Hedge Funds Increased Equity Exposure in Q4

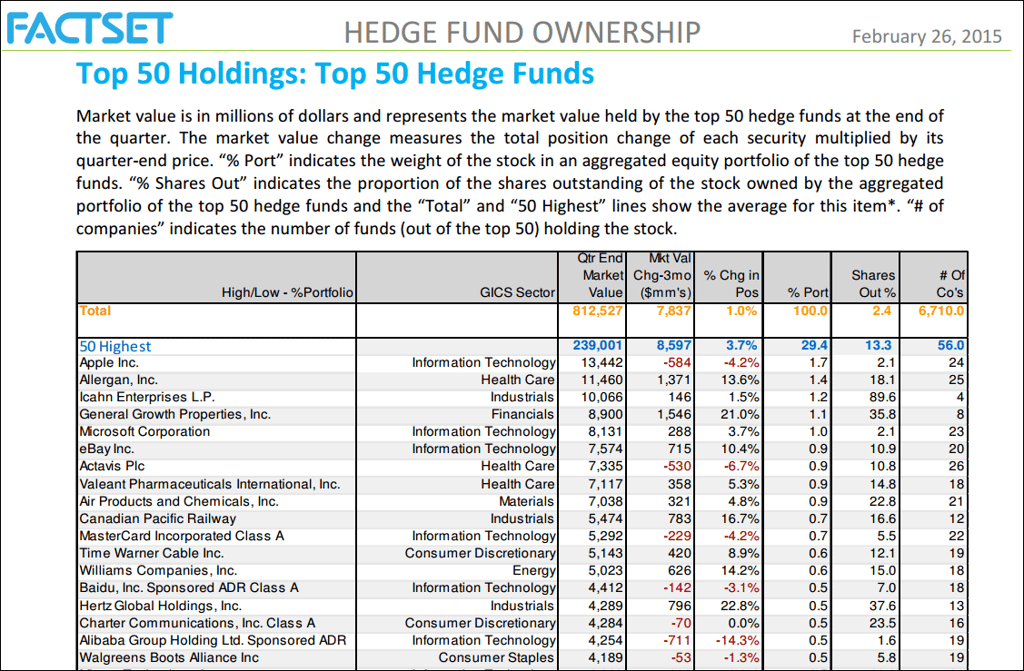

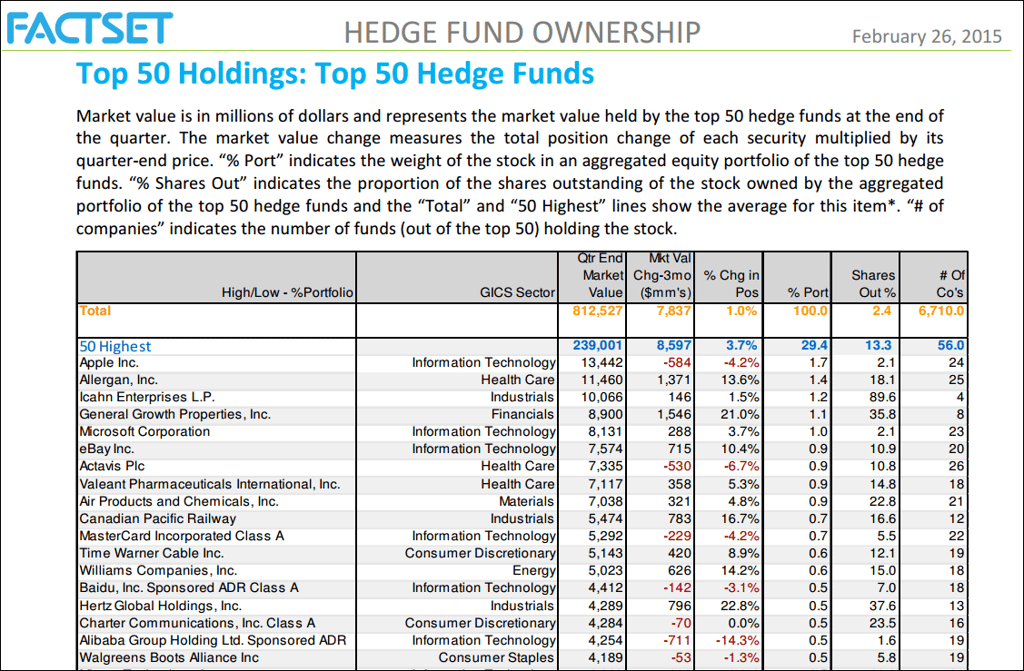

The 50 largest hedge funds increased their equity exposure by 1.0% in Q4 2014.

At the sector level, the 50 largest hedge funds had the largest aggregate holdings in the Information Technology (18.2%) and Consumer Discretionary (16.5%) sectors at the end of the fourth quarter. During the quarter, the funds added exposure in aggregate in eight of the ten sectors, led by the Health Care, Consumer Staples, and Industrials sectors. The only two sectors in which the 50 hedge funds decreased exposure in aggregate were the Consumer Discretionary and Telecom Services sectors.

