It was a tale of two earnings growth rates for the S&P 500 this past week. While the blended earnings growth rate for Q4 rebounded to 2% from 0% (mainly due to the upside surprise reported by Apple) during the week, the estimated earnings growth rate for Q1 dropped below 0% (year-over-year decrease in earnings now projected for the quarter) over the same period.

Apple Accounts for 50% of Increase in S&P 500 Earnings Growth Rate for Q4 This Week

During the past week, the blended earnings growth rate for the S&P 500 for Q4 2014 increased to 2.1% today from 0.2% last Friday. The dollar-level earnings for the index rose by $5.0 billion over this period (to $273.8 billion today from $268.8 billion last Friday). What caused the increase in dollar-level earnings for the index this past week?

At the sector level, the Information Technology sector witnessed the largest increase in dollar-level earnings of all ten sectors over the past week, as the dollar-level earnings for the sector rose by $3.1 billion over this period.At the company level within the Information Technology sector, Apple was the largest contributor not only to the increase in dollar-level earnings for the Information Technology sector, but also to the increase for the S&P 500 index as a whole.

On January 27, Apple reported actual EPS of $3.06 for Q4 2014, which was 17.5% above the mean EPS estimate of $2.60. Due to the magnitude of the surprise and the company’s weight in the index, Apple accounted for just over 2.5 billion (or 51%) of the $5.0 billion increase in earnings for the S&P 500 index over the past week. If Apple had reported actual EPS that matched the mean EPS estimate, the blended earnings growth today would be 1.1% rather than 2.1%.

As a result of the upside earning surprise, Apple is now the largest contributor to earnings growth for the S&P 500 at the company level for the fourth quarter. If Apple is excluded, the blended earnings growth rate for the S&P 500 for Q4 2014 would drop to 0.3% from 2.1%.

Year-Over-Year Earnings Decline Now Projected for S&P 500 for Q1 2015

At just about the mid-point of the Q4 2014 earnings season, the blended earnings growth rate for the fourth quarter stands at 2.1%. Of the 227 companies that have reported earnings to date for the quarter, 80% have reported actual EPS above the mean EPS estimate. Barring an unusually high number of companies reporting earnings below expectations in the second half of the earnings season, it appears likely the S&P 500 will report year-over-year growth in earnings for the quarter. Thus, the fourth quarter will likely mark the 8th consecutive quarter of year-over-year earnings growth for the index, after a year-over-year decline in Q3 2012 (-1.0%).

Looking at the current quarter (Q1 2015), what are analyst expectations for earnings growth? Is the current streak of eight consecutive quarters of earnings growth expected to continue?

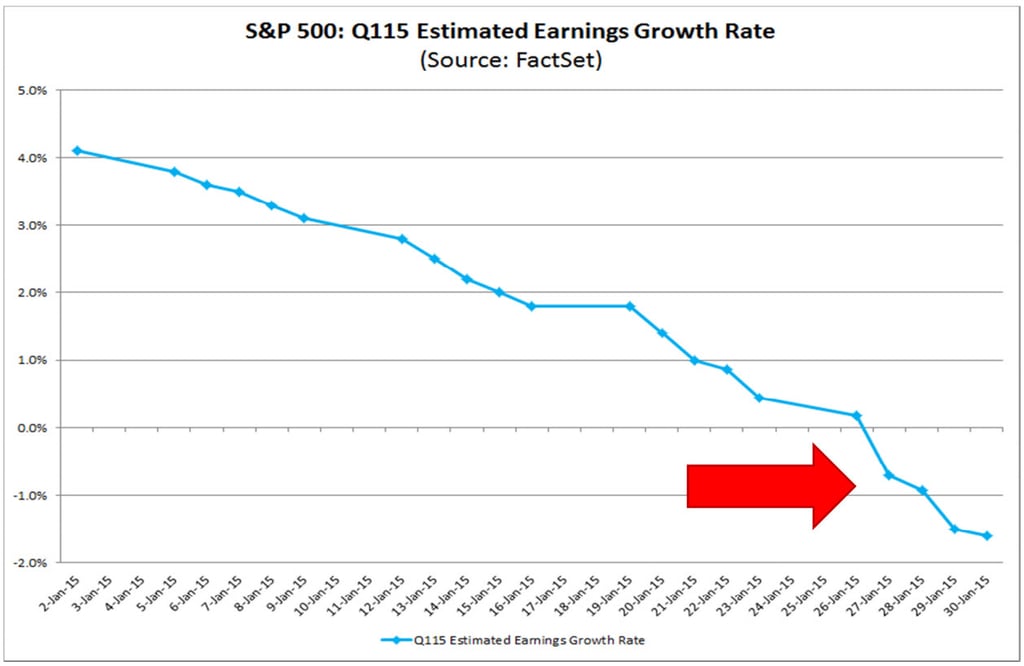

The answer is no. This week marked a change in the aggregate expectations of analysts from year-over-year growth in earnings for Q1 2015 to now a year-over-year decline in earnings. However, expectations for earnings growth for Q1 2015 have been falling not only over the past few weeks, but also over the past few months. On September 30, the estimated earnings growth rate for Q1 2015 was 9.9%. By December 31, the estimated growth rate had declined to 4.2%. Today, it stands at -1.6%.

Most of the expected decline in the estimated earnings growth rate for the S&P 500 for Q1 2015 is due to reductions in earnings estimates for companies in the Energy sector. On September 30, the estimated earnings growth rate for the Energy sector for Q1 2015 was 3.3%. By December 31, the estimated growth rate fell to -28.9%. Today, it stands at -53.8%