U.S. activist activity is running at near-record levels. Add in unfriendly acquisition offers, primarily from strategic buyers, and the result is an increasing demand for corporate defense advisory services. The increased money flowing into activist funds has been widely reported but clear evidence is now emerging that this increased firepower is being put to use by targeting larger companies. There have already been more activist campaigns announced against S&P 500 companies in 2014 than any other full year since we began tracking this activity in 2006. 2014's year-to-date total of 29 campaigns is over three times the activity against S&P 500 firms in 2006. Among the companies targeted in 2014 are household names Amgen Inc., Apple Inc., E.I. du Pont de Nemours and Company, and eBay Inc.

U.S. activist activity is running at near-record levels. Add in unfriendly acquisition offers, primarily from strategic buyers, and the result is an increasing demand for corporate defense advisory services. The increased money flowing into activist funds has been widely reported but clear evidence is now emerging that this increased firepower is being put to use by targeting larger companies. There have already been more activist campaigns announced against S&P 500 companies in 2014 than any other full year since we began tracking this activity in 2006. 2014's year-to-date total of 29 campaigns is over three times the activity against S&P 500 firms in 2006. Among the companies targeted in 2014 are household names Amgen Inc., Apple Inc., E.I. du Pont de Nemours and Company, and eBay Inc.

On the unfriendly M&A front, noteworthy offers have been made for Allergan, Inc., Family Dollar Stores, Inc., Time Warner Cable Inc., and Time Warner Inc. With company size becoming less of a deterrent to activists there will be additional business opportunities for the financial and legal advisors that specialize in this area.

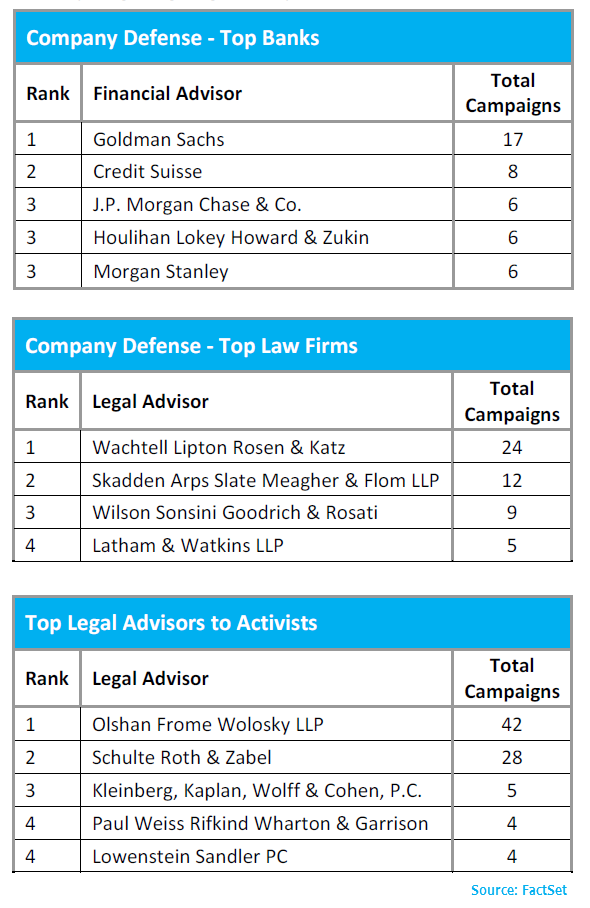

So far this year, Goldman Sachs and Wachtell Lipton Rosen & Katz, both long associated with company defense, are the two firms that targeted companies have most frequently retained. These defense situations include unsolicited and hostile acquisition offers seeking at least a majority common equity interest in the targeted company as well as high-impact activist campaigns - those focused on value creation, public short (bear raid), board seat, and officer/director removal. Among financial advisors to target companies, Goldman Sachs has been involved in the most defense situations with 17. Credit Suisse was the next most frequently retained defense advisor with eight.

Determining market share as it applies to activism defense is a challenging and inexact exercise due to the limited disclosure of advisor information in public sources and the fact the advisors are often unable to disclose their roles even in activism campaigns that were made public. Analyzing only the subset of defense situations in 2014 where FactSet was able to identify that a financial advisor was retained, Goldman Sachs was involved in 27% of the campaigns.

Wachtell Lipton Rosen & Katz is the top law firm for company defense. Wachtell Lipton Rosen & Katz was involved 24 situations so far this year including Allergan, Inc. in its defense against Valeant Pharmaceuticals International, Inc.'s hostile takeover bid and Pershing Square Capital Management, L.P.'s related proxy fight as well as activist campaigns by Icahn Associates against eBay Inc. and Hertz Global Holdings, Inc. Skadden Arps Slate Meagher & Flom LLP represented companies on the second most campaigns with 12 followed by Wilson Sonsini Goodrich & Rosati with 9.

In terms of providing legal advice to activist funds, Olshan Frome Wolosky LLP and Schulte Roth & Zabel are the unequivocal go-to firms. Olshan Frome Wolosky LLP has been the most retained law firm by activists this year having worked on 42 campaigns. Among the prominent names of activist hedge funds that are Olshan Frome Wolosky LLP clients, all of which they represented in at least one activist campaign this year, are Starboard Value LP, Lone Star Value Management, LLC, Raging Capital Management LLC, Engaged Capital LLC, and FrontFour Capital Group LLC. Schulte Roth & Zabel has represented an activist firm on 28 situations so far this year including campaigns by Clinton Group, Inc., Carlson Capital LP, JANA Partners LLC, Sandell Asset Management Corp., and Trian Fund Management, L.P.

Based on the available data, it does not appear that any one investment bank has carved out a dominant position in terms of activist financial advisory services. The bulge bracket investment banks don't typically work with activists. The only exceptions we've identified this year are Deutsche Bank serving as financial advisor to Corvex Management LP and Related Fund Management LLC in their successful proxy fight for control of CommonWealth REIT's board and Credit Suisse's work for Pershing Square Capital Management LP in its ongoing proxy fight with Allergan. However, the Allergan campaign is part of an effort to facilitate an acquisition and CommonWealth REIT included an acquisition offer, so they could arguably be categorized along the lines of the advisory services they traditionally provide for hostile acquirers. Houlihan Lokey Howard & Zukin is among the small group of banks that works with companies on activism defense and provides advice to activist shareholders. Included among its activist assignments this year is being retained by hedge fund Marcato Capital Management LP in August to serve as financial advisor and to assist it in conducting a full strategic review for enhancing shareholder value at InterContinental Hotels Group.

Methodology:

Includes campaigns announced between January 1 and October 21.

The Company Defense League Table ranks financial and legal advisors based upon number of activist and unfriendly M&A situations the firm advised the targeted company. Only activist campaigns and unfriendly M&A against U.S. companies are eligible. Activism defense only includes campaigns focused on value creation, public short (bear raid), board seats, and director and officer removal. Unfriendly M&A includes unsolicited and hostile offers seeking at least a majority common equity interest in the target company.

The Top Legal Advisors to Activists League Table ranks law firms based upon the number of campaigns they advised the activist that were announced this year. Only campaigns against U.S. companies and only those focused on value creation, public short (bear raid), board seats, and director and officer removal are eligible.

FactSet surveyed leading investment banks and law firms to supplement advisory assignments that may not have been disclosed in public sources. Only publicly disclosed campaigns are included so advisory work performed in a situation that remained behind the scenes would not be reflected in an advisor’s campaign total.