By Andrew Birstingl | November 10, 2015

Uber, SpaceX, and Pinterest are three of the largest and best-known private technology companies in the U.S. But have you heard of D2L, Lightspeed POS, and D-Wave Systems? No? Well, that may soon change.

These companies are three of the largest private technology companies in Canada. Although Canada has traditionally been known for its energy and mining sectors, the country’s technology sector is on the rise. Here are a few trends to be aware of:

The technology sector consists of three FactSet sectors: Electronic Technology, Technology Services, and Health Technology. Any further references to the “technology” or “tech sector” refer to the aggregate of these three FactSet sector classifications, unless otherwise stated.

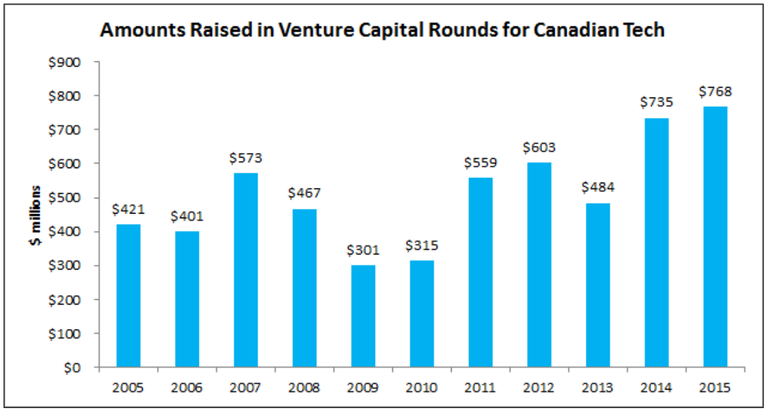

The amount of equity capital being raised in the private market by companies in Canada’s technology sector has increased in recent years. The amount raised in venture capital investment rounds in the tech sector has totaled $768 million year-to-date, which is the highest amount raised in 10 years. The average over the past 10 years is $512 million.

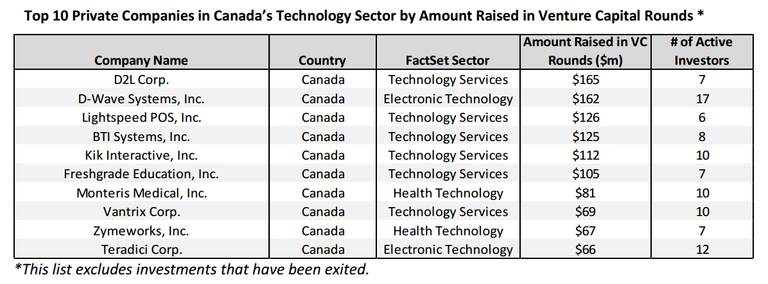

Currently, the two private Canadian companies with the largest amount raised in venture capital investment rounds are Desire2Learn (D2L) and D-Wave Systems. D2L is an education technology company that provides learning solutions in an open platform. The company has six active investors and has raised approximately $165 million in venture capital via two investment rounds. D-Wave Systems designs and develops quantum computer systems. It has 14 active investors and has raised approximately $162 million. As venture capital funding continues to increase in Canada’s technology sector, it will be interesting to watch the development of these companies as well as other startups in the space to see how quickly they enter the public market.

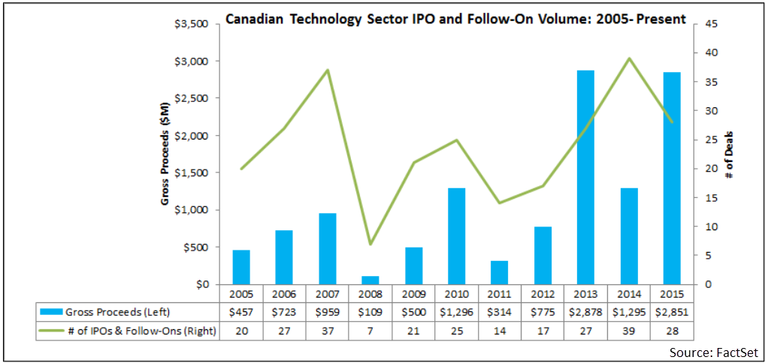

It is not simply the amount raised in venture capital rounds by companies in Canada's technology sector that has been growing. The amount of equity capital these companies have been raising in public markets has been growing as well. Since the start of 2005, there have been 934 initial public offerings by Canadian companies across all FactSet sectors, amounting to $33.9 billion in gross proceeds. Gross proceeds are defined as the total amount acquired from the offering by the issuing company with over-allotment proceeds included. The offerings exclude blank check offerings (i.e., SPACs or targeted acquisition companies) and the conversions of mutual insurance companies or savings and loans to stocks, investment trusts, and closed-end funds. The tech sector made up approximately 8% of the total gross proceeds from these IPOs going back to 2005.

So far in 2015, there have been four IPOs in Canada's tech sector totaling $422.1 million in gross proceeds. This amount represented a 109% increase from the total gross proceeds in 2014 for the tech sector, and was 71.4% above the 10-year average ($246.2 million). This year was the highest amount of total gross proceeds for Canada's tech sector since 2010, when four IPOs amounted to $876.9 million in gross proceeds.

