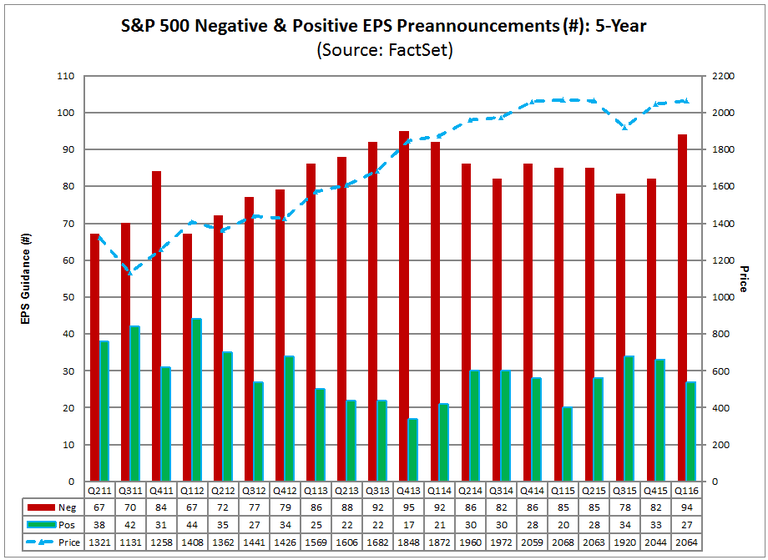

For Q1 2016, 94 companies in the S&P 500 have issued negative EPS guidance and 27 companies in the index have issued positive EPS guidance. If 94 is the final number of companies issuing negative EPS guidance for the quarter, it will mark the second highest number of companies issuing negative EPS guidance for a quarter since FactSet began tracking guidance data in 2006. The current record is 95, which was recorded in Q4 2013.

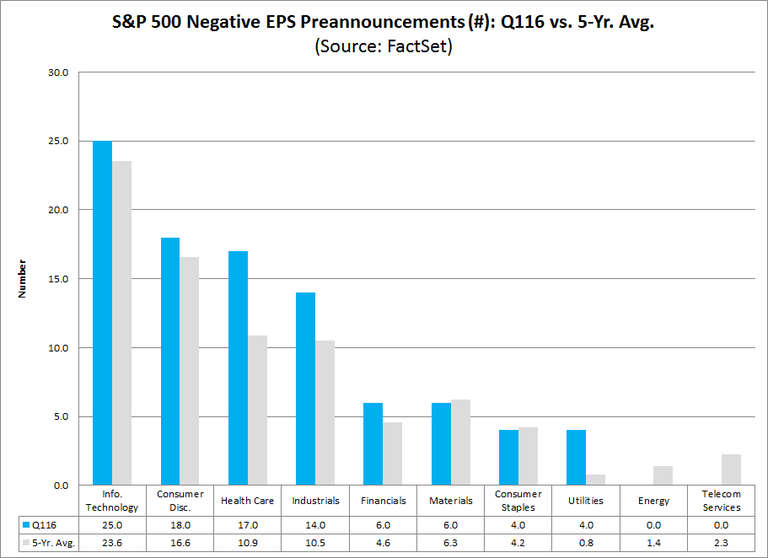

Which sectors are seeing an uptick in negative EPS guidance? The Information Technology (25), Consumer Discretionary (18), and Health Care (17) sectors have the highest number of companies issuing negative EPS guidance for the first quarter. This is not surprising, as these three sectors have historically had the highest number of companies provide quarterly EPS guidance on average.

