The first week of January 2017 was the second worst start to the year for global M&A activity in the last 20 years. Only 2009 started off slower, and that can clearly be blamed on the financial crisis gripping the economy at the time. As we’ve seen, January is historically the highest month for deal announcements, and though there isn’t particularly anything wrong with a slow start, further analysis suggests that whatever direction January goes, so goes the year.

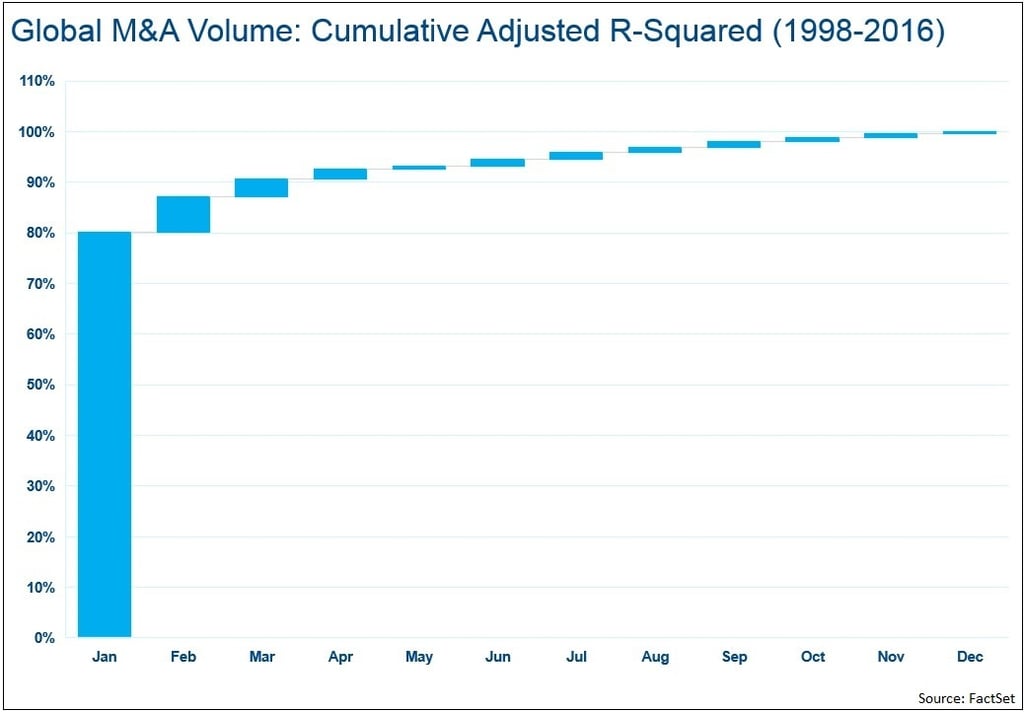

Looking at the last 20 years of M&A volume and using a simple regression to determine the correlation of each month’s cumulative deal volume with the full year deal volume and subsequently generating an Adjusted R-Squared, the results indicate that January has a very high impact on the rest of the year. The chart below highlights this impact.

