Aggregate Dividends Come in at $376 billion

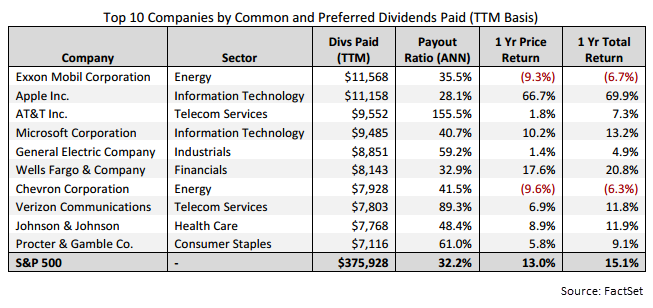

Companies in the S&P 500 paid $375.9 billion in dividends in aggregate during the trailing 12-month period ending in January (Q4 2014). This marked the fourth consecutive quarter that the amount of dividends paid on a trailing 12-month basis reached a new record high.

At the sector level, the Financials ($60.7 billion) and Information Technology ($57.0 billion) sectors paid the largest aggregate dividends on a trailing 12-month basis. At the company level, Exxon Mobil ($11.6 billion) and Apple ($11.2 billion) paid the largest aggregate dividends on a trailing 12-month basis.

Double-Digit DPS Growth (11.9%) Continued in Q4

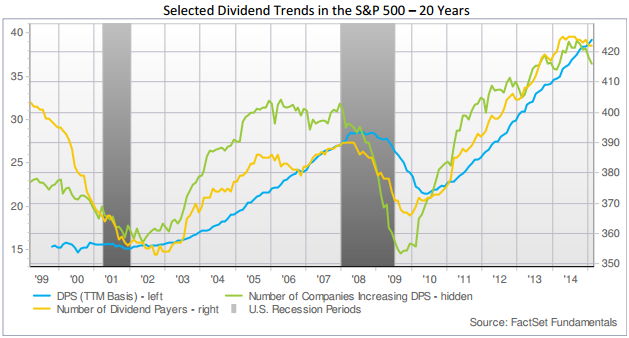

Dividends per share (DPS) grew 11.9% to $38.77 in the trailing twelve-month (TTM) period ending in January. This marked the 16th consecutive quarter in which DPS for the S&P 500 has grown at doubledigit rates. Over this 16-quarter window, DPS for the index has seen average growth of 14.1%.

At the sector level, all 10 sectors recorded growth in DPS over the prior 12 months. Six of the 10 sectors recorded double-digit increases in DPS growth: Consumer Discretionary (19.0%), Financials (18.3%), Telecom Services (17.2%), Energy (14.2%), Industrials (13.1%), and Information Technology (10.7%). This quarter marked the second consecutive quarter in which the Consumer Discretionary sector reported the highest DPS growth of all ten sectors over the prior 12 months.

Dividend Payout Ratio: 32.2% The dividend payout ratio (ratio of dividends to earnings) on a trailing 12-month basis was 32.2% at the end of the fourth quarter, which was above the 10-year median (29.2%) for the index. This quarter marked the highest payout ratio since the end of Q1 2010 (33.1%). Over the past 12 months, DPS growth (11.9%) outpaced EPS growth (5.9%) for the index.

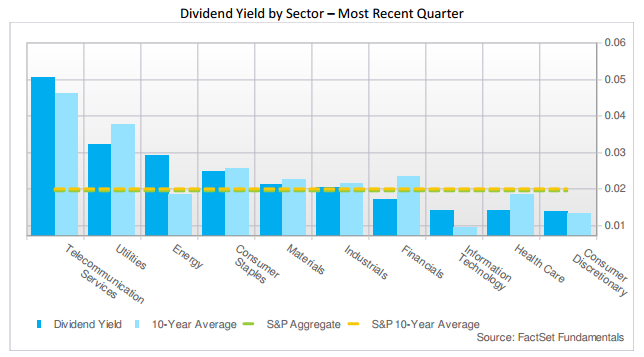

The dividend yield (ratio of dividends to price) on a trailing 12-month basis was 1.9% at the end of Q4 2014, which was equal to the 10-year median (1.9%).

The number of companies paying dividends in the TTM period was 421 (or 84% of the index) at the end of January. Overall, 341 companies increased their dividend payments over the past 12 months.

Several companies from a variety of industries have been remarkably consistent in boosting their DPS payouts. For example, Ensco, Seagate Technology, and ONEOK were the top companies by compound annual DPS growth over the three-year, five-year, and ten-year horizons (38.9%, 44.0%, and 17.1%, respectively). ONEOK was also on the top ten list for all three time horizons.

Analyst Project 8.2% Growth in DPS Over Next 12 Months

It is interesting to note that the estimate for DPS growth over the next 12 months (NTM) is 8.2%. While all ten sectors are projected to report growth in DPS over this time frame, only the Financials (12.8%) and Industrials (10.0%) sectors are expected to report double-digit growth in dividends. As noted in last quarter’s report, it appears dividend payments for the Financials sector have not yet fully recovered from the financial crisis, resulting in higher growth expectations going forward. The Financials sector is currently the only sector in the index still reporting DPS on a trailing 12-month basis ($5.49) below the 10-year average for the sector ($6.93).