What do Macy’s, QUALCOMM, and AIG have in common? Each of them is a Large and well-established firm that has been the target of an activist campaign in the past year. In July 2015, Jeffrey Smith’s Starboard Value acquired a stake in Macy’s and urged the clothing retailer to spin off its real estate assets in order to unlock additional value for the company. In April 2015, Barry Rosenstein’s JANA Partners pushed QUALCOMM to cut costs, accelerate its buyback program, and make changes to its board of directors. In late 2015, Icahn Associates and Paulson & Co. pressured AIG to break up the firm into three separate businesses. These three examples of activist investors targeting Larger and well-known companies are not anomalies. This is a growing trend within the shareholder activism space.

Activist Campaigns Against Mega and Large Caps Hit New High in 2015

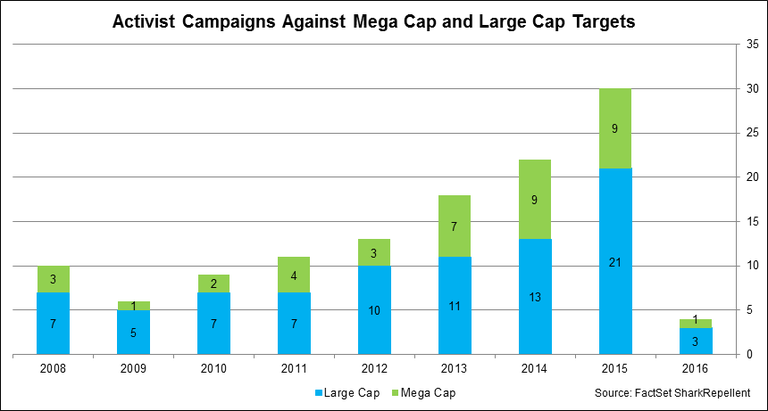

The number of activist campaigns launched against Mega cap (greater than $50 billion in market value) and Large cap (greater than $10 billion in market value) companies in 2015 made up 8% of the total number of activist campaigns tracked by FactSet SharkRepellent (30 out of 375). This represented an increase from 2014, when these companies constituted 6.4% of the total number of activist campaigns (22 out of 345). Campaigns against Mega cap and Large cap firms have been increasing since 2009, when there were only six campaigns of this type, consisting of only 2.6% of the total (six out of 230). So far in 2016, there have been 104 total activist campaigns announced and four have involved a Mega cap or Large cap target. This is right near the number of campaigns against Mega cap and Large cap firms at the same point in 2015 (seven) and 2014 (five).

Average Market Cap of Campaign Targets is 73% Higher than 2012 Value

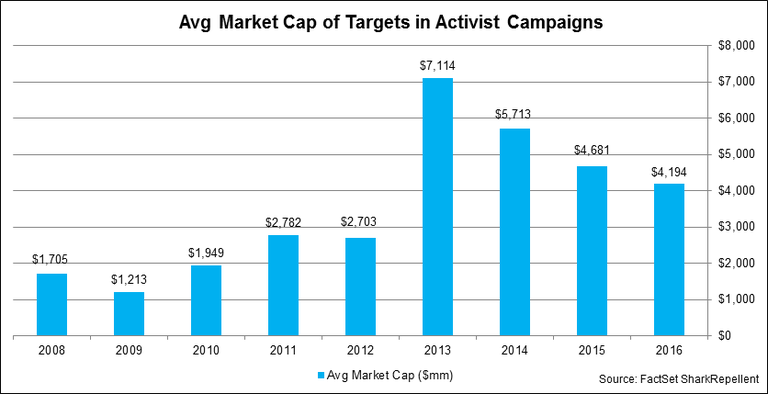

The average market value of companies targeted by activist investors is significantly higher than it was several years ago. In 2012, the average market value of the firms involved in the 262 activist campaigns was $2.7 billion. In 2015, the average market cap of targeted companies was $4.7 billion, 73% higher than the 2012 value.

