Via FactSet Mergers staff

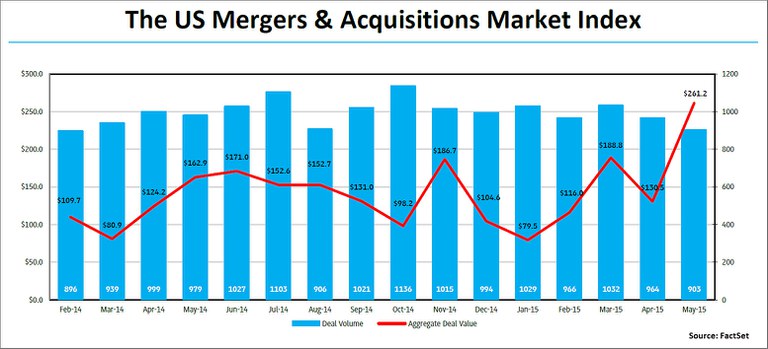

U.S. M&A deal activity decreased in May, going down 6.3% with 903 announcements compared to 964 in April. However, aggregate M&A spending increased. In May, 100.1% more was spent on deals than in April.

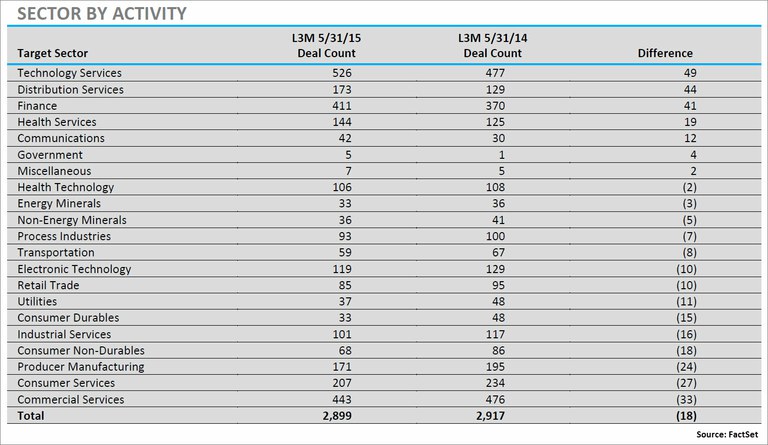

Over the past three months, the sectors that have seen the biggest increases in M&A deal activity, relative to the same three month period one year ago, have been:

- Technology Services (526 vs. 477)

- Distribution Services (173 vs. 129)

- Finance (411 vs. 370)

- Health Services (144 vs. 125)

- Communications (42 vs. 30)

Seven of the 21 sectors tracked by FactSet Mergerstat posted relative gains in deal flow over the last three months compared to the same three months one year prior.

Over the past three months, the sectors that have seen the biggest declines in M&A deal volume, relative to the same three month period one year ago have been:

- Commercial Services (443 vs. 476)

- Consumer Services (207 vs. 234)

- Producer Manufacturing (171 vs. 195)

- Consumer Non-Durables (68 vs. 86)

- Industrial Services (101 vs. 117)

Fourteen of the 21 sectors tracked by FactSet Mergerstat posted negative relative losses in deal flow over the last three months compared to the same three months one year prior, for a combined loss of 198 deals.

Topping the list of the largest deals announced in May are:

- Charter Communications, Inc. agreeing to acquire Time Warner Cable, Inc. for $55 billion

- Monsanto Co.'s proposal to acquire Syngenta AG for $44 billion

- Avago Technologies Ltd.'s deal to acquire Broadcom Corp. for $35 billion

- The Williams Cos., Inc.'s agreement to acquire the remaining 42% stake not owned in Williams Partners LP for $13.8 billion

- Danaher Corp. agreeing to acquire Pall Corp. for $13.6 billion

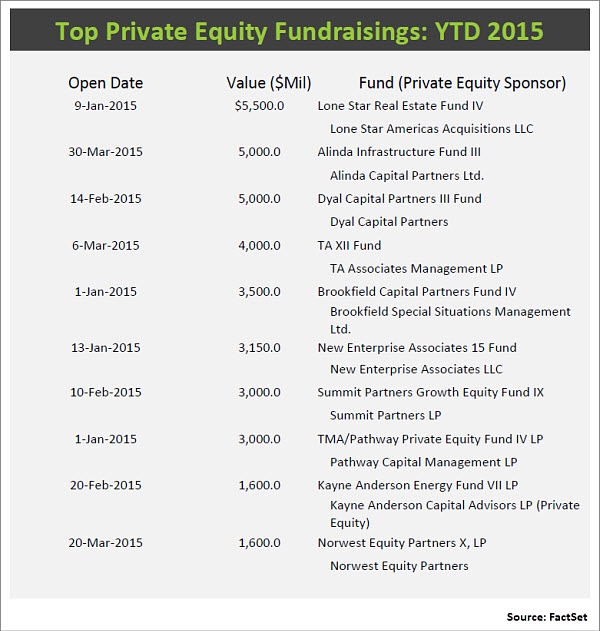

U.S. private equity activity increased in May, up 2.2% from April. There were 93 deals in May compared to 91 in April. However, aggregate base equity decreased, down by 53.6% to $9.5 billion from April's $20.4 billion.

Canadian firms were the biggest buyers of U.S. companies in May. They announced 30 deals for the month, with UK companies in second with 19 deals, followed by Japan, China, and Germany. The largest deal to purchase a U.S. business was the Singapore-based Avago Technologies Ltd.'s deal to acquire Broadcom Corp. for $35 billion. UK firms were the biggest sellers to U.S. firms with 34 deals, followed by Canada, the Netherlands, and Germany. The largest U.S. deal to acquire a foreign company was Monsanto Co.'s proposal to acquire the Switzerland-based Syngenta AG for $44 billion.

The top financial advisors for 2015 based on deal announcements, are: Goldman Sachs & Co., Morgan Stanley, JPMorgan Chase & Co, Bank of America Merrill Lynch, and Citigroup. The top five financial advisors, based on the aggregate transaction value of the deals worked on, are: Goldman Sachs & Co., JPMorgan Chase & Co, Morgan Stanley, Bank of America Merrill Lynch, and Citigroup.

The top legal advisors for 2015 based on deal announcements, are: Kirkland & Ellis LLP, Jones Day LP, Skadden, Arps, Slate, Meagher & Flom LLP, Fenwick & West LLP, Sullivan & Cromwell LLP, and Davis Polk & Wardwell LLP. The top five legal advisors, based on the aggregate transaction value of the deals worked on, are: Skadden, Arps, Slate, Meagher & Flom LLP, Sullivan & Cromwell LLP, Davis Polk & Wardwell LLP, Kirkland & Ellis LLP, and Wachtell, Lipton, Rosen & Katz.

FactSet Flashwire Monthly Report

- Key trend information for the Overall and Middle M&A Markets, such as deal volume, deal value, mega-deals, leading buyers, leading industries, leading sectors, cross-border deals, U.S. regional deals, average P/E, average premiums, payment methods, and much more

- Report on U.S. Sector Activity and Value

- Sector Spotlight

- U.S. Strategic Buyer Report and U.S. Private Equity Report

- Top U.S. Financial and Legal Advisor Rankings

- Top U.S. Deals Scoreboard