-

-

- Your Industry

- Solutions

-

Marketplace

-

Delivery Methods

-

APIs

Content, analytics, functional, and utility APIs

-

Data Feeds

FactSet and third-party concorded datasets

-

Platforms

Integrated software solutions across front, middle and back office

-

APIs

-

Trending Data Categories

-

Popular Platform Products

-

-

Insights

-

Insights

-

FactSet Insight Blog

Subscribe to insights from FactSet experts across topics that matter to you

-

Companies & Markets

Make smarter—and more informed— decisions with regular market outlooks

-

Data Science & AI

Stay up-to-date on the latest perspectives around AI

-

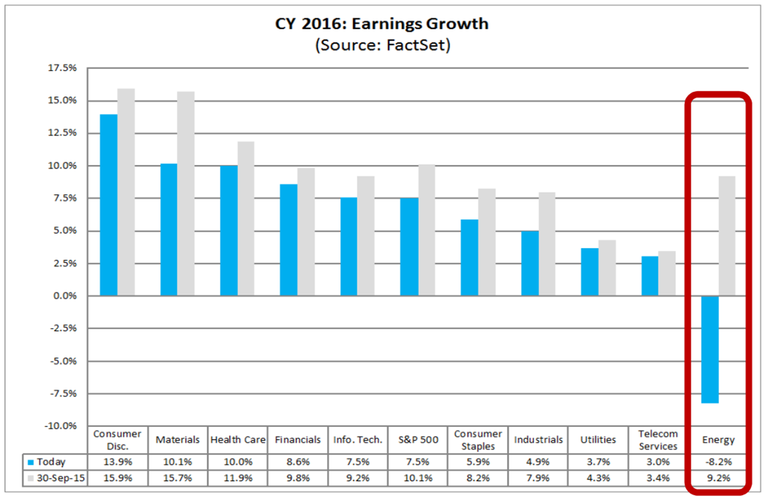

Earnings

Access unique analysis and commentary on earnings data for S&P 500 companies

-

FactSet Insight Blog

-

Resources

-

Resource Library

Access our brochures, case studies, videos, and more

-

Videos

Watch our brand, thought leadership, and solution videos

-

News & Events

Access the latest news about FactSet and explore upcoming events

-

Case Studies

See how our clients are putting FactSet solutions to work

-

Product & Solution Tours

Experience our products and workflow solutions firsthand

-

Resource Library

-

eBook: In the Thick of It: How Performance Teams Are Driving Value Across the Organization

Read the eBook

-

-

Our Company

-

About Us

-

Values & Recognition

-

Careers

Join a team of highly motivated, talented individuals who are empowered to find answers through creative technology.

Explore Career Opportunities

-

- Why FactSet

- FactSet Login

Insight/Author%20Bios/JohnButters2.jpg)