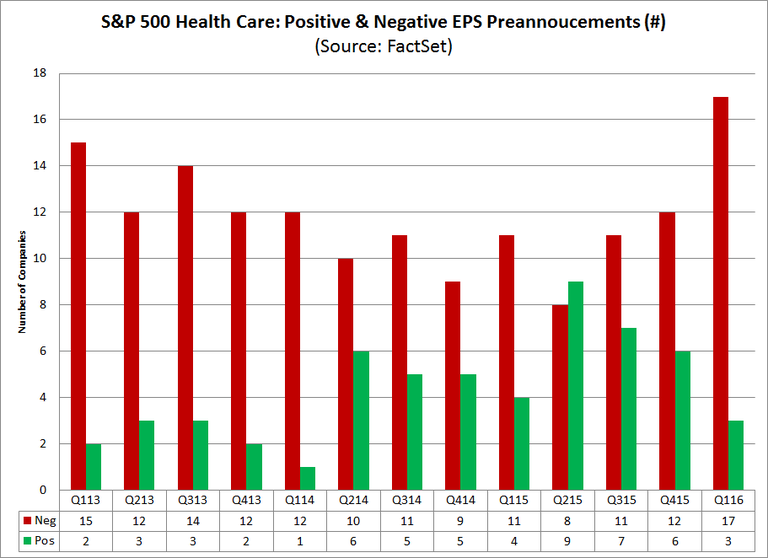

What is surprising, however, is the unusually high number of companies in the Health Care sector issuing negative EPS guidance for Q1. In the Information Technology sector, the number of companies issuing negative EPS guidance for Q1 (25) is just slightly above the five-year average (23.6) for the sector. In the Consumer Discretionary sector, the number of companies issuing negative EPS guidance for Q1 (18) is again just slightly above the five-year average (16.6) for the sector. However, the number of companies issuing negative EPS guidance in the Health Care sector for Q1 (17) is more than 50% above the five-year average (10.9) for the sector.

If the final number of companies in the Health Care sector issuing negative EPS guidance is 17, it will be the highest number for this sector since FactSet began tracking guidance in 2006. The current record for the sector is 15, which occurred in Q1 2013.

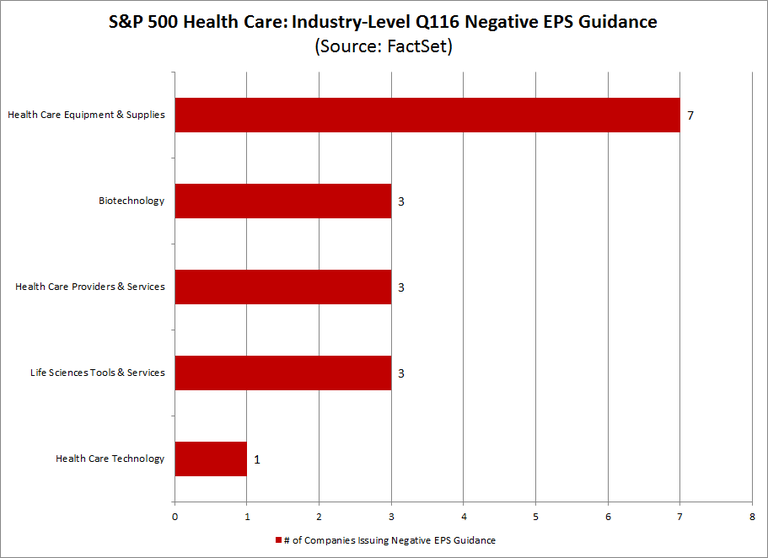

At the industry level, seven of the 17 companies that have issued negative EPS guidance in this sector are in Health Care Equipment and Supplies industry.

