Since the 2008 financial crisis, big changes have occurred that have had an enormous impact on all aspects of the mortgage-backed securities (MBS) market. A slew of legislative and regulatory initiatives have been introduced: the government-sponsored enterprises (GSEs) were placed into conservatorship on September 7, 2008; g-fees were increased and loan-level price adjustments (LLPAs) were introduced in a first attempt at risk-based pricing; the Federal Housing Administration (FHA) raised mortgage insurance premiums (MIPs); the Home Affordable Refinance Program (HARP) made its debut; and the Basel III bank capital adequacy standards were introduced. The economic environment and housing market fundamentals have also changed: consumer sentiment has shifted; the homeownership rate has been steadily declining since peaking in the mid-2000s; and private-market mortgage funding is much harder to secure.

Collectively, these changes have influenced market composition, underwriting standards, prepayment trends, supply/demand technicals, and valuations. Given the magnitude and scope of these changes, today’s MBS market would, in many ways, be unrecognizable to a pre-crisis analyst. Some of the key themes that have shaped the post-crisis MBS market are summarized below.

Fixed income market composition has changed

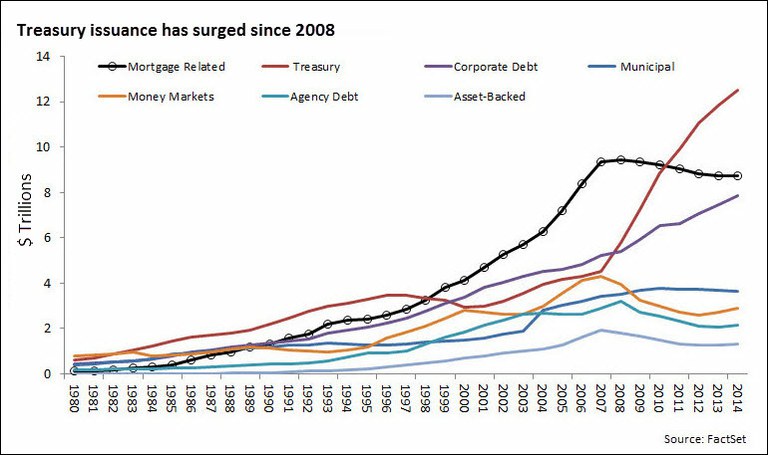

The total mortgage-related securities market (agency MBS + non-agency MBS + CMBS) was the largest sector of the U.S. fixed income market from 1999 through 2010. But the overall MBS market has been shrinking since the financial crisis. Mortgage-related securities totaled $8.7 trillion as of 4Q 2014, versus $9.5 trillion at the market peak. Meanwhile, Treasury issuance has surged and this sector is once again the largest market component.

Agency MBS now dominates the total MBS market

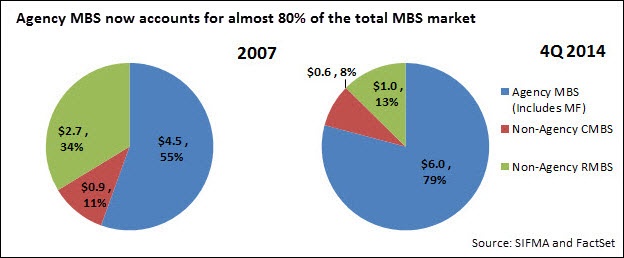

While the total outstanding balance of the mortgage-related securities market has been shrinking for the past several years, the decline has been driven by a sharp drop in the issuance of non-agency residential mortgage-backed securities and private-label commercial mortgage-backed securities. The agency MBS market (inclusive of agency multifamily pools) has actually grown by around $1.5 trillion since 2007. As of 4Q 2014, agency MBS accounts for around 80% of the total MBS market.

Loan putback fears have led to sharply tighter underwriting

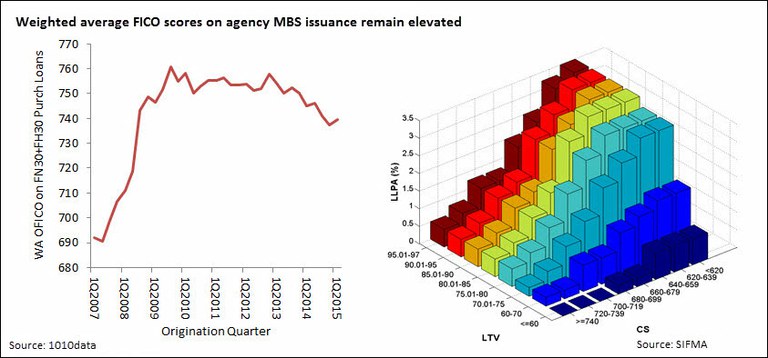

The GSEs and FHA began exercising their putback option much more aggressively in the aftermath of the housing market crash. Lenders responded by applying “credit overlays,” making it much harder for lower-credit quality borrowers to qualify for a conventional loan. Higher g-fees and LLPAs have also made conventional loans much more expensive, especially for borrowers with lower FICO scores. Weighted average FICO scores on post-crisis issuance are running in the mid-700s, much higher than before the financial crisis.

