Share Buybacks Down Slightly in Q4 2014

First Year-Over-Year Decline in Buyback Spending Since Q3 2012

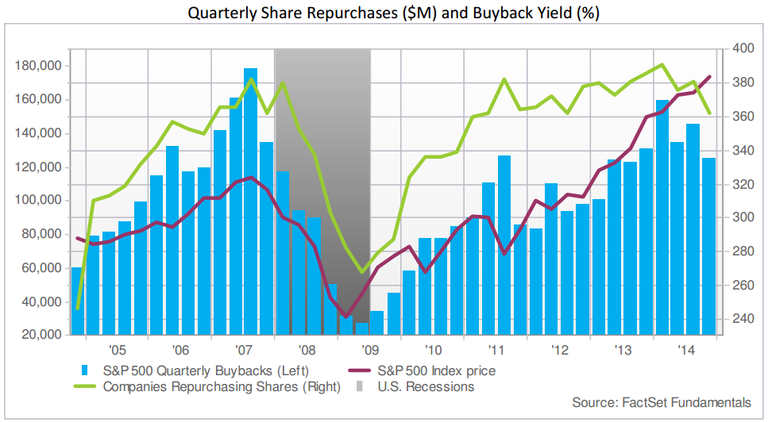

For the fourth quarter, aggregate share buybacks amounted to $125.8 billion. This dollar level reflected a year-over-year decrease of 4.4%, and a quarter-over-quarter decrease of 13.5%. This quarter marked the first year-over-year decline in spending on buybacks by companies in the S&P 500 since Q3 2012 (-26.8%).

On a trailing 12-month basis (TTM), spending on buybacks by S&P 500 companies totaled $564.7 billion. This amount reflected a year-over-year increase of 17.6% compared to the spending over the prior (year-ago) 12-month period. The fourth quarter of 2014 reflected the fifth highest quarter for spending on buybacks on a trailing 12-month basis since 2005, behind only Q4 2007 ($618.0 billion), Q3 2007 ($603.3 billion), Q1 2008 ($593.6 billion), and Q3 2014 ($569.9 billion).

Company-Level Buybacks: Apple Was Largest Spender on Buybacks during Q4 2014

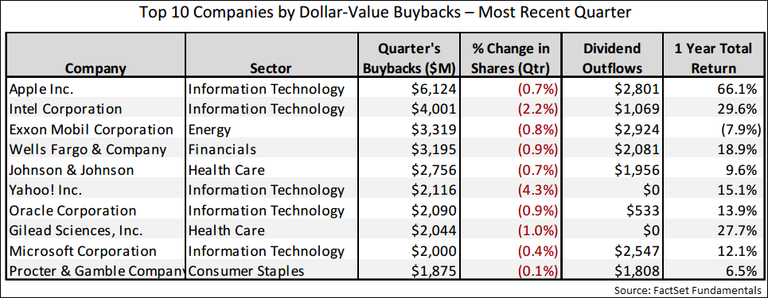

At the company level, Apple was the largest spender on buybacks in the S&P 500 during the quarter. The company spent $6.1 billion in share repurchases during Q4 2014, which reflected a 19.9% increase on a year-over-year basis. However, on a quarter-over-quarter basis, this amount reflected a 64% decline in spending. In the previous quarter (Q3 2014), Apple spent the second-largest dollar amount on share repurchases by an individual company in the S&P 500 (since 2005) at $17.0 billion. Over the past three quarters (Q114 – Q314), Apple has spent $16.9 billion on share repurchases on average. As a result, on a trailing 12-month basis (TTM), Apple has now spent the highest amount on buybacks ($57.0 billion) of all the companies in the index. Apple's total spending over this time frame is more than four times higher than IBM's total spending ($13.4 billion), which is the second-highest amount in the index.

While Apple recorded about a $1 billion year-over-year increase in spending on share repurchases during the fourth quarter, a number of companies witnessed even larger dollar-level increases in spending on buybacks during this time, including Intel (+$3.5 billion), Johnson & Johnson (+$2.3 billion), Wells Fargo (+$1.9 billion), and Yahoo! (+$1.9 billion).

On the other hand, a number of companies recorded substantial, year-over-year, dollar-level declines in spending on buybacks during the fourth quarter. Some of the companies that were the largest contributors to the 4% decrease in spending on share repurchases for the S&P 500 during the quarter include IBM (-$5.9 billion), Pfizer (-$3.9 billion), Cisco Systems (-$2.8 billion), General Electric (-$2.2 billion), and AT&T (-$1.9 billion).

Overall, 362 companies (or 72% of the index) participated in share buybacks during Q4 2014. The average participation rate over the past five years (20 quarters) for the S&P 500 has also been 72%. On a year-over-year basis (compared to Q4 2013), the number of companies that participated in share repurchases fell by 6% (to 362 from 386). On a sequential basis (compared to Q2 2014), the number of companies that participated in a share repurchases dropped by 5% (to 362 from 381).

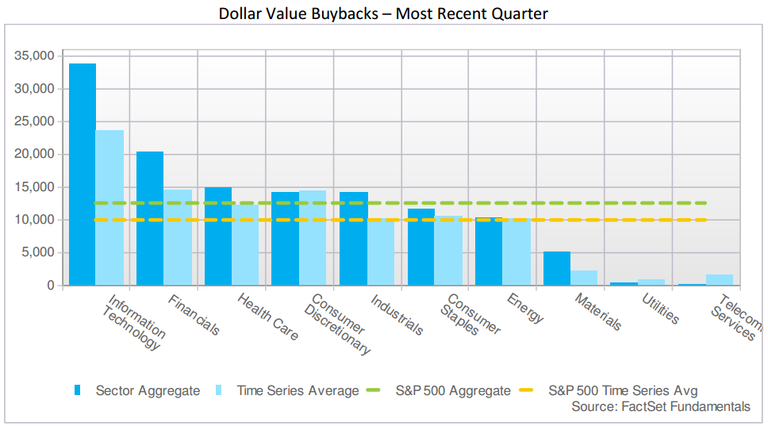

Sector Trends: Telecom Services Down, Utilities Up

At the sector level, seven of the 10 sectors recorded a year-over-year decrease in spending on share repurchases, led by the Telecom Services sector. On the other hand, the Utilities sector witnessed the largest increase in spending on share repurchases for the quarter.

The Telecom Services sector witnessed the largest decrease in aggregate spending in share repurchases of all 10 sectors at -95.8%. This sector has not historically been a large spender on buybacks, which makes it susceptible to large swings in quarterly growth rates. Most of the decline in this sector can be attributed to AT&T, which spent nothing on buybacks in Q4 2014, compared to $1.9 billion in Q4 2013.

In the Utilities sector, companies in aggregate reported a 54.2% rise in spending on share repurchases, which was the highest percentage of all 10 sectors. This sector has also not historically been a large spender on buybacks, which makes it susceptible to large swings in quarterly growth rates. Companies that were significant contributors to the increase in buyback spending in this sector include Entergy (+$165 million), NRG Energy (+$44 million), and JPMorgan Sempra Energy (+$38 million).