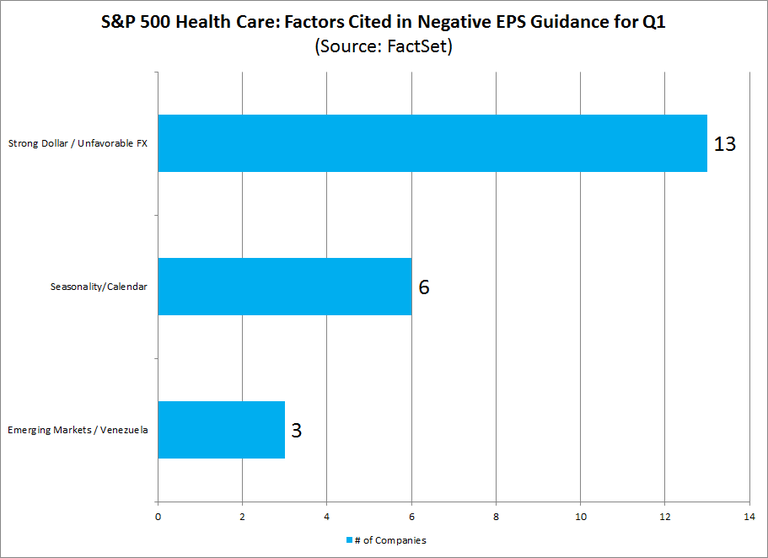

What factors are driving a high number of companies to issue negative EPS guidance in this sector? The chart below highlights factors that companies in Health Care sector specifically discussed when issuing negative EPS guidance for Q1. The numbers do not add to 17, as some companies cited more than one of the factors listed below, while others did not cite any specific factors. The stronger US dollar was cited by the highest number of companies (13 out of 17) in this sector as a negative contributor to earnings guidance for Q1.

It is interesting to note that the Health Care sector has also recorded the largest price decline of all tens sectors since the start of the first quarter. The price of the sector has declined by 5.7% since December 31 (to 785.57 from 833.23).

Industrials and Utilities Sectors Also At Record Levels for Number of Negative Preannouncements

Outside of the Health Care sector, the Industrials and Utilities sectors are on pace to tie their previous records for the highest number of companies issuing negative EPS guidance for a quarter.

In the Industrials sector, 14 companies have issued negative EPS guidance to date for Q1 2016. If this is the final number for the quarter, it will mark a tie with the record-high number of 14 set in Q1 2014. The number of companies issuing negative EPS guidance in this sector (14) is 33% above the five-year average (10.5).

In the Utilities sector, four companies have issued negative EPS guidance to date for Q1 2016. If this is the final number for the quarter, it will mark a tie with the record-high number of four set in Q3 2015 and Q2 2014. The number of companies issuing negative EPS guidance in this sector (4) is 400% above the five-year average (0.8).

Percentage of Companies Issuing Negative EPS Guidance for Q1 above Five-Year Average

The percentage of companies issuing negative EPS guidance for Q1 2016 is 78% (94 out of 121), which is above the five-year average for a quarter (73%). If 78% is the final percentage for the quarter, it will mark the sixth highest percentage of companies issuing negative EPS guidance for a quarter since FactSet began tracking the data in 2006.

At the sector-level (with a minimum of five companies issuing quarterly EPS guidance), the Industrials (93%), Materials (86%), and Health Care (85%) sectors have the highest percentages of companies issuing negative EPS guidance for the quarter.

Surprise Percentage (-6.7%) for EPS Guidance Below 5-Year Average

While the number of companies issuing negative EPS guidance is unusually high for Q1, the amount by which companies are guiding EPS estimates lower is smaller than average. The 121 companies that have given EPS guidance for Q1 2016 have guided earnings 6.7% below the expectations of analysts on average. This percentage decline is smaller than the five-year average of -10.9%.

Market Rewarding Both Negative EPS Guidance and Positive EPS Guidance

To date, the market is rewarding both companies that have issued negative EPS guidance for Q1 2016 and companies that have issued positive EPS guidance for Q1 2016.

The 94 companies that have issued negative EPS guidance for Q1 2016 have seen an average increase in price of 1.0% from two days before the guidance was issued through two days after the guidance was issued. This percentage is much higher than the five-year average price decrease of 0.7% during this same window for companies issuing negative EPS guidance.

In fact, this quarter marks the largest average price increase for companies issuing negative EPS guidance for a quarter since Q2 2009 (+4.3%). Overall, 54 of the 94 companies that have issued negative EPS guidance recorded an increase in price during this time frame. Of these 54 companies, six recorded a double-digit price increase.

The 27 companies that have issued positive EPS guidance for Q1 2016 have seen an average increase in price of 4.4% from two days before the guidance was issued through two days after the guidance was issued. This percentage increase is above the five-year average price increase of 2.5% during this same window for companies issuing positive EPS guidance. Overall, 19 of the 27 companies that have issued positive EPS guidance recorded an increase in price during this time frame.