Ginnie issuance share has increased

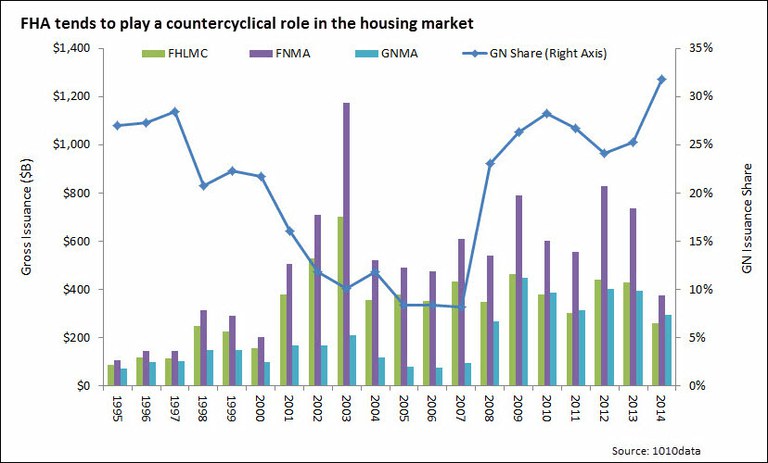

The collapse of the market for second liens has made FHA the only viable source of funding for many first-time buyers, leading to an upward trend in the Ginnie issuance share. Risk-based pricing has also increased the cost of a conventional loan versus an FHA loan for many borrowers. The trend is in line with FHA’s traditionally countercyclical role in the mortgage market—FHA tends to insure more mortgages when private-market credit is tight.

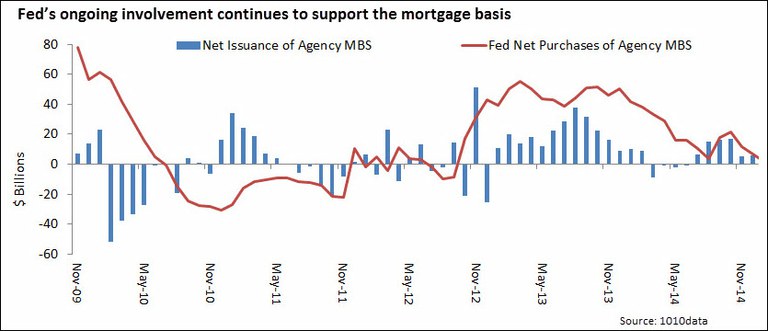

Fed’s involvement has created supportive technicals

The Fed’s adoption of “unconventional monetary policy” included three rounds of “quantitative easing” (QE), which created a new source of demand for agency MBS. Simultaneously, agency MBS net issuance plummeted because of low post-crisis levels of purchase activity and limited cash out refinancings. Low net supply, combined with overwhelming Fed demand, created supportive technicals, leading to a gradual tightening of OAS. QE3 ended back in October 2014, but the Fed continues to reinvest paydowns of agency MBS and debt back into agency MBS. Reinvestment purchases will eventually cease, but for now, the Fed’s ongoing involvement continues to support the mortgage basis.

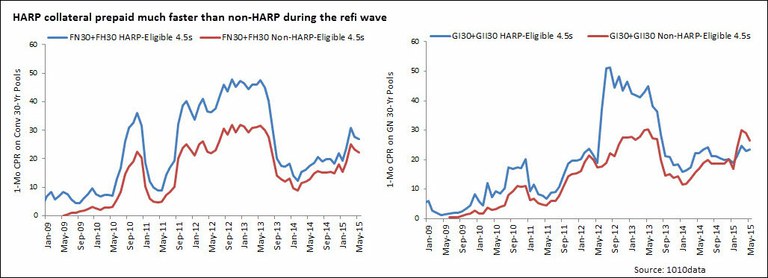

HARP and FHA-HARP have bifurcated the universe

Government-sponsored refinancing programs divided the MBS universe into slow- and fast-paying populations. FHFA announced HARP in March 2011 in an effort to make it easier for underwater borrowers to refinance. FHA followed by introducing its own Streamline Refinance program (“FHA-HARP”), which allows eligible borrowers to grandfather the annual MIP at 55 basis points (level in effect before FHA began aggressively increasing premiums in 2010). The result of these refinancing programs was a wide speed differential between in-the-money HARP-eligible and ineligible collateral. More recently, the speed differential has narrowed as HARP-eligible collateral has experienced burnout.

