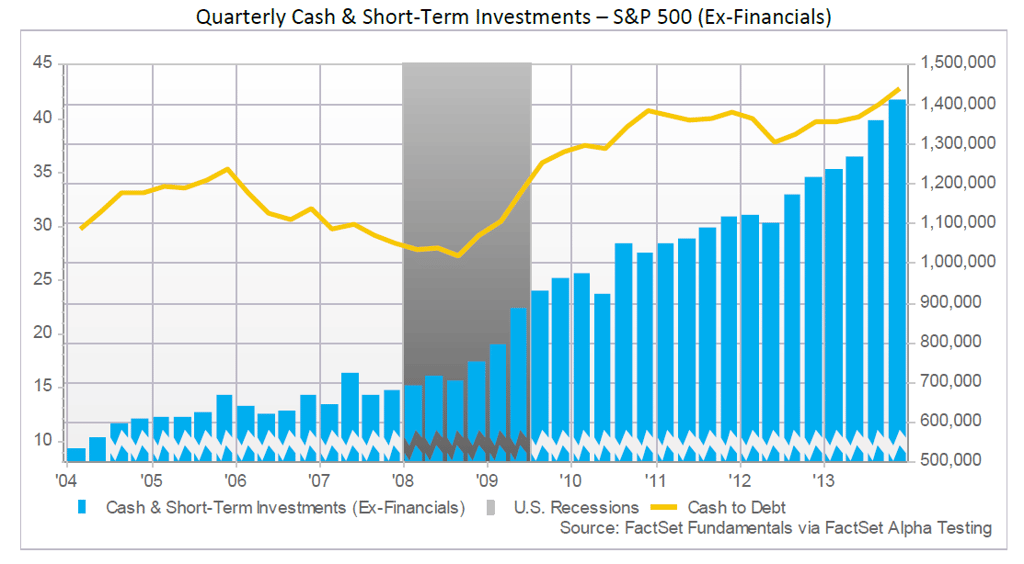

Cash & short-term investment balances (“cash”) in the S&P 500 (ex-Financials) rose by 13.9% year-over-year and settled at a balance of $1.41 trillion at the end of Q4 2013.

Cash & short-term investment balances (“cash”) in the S&P 500 (ex-Financials) rose by 13.9% year-over-year and settled at a balance of $1.41 trillion at the end of Q4 2013.

One of the major factors for cash growth was large cash inflows from operations. S&P 500 companies generated $381.5 billion in operating cash flow in Q4, the largest amount in at least ten years. This resulted from 6.2% growth year-over-year, and, due to a decline in fixed capital expenditures (-4.0%), free cash flow (operating cash flow less fixed capital expenditures) grew at an even higher rate of 15.6%. This represented the highest growth in free cash flow since Q3 2011, and increased fourth quarter free cash flows to their highest quarterly level ($214.7 billion) in at least ten years.

Seven of the nine sectors under consideration grew quarterly free cash flow year-over-year, with the Industrials sector showing the largest growth (+24.9%). General Electric led the group ($8.0 billion in free cash flow) due primarily to strong net income and lower capital expenditures. But Lockheed Martin had the highest year-over-year improvement (+$2.4 billion), due to unfavorable changes in working capital in Q4 2012. Overall, though, Apple had the highest free cash flow ($20.3 billion) in Q4 from strong holiday sales. However, this sum represented a decline of $0.8 billion year-over-year.

Six of the nine sectors grew cash by at least double-digit rates year-over-year. In addition, the three sectors which showed declines in cash had an insignificant impact on the index-level balance. Two of the three sectors—Consumer Discretionary and Energy—showed declines of less than 3%, and the Utilities sector’s 9.8% decline impacted a small fraction of the aggregate cash balance. The Utilities sector has the lowest cash balance in the index by more than a factor of two.

On the other hand, the three sectors with the largest cash balances—Information Technology, Industrials, and Health Care—all grew cash at double-digit rates (12.8%, 14.3%, and 11.7%). In addition, the elevated growth in cash was positively impacted by Verizon Communication’s $49 billion debt offering in Q3 intended to help finance its $130 billion acquisition of Vodafone Group’s stake in Verizon Wireless. Excluding Verizon, the top six companies by year-over-year dollar-value growth in cash were from these three sectors. And, the top four companies—Microsoft, Medtronic, General Electric, and Google—each grew cash by more than $5 billion year-over-year. Microsoft, which grew cash by $15.6 billion year-over-year, also received significant funds from net debt issuance ($7.0 billion) in the fourth quarter.

On the other end of the spectrum, the Energy sector experienced a decline in cash (-1.1%) for the sixth consecutive quarter. Here, Chevron experienced the largest decline in cash in Q4 (-$5.4 billion) due to capital expenditures that outstripped operating cash flow, and shareholder distributions that further utilized $3.1 billion. In addition, Exxon Mobil was again a major contributor to the decline, as the company showed a $5.4 billion decline in cash and equivalents year-over-year. Though Exxon has generated free cash flow in three of the last four quarters (amounting to $11.2 billion over the year), its significant dividend and regular share repurchase activity have more than utilized cash generated from the business. Net stock purchases and cash dividends paid amounted to $26.8 billion over the trailing year. However, Exxon has worked to trim these outflows, and twice reduced its share repurchase target in 2013. The company went from averaging $5 billion per quarter over a two year period to paying $4 billion in Q2 to an average of $3.2 billion in the second half of 2013.