By Andrew Birstingl | August 24, 2015

The 50 largest hedge funds increased their equity exposure by 4.4% in Q2 2015. Health Care and Consumer Discretionary were the two most popular sectors in terms of equity additions, with six of the top 10 purchases in the quarter coming from companies in these sectors.

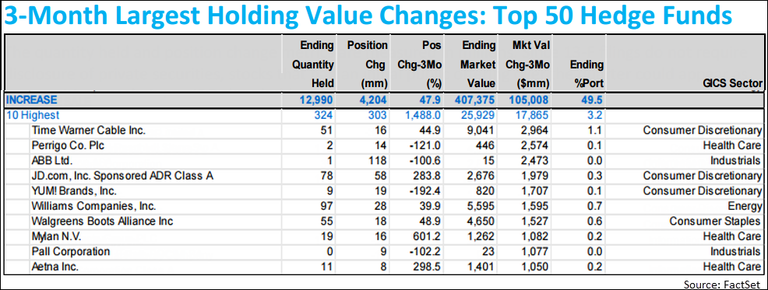

The two largest purchases in the second quarter were Time Warner Cable (TWC) and Perrigo Co. Plc (PRGO), and each was involved in significant merger discussions during the quarter.

Time Warner Cable was the largest purchase in Q2, as the top 50 hedge funds invested an additional $3 billion by the end of the quarter. Of the top 50 hedge funds, 16 increased their position in the internet and cable provider, led by Egerton Capital (UK) and Senator Investment Group. Time Warner Cable was also the most widely held stock, with 29 funds holding a position in the company at the end of Q2. This was an increase from the 21 hedge funds that held the stock at the end of Q1. Depending on the timing of the purchases, hedge funds could have reaped healthy benefits from their bets on Time Warner Cable, as the stock has soared 23.6% since the start of the second quarter. It is important to note that on May 26, it was announced that Charter Communications offered to acquire Time Warner Cable for $55 billion in a deal that valued the company at $194.84 per share. This represented a 13.8% premium to its closing price a day prior to the announcement.

Perrigo Co. PLC was the second largest purchase, with over $2.5 billion being added to the stock in Q2. York Capital Management Global Advisors, OZ Management, and Pentwater Capital Management led the buying, as each hedge fund added over $400 million worth of stock. Perrigo is a global healthcare supplier that develops, manufactures, and distributes over-the-counter and prescription pharmaceuticals. On April 8, rival drug-maker Mylan NV submitted a hostile takeover bid for Perrigo at $205 per share, which represented a 24.5% premium to the stock's closing price on April 7. The deal is still pending, with a special Mylan shareholders meeting occurring on August 28. The stock is up 13.5% since April 7.

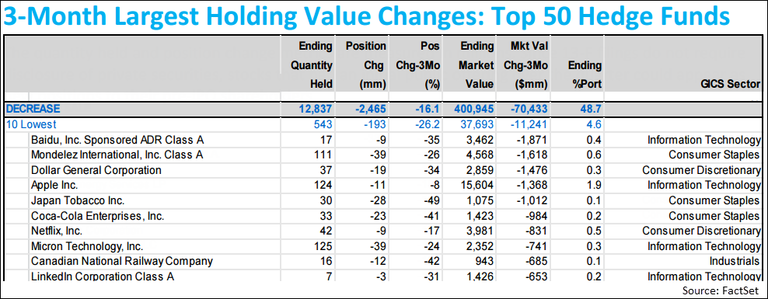

On the other end of the spectrum, hedge funds sold large interests in Baidu, Inc, Mondelez International, and several other large consumer and technology names. The stock prices of Baidu and Mondelez have gone in opposite directions as of late, with the Chinese internet giant falling 32.9% year-to-date and the U.S. snack and beverage manufacturer rising 18.9% year-to-date. Lone Pine Capital led the exodus from Baidu, selling its entire stake of almost 2% ($1.05 billion) in the second quarter. Coatue Management removed over $440 million, but still left $156 million in the stock by the end of Q2. The top 50 hedge funds took out $1.6 billion in the stock of Mondelez, with Viking Global Investors leading the selling. On August 6, Bill Ackman's activist hedge fund Pershing Square filed a 13D reporting a 7.5% stake in Mondelez International and disclosed intent to engage in discussions with the company and stakeholders regarding its business strategy, operations, and board composition.

Apple Inc. remained the top holding of the 50 largest hedge funds for the fifth straight quarter. The company made up 1.6% of the aggregate hedge fund portfolio. However, the top 50 hedge funds decreased their position in the company by 8.8% from Q1. The decrease was led by Lone Pine Capital, which exited its entire position in Apple (worth over $850 million). Of the 26 hedge funds that held Apple, 16 sold shares during the second quarter. However, seven hedge funds still had Apple as its top holding in their portfolio by the end of Q2. During the course of the quarter (April 1 through June 30), the stock increased 0.95%.

At the country level, the top 50 hedge funds increased their exposure to the United States. U.S. equities made up 84.9% of the aggregate portfolio of equity holdings at the end of Q2. The other notable trend from a geographical perspective was hedge funds' pullback from China. Hedge funds took out over $2.2 billion worth of equity investments in the second quarter, primarily driven by decreased exposure to Baidu and Alibaba Group. The bearish sentiment may be warranted as the stocks of Baidu and Alibaba have already dropped 32.9% and 34.4% on a year-to-date basis.