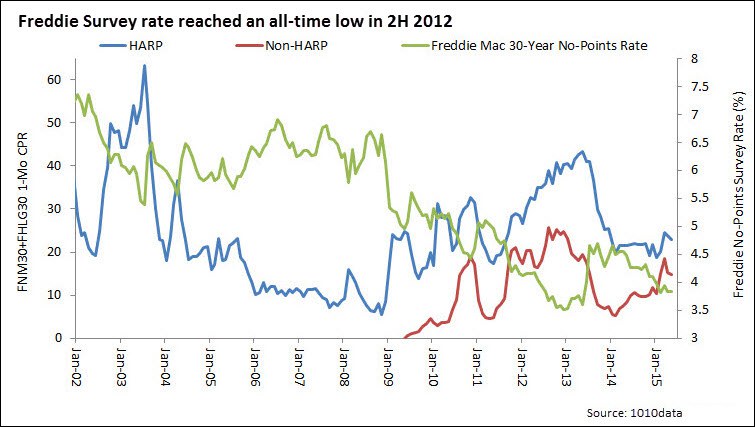

Refinancings dominated prepays during most of the post-crisis period

QE led to a steady decline in the primary mortgage rate—the Freddie Survey rate fell from around 6.5% in late 2008 to an all-time low of around 3.5% by the end of 2012. The QE-driven rates rally, combined with HARP, led to a surge in refinancing activity. Refinancings accounted for well over 50% of issuance from late-2008 through mid-2013. The purchase share of originations only began to pick up again in the second half of 2013 after the selloff precipitated by the mid-2013 “taper tantrum.”

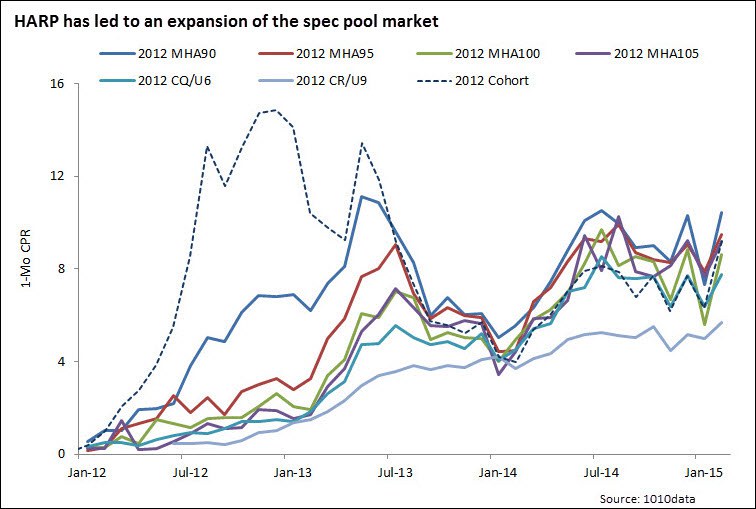

New spec stories have been created

HARP led to the creation of call-protected Making Home Affordable (MHA) paper backed by “HARPed” loans (in practice, pools backed exclusively by high-LTV refinancing loans). Subsequent increases in the HARP LTV ceiling led to the creation of CQ/U6 (105% < LTV < 125%) and CR/U9 (LTV > 125%) pools. Strong home price appreciation (HPA) in recent years has eroded this call protection to some extent, but pent-up demand has created extension protection on some of these pool types.

More changes to come in the years ahead

The agency MBS market continues to evolve, and many more changes are on the horizon. The Fed will likely start tightening later this year, and QE reinvestment purchases will eventually cease. Regulators continue to focus on expanding the availability of mortgage credit, and are trying to address lenders’ concerns surrounding reps and warrants. G-fees and FHA MIPs could undergo further changes in the months ahead as regulators try to find a balance between minimizing the agencies’ credit risk exposure and market liquidity. Moreover, the future of the GSEs remains uncertain—a number of housing finance housing reform bills have been introduced which aim to reduce the GSEs’ market footprint and increase private market participation. MBS investors must continuously monitor market developments and try to gauge their impact on MBS prepayments, technicals, and valuations.