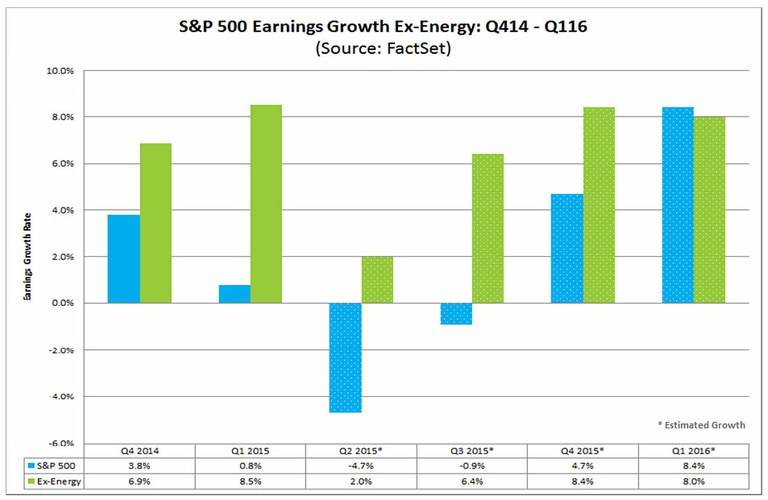

For Q2 2015, year-over-year earnings for the S&P 500 are projected to decline by 4.7%. The Energy sector is expected to be the largest contributor to the earnings decline for the index for the quarter, as the sector is projected to report a year-over-year decrease in earnings of 60.5%. If the Energy sector is excluded from the index, the S&P 500 would be projected to report earnings growth of 2.0%.

Given the decline in the price of oil from year-ago levels, how long is the Energy sector projected to be a drag on earnings growth for the S&P 500? When is the sector projected to be a positive contributor to earnings growth for the index?

For the remainder of 2015, the Energy sector is expected to continue to be the largest detractor to earnings growth for the S&P 500.

For Q3 2015, year-over-year earnings for the S&P 500 are projected to decline by 0.9%. The Energy sector is expected to be the largest contributor to the earnings decline for the index for the quarter, as the sector is projected to report a year-over-year decrease in earnings of 58.5%. If the Energy sector is excluded from the index, the S&P 500 would be projected to report earnings growth of 6.4%.

For Q4 2015, year-over-year earnings for the S&P 500 are projected to increase by 4.7%. The Energy sector is expected to be the largest detractor to earnings growth for the index for the quarter, as the sector is projected to report a year-over-year decrease in earnings of 38.7%. If the Energy sector is excluded from the index, the projected earnings growth rate for the S&P 500 would jump to 8.4%.

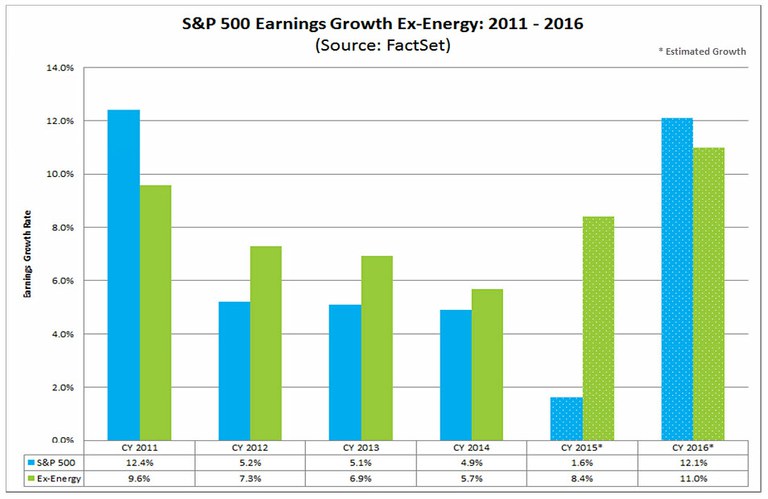

For all of 2015, the S&P 500 is projected to report earnings growth of 1.6%. The Energy sector is predicted to be the largest detractor to earnings growth for the index for the year, as the sector is expected to report a year-over-year decline in earnings of 55.2%. If the Energy sector is excluded from the index, the projected earnings growth rate for the S&P 500 would improve to 8.4%.

Starting in Q1 2016, however, the Energy sector is projected to be a positive contributor to earnings growth for the S&P 500.

For Q1 2016, year-over-year earnings for the S&P 500 are projected to increase by 8.4%. The Energy sector is expected to be a positive contributor to earnings growth for the index for the quarter, as the sector is expected to report a year-over-year increase in earnings of 16.0%. If the Energy sector is excluded from the index, the projected earnings growth rate for the S&P 500 would fall to 8.0%

For all of 2016, the S&P 500 is projected to report earnings growth of 12.1%. The Energy sector, due to a combination of higher projected earnings and the easier comparison to lower earnings in 2015, is predicted to be the largest contributor to earnings growth for the S&P 500 for the year. The sector is projected to report year-over-year growth of 34.4%, which is the largest estimated earnings growth rate of all ten sectors. If the Energy sector is excluded from the index, the projected earnings growth rate would decrease to 11.0%.

If these earnings projections for 2016 prove to be accurate, the Energy sector will be a positive contributor to annual earnings growth for the S&P 500 in 2016 for the first time since 2011.