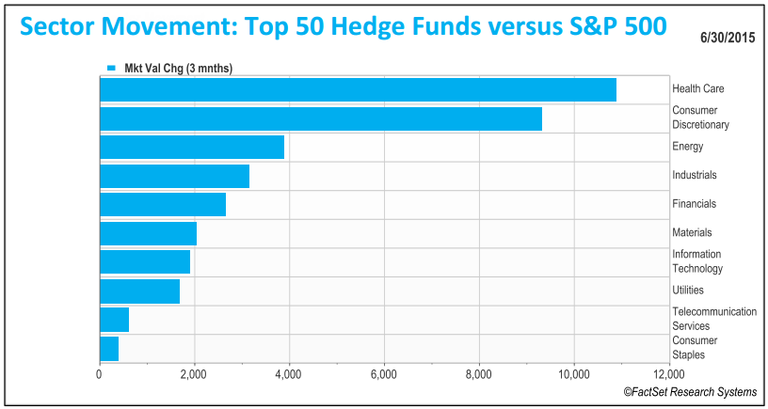

At the end of the second quarter, the 50 largest hedge funds had the largest exposure to the Information Technology (17.4%) and Consumer Discretionary (17.2%) sectors, just as they did at the end of the first quarter. The funds increased their aggregate value of holdings in all ten GICS sectors, with Health Care and Consumer Discretionary seeing the largest gains, and Consumer Staples and Telecom Services seeing the smallest gains. On a relative basis versus the GICS sector weights of the S&P 500, the aggregate hedge fund portfolio was overweight in five sectors and underweight in five sectors. The most overweight sectors were Consumer Discretionary (17.2% vs 12.8%) and Materials (5.6% vs 3.1%), while the most underweight sectors were Financials (12.7% vs 16.6%) and Consumer Staples (6.1% vs 9.4%).

At the security level, Time Warner Cable was the most overweight equity of the S&P 500 constituents in the aggregate hedge fund portfolio (+1.1 percentage points). (Security-level overexposures are determined by excluding the funds' positions in securities that are not within the comparison index.) The announcement of the acquisition of Time Warner Cable by Charter Communications in late May could be a reason for hedge funds favoring the stock in Q2. Time Warner Cable was the third largest holding in the aggregate portfolio and the top purchase during the quarter. It made up 1.1% of all equity holdings and was the top holding of five of the hedge funds.

Allergan (+0.7 percentage points), Air Products and Chemicals (+0.6 percentage points), and Williams Companies (+0.6 percentage points) were several of the other most overweight equities. On the other hand, Apple was the most underweight holding of the S&P 500 companies, with a portfolio weight 2.3 percentage points lower than its exposure in the S&P 500 index. Exxon Mobil (-1.8 percentage points), Google Inc. Class C (-1.8 percentage points), and Berkshire Hathaway (-1.6 percentage points) were several of the other most underweight equities.

FactSet's "SharkWatch50" is a compilation of the fifty most significant activist investors. During the second quarter, the nine SharkWatch activist investors within the top 50 hedge funds took several new positions of considerable size. The two largest were American Express and Nomad Foods. ValueAct Capital Management made an $870 million investment (1.1% stake) in the credit card company and has since initiated dialogues with management. The second largest new position was taken in Nomad Foods, a British Virgin Islands-based special purpose acquisition company, which focuses on the frozen food industry. In the second quarter, Third Point LLC and Corvex Management disclosed 6.8% and 8.3% stakes in Nomad, respectively. Press releases have since indicated that Bill Ackman's Pershing Square has taken a 21.7% stake in the company. This is not the first time Ackman has bet on a SPAC or made an investment in a firm that has connections to Martin Franklin, the co-founder of Nomad Foods. He previously invested in Justice Holdings alongside Franklin, and in Platform Specialty Products, which Franklin founded.

A stock that experienced a notable sale was Netflix. Carl Icahn's Icahn Associates sold its remaining $925 million investment in the media-streaming company during the second quarter. In terms of position increases, the SharkWatch funds added to their investments in Yum! Brands and ConAgra Foods. Corvex Management and Dan Loeb's Third Point each increased their stakes in Yum!, while JANA Partners accumulated a 2.7% stake in ConAgra. In July, JANA Partners was granted two board seats by ConAgra management. In terms of position decreases, the SharkWatch funds decreased their positions in Valeant Pharmaceuticals and eBay. Valeant, which was the second top holding of the largest 50 hedge funds in Q2, saw ValueAct and JANA dump shares in its stock, while Pershing Square maintained their 5.7% stake in the company. JANA, Third Point, and Highfields Capital each cut their positions in eBay, with JANA Partners dumping over 40% of its shares.

Analysts Increasing EPS Estimates Slightly for S&P 500 Companies for Q4

Stay updated on the S&P 500 with this earnings insight from FactSet. Q4 EPS estimates rose slightly despite macro concerns,...

By John Butters | Earnings

Highest Number of S&P 500 Earnings Calls Citing “AI” Over the Past 10 Years

FactSet S&P 500 earnings analysis: AI cited on a record 306 Q3 earnings calls, far above average, with higher stock gains for...

By John Butters | Earnings

Are Industry Analysts Overestimating S&P 500 EPS For 2026?

This FactSet S&P 500 earnings analysis provides insights into full-year EPS estimates versus actual results over the past 25...

By John Butters | Earnings

Earnings Insight Infographic: Q3 2025 By the Numbers

Stay updated on critical trends in the S&P 500 with FactSet analysis. Here are key highlights of the third quarter 2025 earnings...

By John Butters | Earnings

The information contained in this article is not investment advice. FactSet does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.