The 50 largest hedge funds increased their equity exposure by 1.9% in Q1 2014. However, equity positions grew faster in the funds’ concentrated positions. The funds grew exposure in their top fifty holdings by 7.5%. On the security level, Verizon Communications experienced the highest increase in exposure at $2.9 billion—328% greater than the stock’s Q4 position. The stock was the number one equity purchase for three funds over the quarter: Adage Capital Management, Lansdowne Partners, and Two Sigma Advisors.

eBay also attracted widespread attention with its equity exposure growing 109% (+$2.1 billion) in the aggregate hedge fund portfolio. Glenview Capital Management, Highfields Capital Management, JANA Partners, OZ Management, Omega Advisors, and D.E. Shaw & Co. all followed Icahn Associates’ lead and bought more than $100 million in the online retailer during the push to split its PayPal business.

Liberty Global also grew by a significant margin in the aggregate portfolio (64%, or +$1.7 billion), and the international cable company represented the number one equity purchase of five of the fifty funds: D.E. Shaw & Co., Lone Pine Capital, Orbis Investment Management, SPO Partners & Co., and Maverick Capital. In addition, the hedge funds showed significant interest in Actavis (+67%, or $1.7 billion) and Walgreen (+52%, or $1.6 billion). Actavis, which announced its intent to acquire Forest Laboratories in February, was also noteworthy as being a top fifty equity holding in more than half of the top fifty hedge funds.

Finally, the IPO of EP Energy also added significant public equity exposure to the hedge fund portfolio. Following a January 16th offering, Apollo Capital recognized $2.3 billion, or 46%, ownership in the unconventional onshore exploration and production company. Other hedge funds, including JANA Partners with a $20 million stake, showed small positions in EP Energy that amounted to less than 1% of shares outstanding.

On the other end of the spectrum, individual funds sold large interests in several equities in Q1, most significantly Kinder Morgan, General Motors, and Bank of America. All three companies’ shares are down over six months, but General Motors lost the most value at 13%. Sales in the three equities were widespread, and no single fund’s sale represented more than a third of the overall reduced exposure in each of the equities. The biggest sellers of Kinder Morgan among the fifty largest funds were Kayne Anderson Capital Advisors and Omega Advisors. JANA Parners and OZ Management were the largest sellers of GM, and D.E. Shaw & Co. and Viking Global Investors each divested more than $400 million in Bank of America.

It’s also interesting to note that Apple was the largest sale of four of the fifty funds. Apple is still the most represented, largest equity holding of the top fifty hedge funds, but the number of funds that hold the most equity exposure in Apple has fallen from six in Q4 2013 to three in Q1.

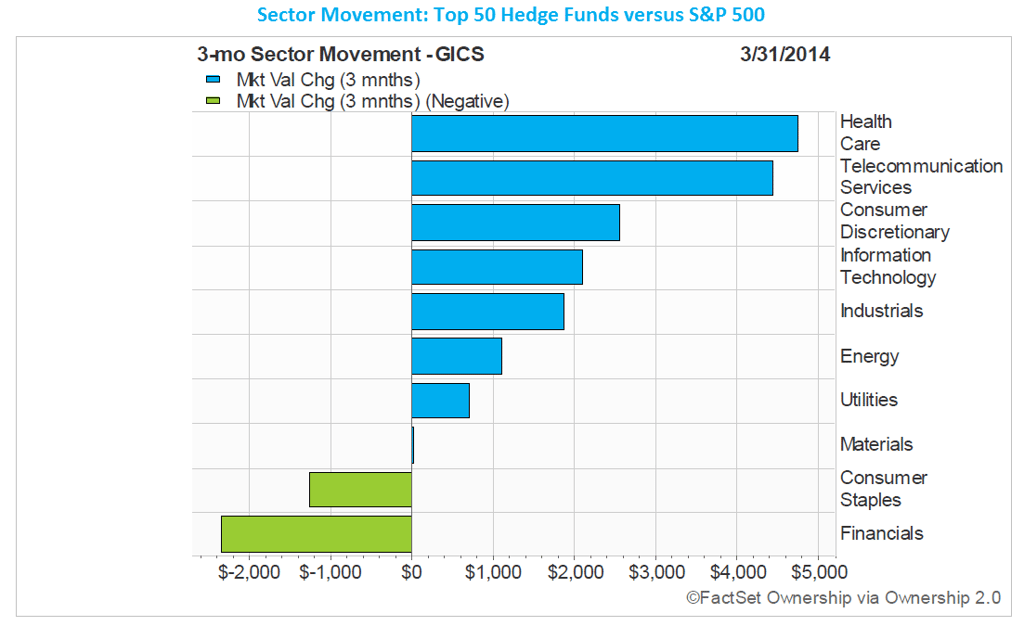

At the country-level, the top 50 hedge funds added the most exposure to U.S. equities in Q1, but were also bullish in Chinese equities due to activity in Baidu’s ADR (+$1.2 billion in exposure). The largest buyers of the Chinese search engine, which reported nearly sixty percent growth in revenue in April, were Viking Global Investors, Point72 Asset Management (formerly known as SAC Capital Advisors), and Lone Pine Capital. However, the fifty largest hedge funds may have been more noteworthy for their net additions to Russian equities. The funds predominantly added to ADRs of two telecommunications companies with significant operations in both Russia and Ukraine: VimpelCom and Mobile TeleSystems. On the sector-level, the top 50 hedge funds added the most exposure to the Health Care sector and most reduced exposure to the Financials sector.

At the country-level, the top 50 hedge funds added the most exposure to U.S. equities in Q1, but were also bullish in Chinese equities due to activity in Baidu’s ADR (+$1.2 billion in exposure). The largest buyers of the Chinese search engine, which reported nearly sixty percent growth in revenue in April, were Viking Global Investors, Point72 Asset Management (formerly known as SAC Capital Advisors), and Lone Pine Capital. However, the fifty largest hedge funds may have been more noteworthy for their net additions to Russian equities. The funds predominantly added to ADRs of two telecommunications companies with significant operations in both Russia and Ukraine: VimpelCom and Mobile TeleSystems. On the sector-level, the top 50 hedge funds added the most exposure to the Health Care sector and most reduced exposure to the Financials sector.