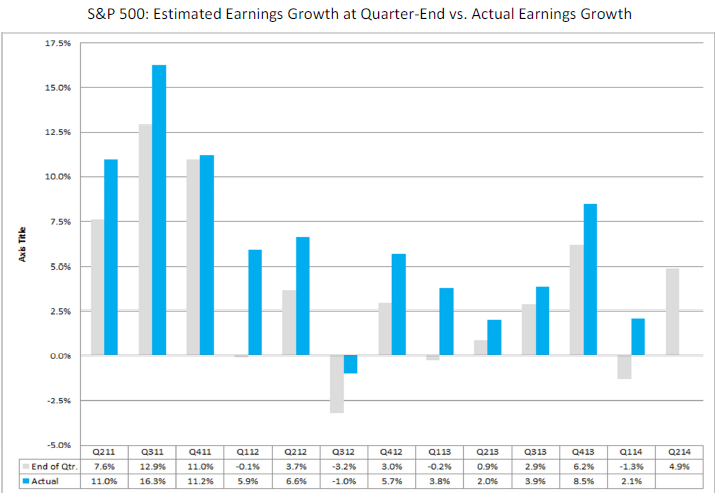

As of today, the S&P 500 is projected to report year-over-year growth in earnings of 4.6% for the second quarter. At the end of the second quarter (June 30), the estimated year-over-year growth rate was 4.9%. If the S&P 500 reports actual earnings growth of at least 4.0% for the quarter, it will mark the second-highest quarterly earnings growth rate for the index since Q4 2012. What is the likelihood the index will report actual earnings growth above 4.0% for the quarter?

When companies in the S&P 500 report actual earnings above estimates during an earnings season, the overall earnings growth rate for the index increases, because the higher actual EPS numbers replace the lower estimated EPS numbers in the calculation of the growth rate. For example, if a company is projected to report EPS of $1.05 compared to year-ago EPS of $1.00, the company is projected to report earnings growth of 5%. If the company reports actual EPS of $1.10 (a $0.05 upside earnings surprise compared to the estimate), the actual earnings growth for the company for the quarter is now 10%, five percentage points above the estimate growth rate (10% - 5% = 5%).

Over the past four years, 72% of companies in the S&P 500 have reported actual EPS above the mean EPS estimates on average. As a result, the earnings growth rate has increased 2.8 percentage points on average from the end of the quarter through the end of the earnings season due to these upside earnings surprises.

If this average increase is applied to the estimated earnings growth rate at the end of the second quarter (June 30) of 4.9%, the actual earnings growth rate for the quarter would be 7.7% (4.9% + 2.8% =7.7%).