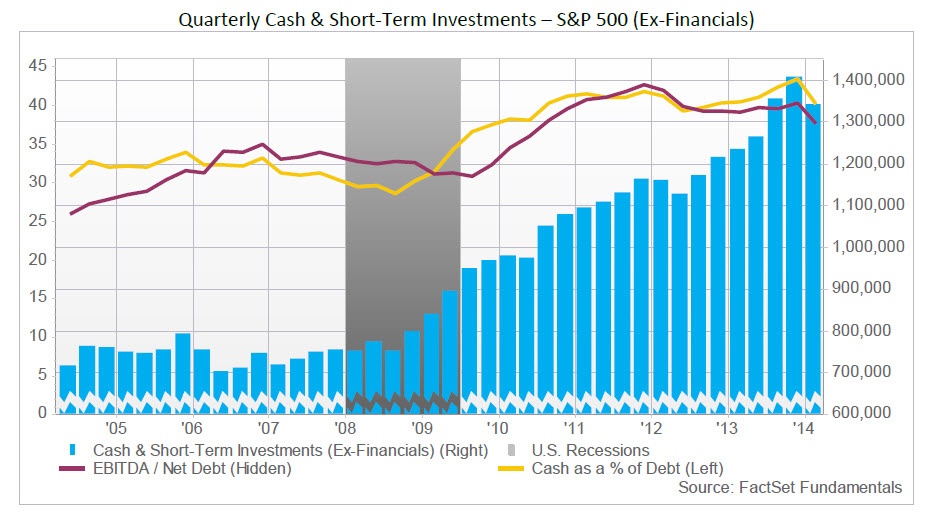

Cash & short-term investment balances (“cash”) in the S&P 500 (ex-Financials) rose by 6.6% year-over-year and settled at a balance of $1.34 trillion at the end of Q1. However, cash declined sequentially (-4.7%) for the first time since Q2 2012. This decline was primarily the result of Verizon Communications closing its acquisition of the remaining stake of Verizon Wireless. This contributed to a decline of more than $50 billion in the balance of cash & short term investments quarter-over-quarter. Ex-Verizon, cash only fell 1.1% sequentially.

Cash & short-term investment balances (“cash”) in the S&P 500 (ex-Financials) rose by 6.6% year-over-year and settled at a balance of $1.34 trillion at the end of Q1. However, cash declined sequentially (-4.7%) for the first time since Q2 2012. This decline was primarily the result of Verizon Communications closing its acquisition of the remaining stake of Verizon Wireless. This contributed to a decline of more than $50 billion in the balance of cash & short term investments quarter-over-quarter. Ex-Verizon, cash only fell 1.1% sequentially.

It’s also important to note that cash is more susceptible to fall sequentially in the first quarter. Operating cash flows in Q1 are consistently below levels of the prior three quarters, especially compared to the holiday fourth quarter. Operating cash flows (“OCF”) in Q1 were 26% lower than Q4, which was in line with the sequential percentage decline at the turn of 2013. In addition, cash has sequentially declined in only ten quarters of the past forty, but six of those declines were in the first quarter.

Overall, S&P 500 companies generated $282.0 billion in operating cash flow in Q1, which represented year-over-year growth of 7.4%. Nine of ten sectors grew OCF in Q1, with the Consumer Staples sector showing the lone decline (this was primarily due to Safeway’s sale of Canada Safeway). The Health Care sector, on the other hand, led in growth of OCF (+28.7%), and showed strong free cash flow growth (+31.6%) as a result of improved inflows from Johnson & Johnson, Cigna, and Bristol-Myers Squibb. After subtracting fixed capital expenditures, aggregate free cash flow grew faster than OCF (+8.7%) in Q1. A low baseline in free cash flow from the Energy and Materials sectors helped them grow by a higher year-over-year rate (31.7% and 34.5%) than the Health Care sector.

Only two of nine sectors grew cash by at least double-digit rates year-over-year, as compared to six in Q4 2013. However, growth was also supported by the Energy sector, which grew cash year-over-year (+2.9%) for the first time in eight quarters. In addition, the fastest growing sectors—Health Care and Information Technology—also had the highest cash balances. The Health Care sector, which represents 16% of aggregate cash, grew cash by 15.0%, and the Information Technology sector, which comprises 37% of the total balance, grew cash by 10.8%.