Of the 104 activist campaigns so far in 2016, the average market value of the target firms has been $4.2 billion. The chart below shows that the average market cap of targets in campaigns has been decreasing since the high set in 2013. However, keep in mind that two activist campaigns were launched against Apple in 2013, and one was launched in 2014. Given Apple’s massive size, these activist campaigns became the largest on record and inflated the data for those two years. If these campaigns are excluded, the data shows that the average market value of target firms in activist campaigns has been generally rising since 2013.

Activists Landing Board Seats at Big Firms

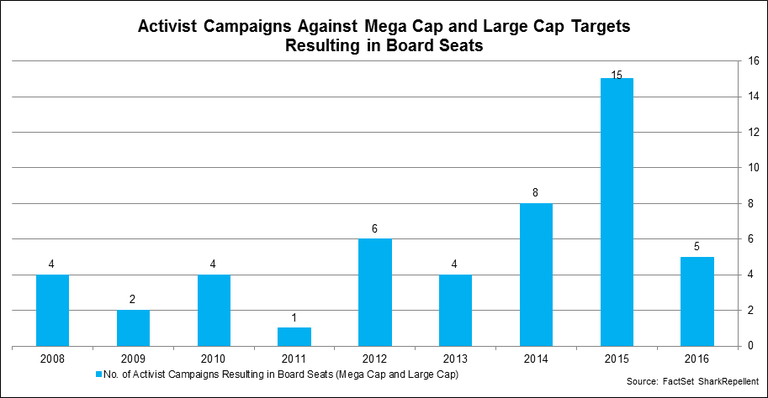

Activist investors pursuing these Mega cap and Large cap companies have also had success in attaining board seats. In 2015, 15 activist campaigns against these companies resulted in board seats for the activist. This represented an increase from eight campaigns in 2014 and four campaigns in 2013.

One recent example was the activist campaign between Elliot Management and Alcoa back in November. Elliot reported a 6.4% stake in the aluminum producer and met with the management and board to discuss various ways to increase shareholder value, including additional opportunities regarding the spin-off of its airplane and automotive manufacturing business. In early February, Alcoa entered into a settlement agreement with the activist and appointed three Elliott nominees to the board.

Smaller Hedge Funds Go After Big Fish

The activist investors involved in campaigns against these large firms are not just big hedge funds with massive assets under management. Smaller, lesser-known institutions are initiating campaigns as well. In January, SpringOwl Asset Management LLC, a small investment management firm based in New York, disclosed a 99-page investor presentation on media and entertainment giant, Viacom. SpringOwl called on Viacom to reconstitute its management and board and recruit new leaders in order to improve its stock’s lackluster performance.

Also this January, two newcomers to activist investing, Altimeter Capital Management and PAR Capital Management, reported a joint 5.5% stake in United Continental. The investors had a combined $8 billion in equity assets under management and no previous activist campaigns. They engaged in discussions with the management and board of the airliner regarding the company’s capital structure, board composition, and strategic alternatives to enhance shareholder value. They later announced their intention of nominating six directors as candidates for election at United Continental’s 2016 annual meeting. These occurrences bring light to the sentiment in the shareholder activism world that, regardless of prominence or size, no company is safe.

Even Outperformers are Vulnerable to Activist Investors

Stock outperformance can be added to the list of attributes that fail to detract activist investors from pursuing campaigns against a company. Even if a company’s stock is performing well, the firm is still susceptible to an activist investor knocking on the door. Of the activist campaigns since 2008, 38% of the target companies’ stocks were up in the last year leading up to the campaign announcement date, and 29% of the target companies’ stocks were up more than 10%.

These numbers are even higher for Mega and Large cap firms. Of the activist campaigns against Mega and Large cap firms since 2008, 57% of the target companies’ stocks were up in the last year leading up to the campaign announcement date, and 43% were up more than 10%. Looking at only 2015, 35% of target firms in the activist campaigns saw their stocks increase in value in the year leading up to the campaign, and 25% of the firms gained more than 10%. For Mega and Large cap companies in 2015, 53% of targets saw their stocks increase in value in the year leading up to the campaign, and 37% gained more than 10%.