Over the past four days, the price of crude oil (NYM $/bbl) has closed the day below $30.00. This marked the first time the price of oil has closed below $30.00 since 2003. Based on yesterday’s closing price of $29.53, the price of oil is now 20% below the closing price on December 31, 2015, 45% below the closing price on December 31, 2014, and 70% below the closing price on December 31, 2013. Given the sharp decline in 2015, do analysts believe the price of oil will reverse course and increase during 2016?

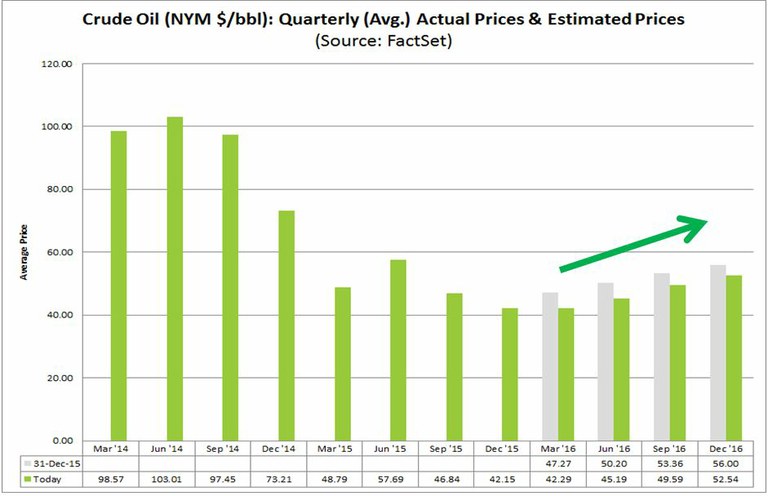

The answer is yes. The estimated average price of crude oil for Q1 2016 is $42.29 (based on estimates from 51 contributors). This estimate is above the average price of crude oil for Q4 2015 ($42.15). Going forward, the estimated average price for crude oil is expected to increase sequentially each quarter during the course of 2016. For Q2 2016, the estimated average price is $45.19. For Q3 2016, the estimated average price is $49.59. For Q4 2016, the estimated average price is $52.54.

However, it is important to note that the estimated average prices for all four quarters of 2016 have declined since the start of the year, as analysts have lowered their estimates for oil prices over the past few weeks. For Q1 2016, the estimated average price for crude has dropped by 10.5% since December 31. For Q2 2016, the estimated average price has fallen by 10.0% during this period. For Q3 2016, the estimated average price has decreased by 7.1%. For Q4 2016, the price has plummeted by 6.2%. Although the estimates for all four quarters have declined since December 31, analysts are still calling for a sequential increase in average prices on a quarterly basis.

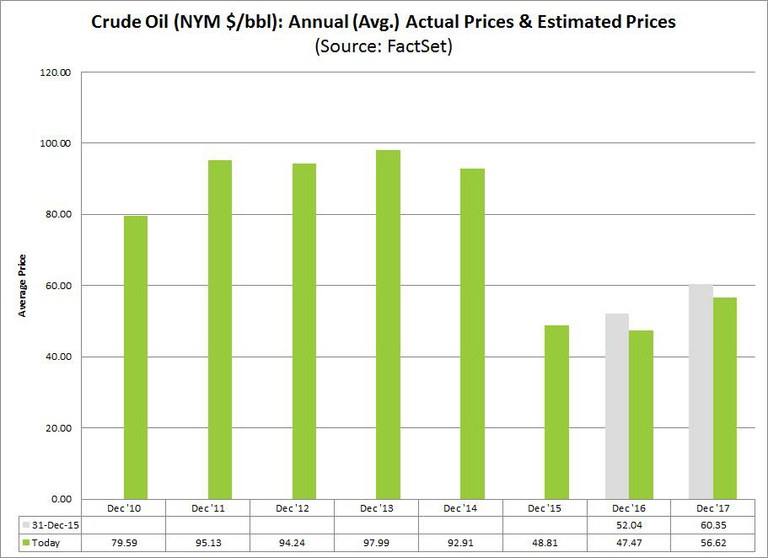

Despite this expected quarterly sequential increase in oil prices for 2016, the estimated average price of crude oil for all of 2016 (on an annual basis) is $47.47, which is below the average price for crude oil recorded on an annual basis for 2015 ($48.81). Thus, the average price of oil for 2016 is expected to be lower than the average price for 2015. Starting in 2017, the estimated average prices for crude oil on an annual basis are projected to rise.

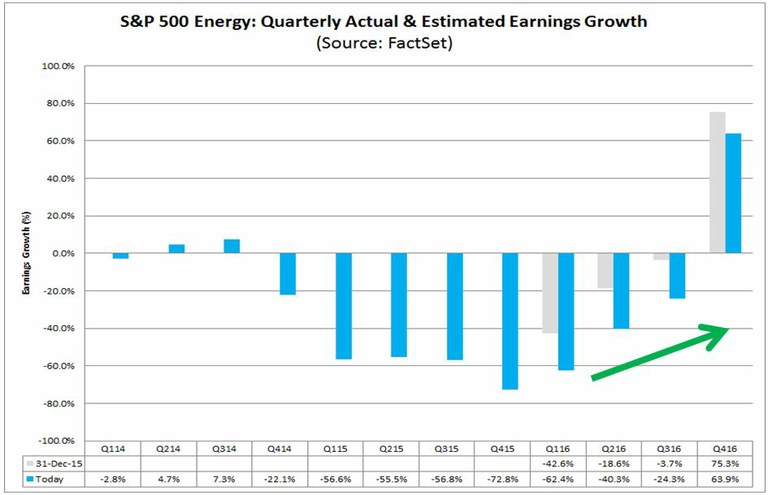

In terms of earnings, the negative impact of lower oil prices relative to last year can already be seen in the S&P 500 Energy sector for Q4 2015, where year-over-year earnings are expected to decline by more than 70% for the quarter. With crude oil prices projected to improve during the course of 2016, do analysts also project improving earnings growth rates for this sector during the course of the year?

The answer is also yes. The estimated earnings decline for the S&P 500 Energy sector for Q1 2016 is -62.4%, which is a smaller year-over-year decline in earnings relative to the estimate for Q4 2015. Going forward, the estimated year-over-year declines in earnings for the S&P 500 Energy sector are expected to continue to decrease sequentially each quarter during the course of the year. For Q4 2016, analysts are actually projecting year-over-year growth in earnings of 64%.

However, analysts have not only lowered their estimates for the price of oil for all four quarters of 2016 since the start of the year, but they have also lowered their estimates for earnings for companies in the S&P 500 Energy sector during this time. As a result, the estimated earnings declines for the first three quarters of 2016 are all larger today relative to expectations on December 31. Although the estimated declines are larger today, analysts are still calling for a sequential improvement each quarter.

Despite the expected sequential increase in year-over-year earnings for each quarter for 2016, earnings for the S&P 500 Energy sector for all of 2016 are still expected to decline year-over-year by 33.0%. However, analysts do expect earnings growth of 94.3% for the sector in 2017.

In conclusion, despite cuts to oil price estimates and to earnings estimates in the Energy sector, analysts do expect the price of oil and year-over-year earnings in the Energy sector to improve each quarter in 2016. However, the estimated average oil price for 2016 is still expected to be below the average price recorded for 2015, and year-over-year earnings for the Energy sector are still expected to decline (-33%) in 2016.