Looking at both IPOs and follow-ons, the 28 equity offerings in 2015 to date have totaled $2.85 billion in gross proceeds, which is the second highest amount in 10 years. The highest amount was reached in 2013, when gross proceeds for Canada's technology sector amounted to $2.88 billion. The number of offerings in 2015 was 11 fewer than the number in 2014 (39 offerings), but the aggregate gross proceeds represented a 120.2% increase from the total in 2014.

Institutional investors seem to have taken notice of Canada's technology sector. Looking at technology companies based in Canada, (excluding companies with stock prices less than $1) institutional investors have invested $60.8 billion worth of shares in these companies as of the end of October, which equated to 65.2% of the aggregate shares outstanding. Valeant Pharmaceuticals made up a huge chunk of this market value due to positions in excess of $1 billion held by investors like Pershing Square, ValueAct, and Ruane, Cunniff, and Goldfarb. Therefore, it is more relevant to run this analysis excluding Valeant.

Looking at tech companies in Canada ex-Valeant (and still excluding companies with stock prices <$1), institutional investors have invested $31.3 billion worth of shares in these companies as of the end of October, which equated to 52.7% of the aggregate shares outstanding. This represented a 2.3% increase from the three months prior, a 3.6% increase from the six months prior, and a 9.9% increase from the 12 months prior.

The ownership data also indicated that it was not solely Canadian-based investors that have been buying up tech stocks. Institutional investors in the United States have also been making purchases. U.S institutional investors held $10.2 billion worth of shares, which equated to 17.2% of the aggregate shares outstanding. This represented a 3.2% increase from the three months prior, a 5.8% increase from the six months prior, and a 13.4% increase from the 12 months prior.

Institutional investors in Canada held $18.9 billion worth of shares, which amounted to 31.8% of the aggregate shares outstanding. Concordia Healthcare, Open Text, CAE, and Celestica were some of the largest purchases by institutional investors.

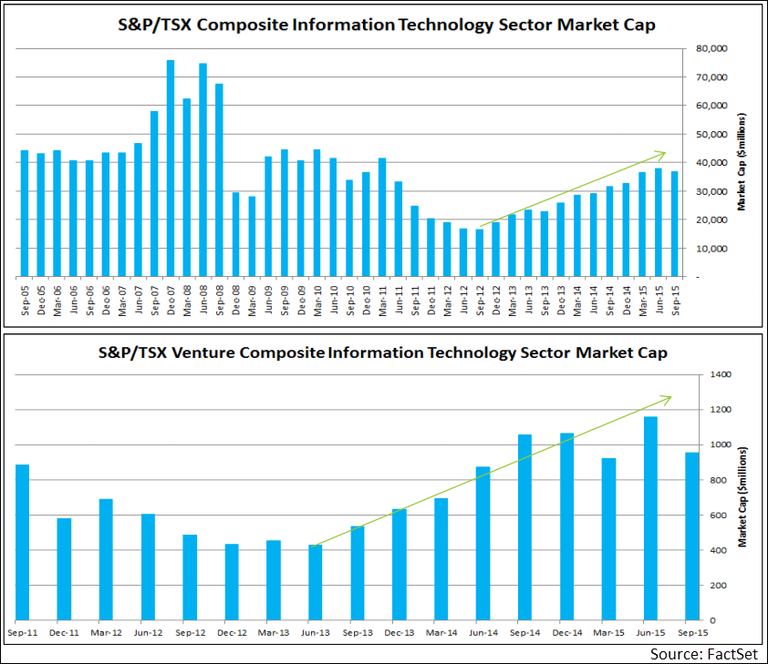

The S&P/TSX Composite Index represents some of the largest companies by market capitalization in Canada. The aggregate market value of the index has historically been dominated by three primary GICS sectors: Financials, Energy, and Materials. This makes sense as Canada is a world leader in the production of many natural resources, such as gold and nickel, and is also one of the few developed nations that is a net exporter of energy. The Information Technology GICS sector is a group in the S&P/TSX Composite that has been continuously growing its market value over the past several years.

The average aggregate market value for the Information Technology sector in Q3 2015 amounted to $36.9 billion, which was the second largest total since March 2011. The aggregate market value for the quarter is derived by taking a simple average of the ending weeks' market values for the entire quarter.

The aggregate market value has been generally increasing each quarter, since September 2012. The S&P/TSX Venture Composite Index, which consists of stocks with a smaller market value that typically are unable to meet listing restrictions for the TSX Composite, reveals a similar trend. In Q2 2015, the market value of the Information Technology sector totaled $1.2 billion, which was the highest quarterly average in five years. The Q3 2015 market value amounted to $954 million, which still represented a 30.2% premium to the five-year average.

Buffer ETFs vs. T-Bills: A Total Cost of Ownership Perspective

When your investment time horizon collapses, is it time for a buffer ETF?

U.S. Mergers & Acquisitions Monthly Review: November 2025

Explore FactSet's U.S. Mergers & Acquisitions Monthly Review. Gain deep insights into market trends and expert analysis to inform...

Fed Cuts and Lower Yields May Pull More Private Capital into Insurance

Read our insurance sector analysis: Allianz’s deal with Oaktree, macro trends on rates, and the impact of private capital on...

Shifts in Post-Trade: Case Studies and Infrastructure Principles for Success

Learn how rising complexity, faster settlements, digital assets, and regulation are reshaping post-trade operations. Explore case...

The information contained in this article is not investment advice. FactSet does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.