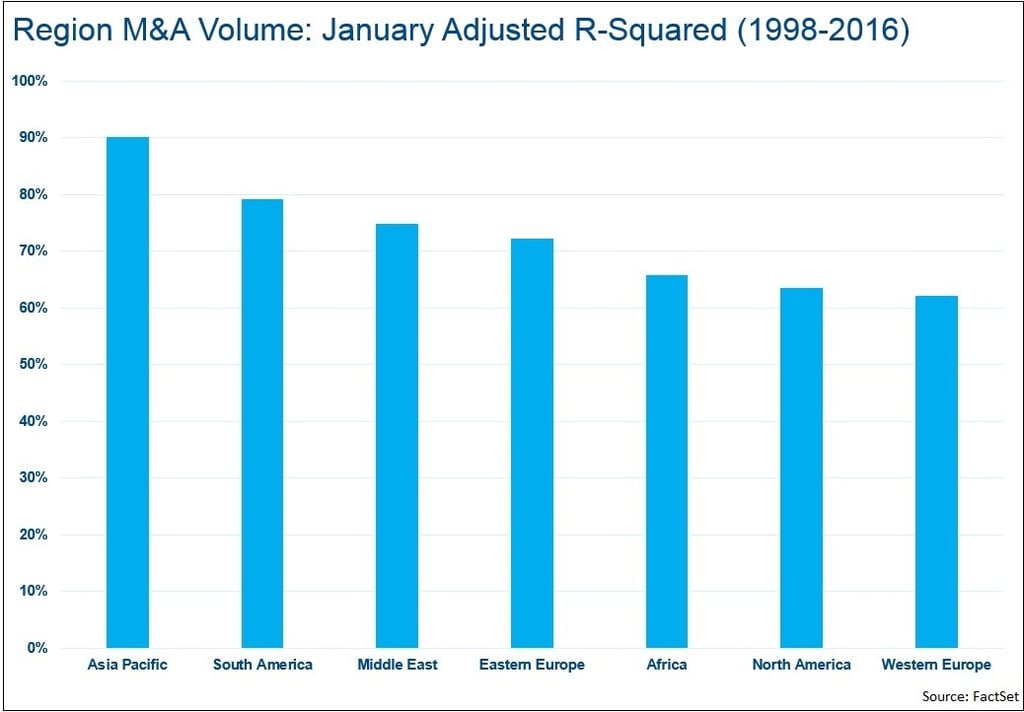

Regional Breakdown

Breaking down global M&A into its various regions, and performing the same analysis, we see that Asia Pacific has the highest January influence while North America and Western Europe have the lowest. Indeed, the deal volume for January in Asia Pacific has a factor influence of 90% and is the only global region above 80%. By the end of April, all regions except for Europe (both Eastern and Western) have a factor at or above 90%.

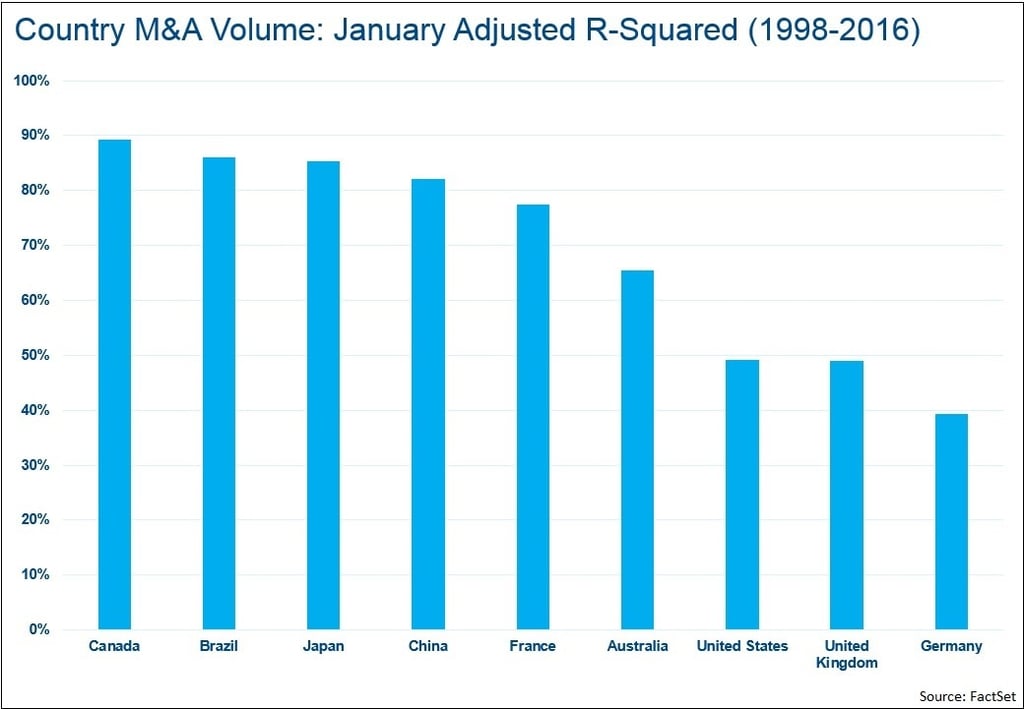

Across key countries, there is still wide variation in the results, with Canada reporting a January impact of 89% while Germany shows just 39%. As with the global regions though, by the end of the first quarter, only the United Kingdom (72%) and Germany (74%) have results below 80%.

Deals follow trends, and those trends follow cycles, and the biggest predictor of deal volume in any given month is the deal volume in the months just prior. While there may be other factors to consider as the year and cycle evolves, what is clear is that January sets the tone and the rest of the year is likely just to fall in line. A slow start certainly isn’t promising.