Will the S&P 500 Actually Report a Decline in Earnings for Q4 2015?

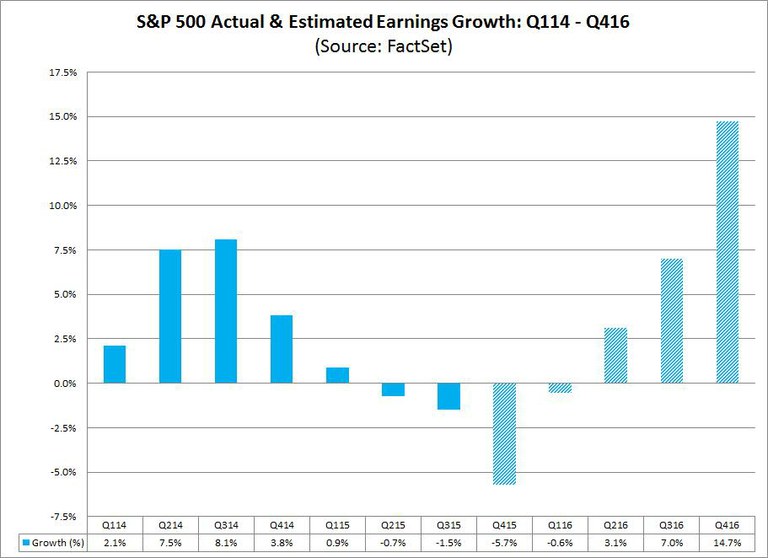

As of today, the S&P 500 is expected to report a year-over-year decline in earnings of 5.7% for the fourth quarter. What is the likelihood the index will report an actual earnings decrease of 5.7% for the quarter?

Based on the average number of companies reporting actual earnings above estimated earnings in recent years, it is likely the index will report a smaller decline in earnings than 5.7%. However, based on this average, the index is still likely to report a year-over-year decrease in earnings for Q4.

When companies in the S&P 500 report actual earnings above estimates during an earnings season, the overall earnings growth rate for the index increases because the higher actual EPS numbers replace the lower estimated EPS numbers in the calculation of the growth rate. For example, if a company is projected to report EPS of $1.05 compared to year-ago EPS of $1.00, the company is projected to report earnings growth of 5%. If the company reports actual EPS of $1.10 (a $0.05 upside earnings surprise compared to the estimate), the actual earnings growth for the company for the quarter is now 10%, five percentage points above the estimated growth rate (10% - 5% = 5%).

Over the past four years, 67% of companies in the S&P 500 have reported actual EPS above the mean EPS estimates on average. As a result, from the end of the quarter through the end of the earnings season, the earnings growth rate has typically increased by 3.0 percentage points on average (over the past 4 years) due to the large number of upside earnings surprises.

If this average increase is applied to the estimated earnings decline at the end of Q4 (December 31) of -4.9%, the actual earnings decline for the quarter would be -1.9% (-4.9% + 3.0% = -1.9%).

It is interesting to note that for Q3 2015, the actual decline for the quarter of -1.5% was smaller than the projected decline of -2.2% on October 9 (based on the average increase in the earnings growth):

Year-Over-Year Earnings Decline (-0.6%) Now Projected for S&P 500 for Q1 2016

As of today, the blended earnings decline for the fourth quarter for the S&P 500 stands at -5.7%. Factoring in the average improvement in earnings growth during a typical earnings season due to upside earnings surprises (see page 2 for more details), it still appears likely the S&P 500 will report a year-over-year decline in earnings for the fourth quarter. If the index does report a year-over-year decline in earnings for the fourth quarter, it will mark the first time the index has reported three consecutive quarters of year-over-year declines in earnings since Q1 2009 through Q3 2009.

Looking at the current quarter (Q1 2016), what are analyst expectations for year-over-year earnings? Do analysts believe earnings will decline in the first quarter of 2016 also?

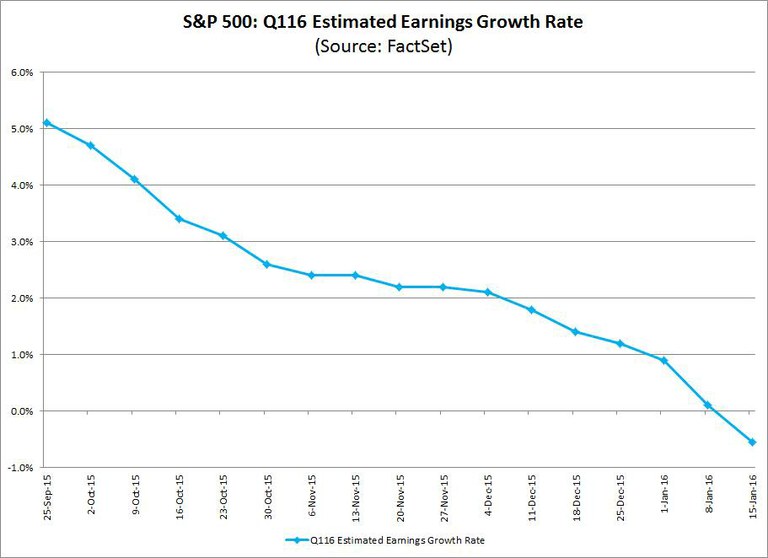

The answer is yes. This past week marked a change in the aggregate expectations of analysts from slight growth in year-over-year earnings (0.1%) for Q1 2016 to a slight decline in year-over-year earnings for Q1 2016 (-0.6%). However, expectations for earnings growth for Q1 2016 have been falling not just over the past few weeks, but over the past few months as well. On September 30, the estimated earnings growth rate for Q1 2016 was 4.9%. By December 31, the estimated growth rate had declined to 0.9%. Today, it stands at -0.6%.

Seven sectors have lower expected earnings growth rates today compared to September 30 (due to downward revisions to earnings estimates), led by the Energy sector. On September 30, the estimated earnings decline for the Energy sector for Q1 2016 was -17.7%. Today, it stands at -56.1%.

However, it is interesting to note that analysts in aggregate do expect earnings growth to return for the remaining quarters of 2016.