On a geographical basis, the 50 largest funds had their largest aggregate holdings in the United States (85.4%) at the end of the fourth quarter. During the quarter, the funds increased their exposure in 30 countries, led by Canada, the United States, and the United Kingdom. This quarter marked the first time since Q3 2013 that the U.S was not the top country in terms of the largest increase in aggregate exposure. In Canada, the increase in exposure was led by purchases of Restaurant Brands International Inc. and Canadian PacificRailway. The aggregate purchases of these two stocks ranked 3rd and 10th respectively on the list of the 10 largest purchases by the 50 hedge funds for the quarter. On the other hand, the 50 largest funds decreased equity exposure in 14 countries, led by Japan and South Korea.

Top Holdings: Apple and Allergan

Apple remained the largest holding of the aggregate portfolio, comprising 1.7% of all equity holdings. The stock was ranked 3rd on the list of companies with the highest number of hedge funds holding a position in the company (24) at the end of the quarter, trailing only Actavis PLC (26) and Allergan (25). Apple was the top holding of seven of the 50 hedge funds at the end of the fourth quarter. During the course of the fourth quarter (October 1 through December 31), the price of the stock rose by 11.3%.

Allergan moved up one spot from last quarter to become the second largest holding of the aggregate portfolio, comprising 1.4% of all equity holdings. The stock was ranked 2nd on the list of companies with the highest number of hedge funds holding a position in the company (25) at the end of the quarter, trailing only Actavis PLC (26). Allergan was the top holding of two of the 50 hedge funds at the end of the fourth quarter. During the quarter, the price of the stock rose by 18.3%.

As previously noted, Actavis PLC was the most widely held stock among the top 50 hedge funds at the end of Q4, as 26 hedge funds held a position in the company at the end of the quarter. Overall, the company was the 7th largest holding in the aggregate portfolio, comprising 0.9% of all equity holdings. Actavis was the top holding of one of the 50 hedge funds at the end of the fourth quarter. During the quarter, the price of the stock rose by 7.9%.

Top Purchase: Shire PLC

Shire PLC was the top purchase of the hedge funds during the fourth quarter. The market value purchased in this company was nearly $1 billion more than the next closest company (Zoetis). It was the top purchase of three of the 50 hedge funds during the quarter. Shire PLC was the target of an acquisition attempt by AbbVie during the course of the third quarter. However, the final merger agreement was ultimately cancelled on October 20. On October 24, Shire reported EPS for the third quarter that was above analyst expectations. Flemming Ornskov, M.D., Shire’s Chief Executive Officer, commented that the company generated “record quarterly product sales of $1,552 million, growing at 33%.” He also made positive comments about remainder of the year, stating, “As a result, I am pleased to once again increase our guidance for 2014. We now expect to deliver Non GAAP diluted earnings per ADS growth in the high thirty percent range in 2014.”

During the first two weeks of October (October 1 through October 15), the price of Shire PLC (ADR) fell by 34.0%. From October 15 through the end of the fourth quarter, the price of the ADR increased by 24.7%.

Top Sales: Kinder Morgan and AbbVie

On the other hand, Kinder Morgan (Class P) was the largest sale in aggregate for the hedge funds during the fourth quarter. The market value sold in this company was nearly $1.5 billion more than the next closest company (AbbVie). It was the top sale of three of the 50 hedge funds during the quarter.

On October 15, the company discussed higher dividend payments during its earnings call. Richard Kinder, Chairman and CEO, stated, “Let me talk about third quarter performance. There's really not a lot to report on the quarter or on our projections for the balance of the year. Steve and Kim will take you through in more detail, except that we do now expect to exceed our $1.72 budget target for dividends at KMI and we expect to meet our targets at KMP, KMR, and EPB....To remind you, we expect the resulting consolidated KMI to pay a dividend of $2 in 2015, that's an increase of 16% over the $1.72 in budget target for 2014, to increase that dividend by 10% a year through 2020 and to generate coverage in excess of $2 billion above these increased dividend payments.”

From October 1 through October 15, the price of the stock fell by 7.6%. From October 15 through the end of the quarter (December 31), the price of the stock increased by 19.9%.

AbbVie was the second largest sale in aggregate of the hedge funds during the fourth quarter. The market value sold in this company was over $1.0 billion more than the next closest company (Crown Castle International). It was the top sale of one of the 50 hedge funds.

As previously noted, AbbVie and Shire PLC announced the cancellation of their merger agreement on October 20. From October 1 through October 20, the price of the stock of AbbVie fell by 4.9%. From October 20 through the end of the fourth quarter (December 31), the price of the stock of AbbVie increased by 20.3%.

Top New Position: CDK Global Inc.

In terms of new positions, CDK Global Inc. was the top position added in aggregate in terms of market value. The company was spun off from Automatic Data Processing on September 30. It was the top buy of one of the 50 hedge funds during the quarter. During the quarter, the price of the stock increased by 31.5%

Read more in Hedge Fund Ownership Quarterly

- Sector-Level and Company-Level Weighting Relative to S&P 500

- Top 50 Holdings: Top 50 Hedge Funds

- Three-month Largest Holding Value Changes

- Country Breakdown: Top 50 Hedge Funds

- Cap Group Breakdown: Top 50 Hedge Funds

Insight/Author%20Bios/JohnButters2.jpg)