annually?

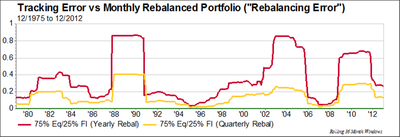

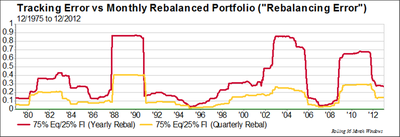

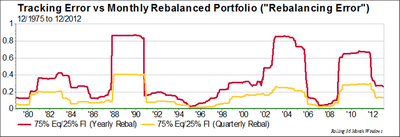

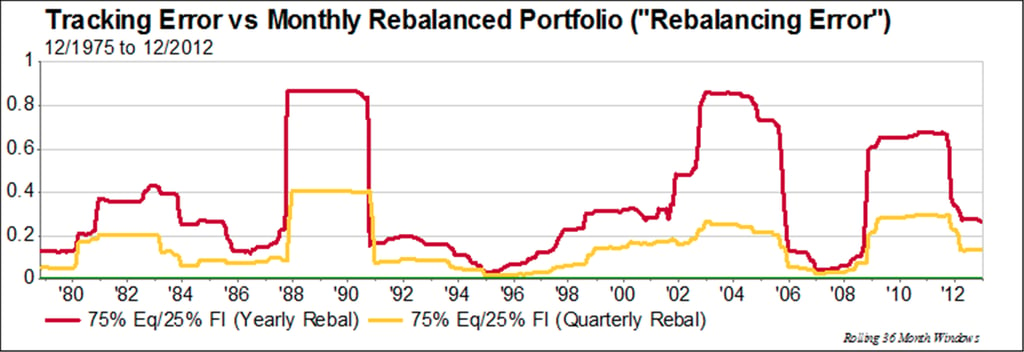

Since our portfolio objective specifies a 75/25 split, one measure of rebalancing risk is the tracking error of a yearly or quarterly rebalanced portfolio versus the constantly rebalanced 75/25 mandate (or “rebalancing error”):

Any spikes (high rebalancing error periods) indicate a stronger need for frequent rebalancing. Any dips or areas where the lines converge indicate there’s less benefit to rebalancing. For example, in 1989 rebalancing quarterly instead of yearly would have cut the rebalancing error by more than half (0.87 to 0.41). On the other hand, in 1995 the yearly rebalancing error decreased to 0.04, meaning that there was little difference attributed to the rebalance frequency and probably not enough benefit to justify any extra costs.

What are the primary factors which drive the rebalancing error?

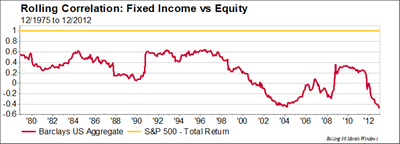

1. Correlation

In general, the differences in rebalancing error widen whenever correlation decreases. Uncorrelated asset classes lead to larger drifts in weight which left unaddressed lead to bigger differences in returns versus a rebalanced portfolio (e.g., higher rebalancing error).

2. Volatility

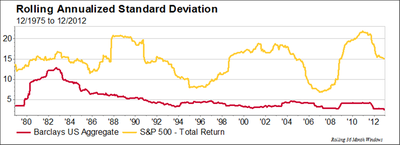

Fixed income volatility has steadily decreased, and we don’t see many large swings. A better gauge is equity volatility. In general, higher equity volatility appears to correlate to a higher rebalancing error (see 1989, 2003, and 2011) and lower volatility correlates to lower rebalancing error (1995, 2007).

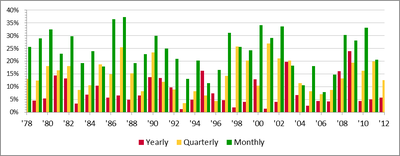

How much does the rebalance frequency affect turnover?

It is difficult to deduce a clear trend with the turnover chart above, but here are some general takeaways:

- On average, monthly rebalancing results in a greater annual turnover than quarterly, and quarterly rebalancing leads to greater turnover than yearly, which is expected.

- However a number of years have higher turnover using a yearly versus quarterly rebalance (’91, ‘95, ‘00, ‘08, ‘09). Thus letting the portfolio drift for a full year has the potential to increase both risk (rebalancing error) AND the cost of correcting that drift (turnover).

- There are periods with high rebalancing error but little difference in the turnover required for different rebalance frequencies. For example, in 2003 yearly rebalancing would have resulted in 20% turnover while monthly would have been less (18%), during a period with one of the highest rebalancing errors (0.86). Thus risk (rebalancing error) could have been significantly reduced for little to no change in cost (turnover).

What does it mean?

The volatility and correlations of asset classes should play a large role in determining whether or not more frequent rebalancing is needed. Recent market conditions are unlike any other period in recent history, with high volatility, extremely low correlations, and high domestic equity returns: four-year average equity returns close to 15%. The benefit of frequent rebalancing (i.e.,reducing rebalancing error) should be weighed against the cost (turnover and trading costs) to determine your own optimal rebalance policy and ensure that you’re prepared for future uncertainty in the market.