"Big Data" isn't anything new to the financial services industry. So would it be unusual if it were also applied to regulatory reporting? Financial institutions are overwhelmed with the amount of data required by every new regulation coming to force. The only differentiator is how granular and comprehensive the dataset required is across the asset classes.

Solvency II is a good example where tremendous amount of work was done by the asset management community and various industry groups that led to the subsequent creation of the Tripartite Template. Of course, more data is required by the insurance companies to comply with the regulation, but it's a great illustration of the collection of data expected: security and entity meta-data, parent hierarchies, terms and conditions, and analytics.

Look at regulatory reporting required for the Alternative Investment Fund Managers Directive (AIFMD), another European regulation affecting buy-side firms. Annex IV Reporting and Form AIF002 can be overwhelming, not necessarily by the amount of data required for reporting, but rather by the amount of data needed as input to drive the mandatory analytics!

The latest force is MiFID II. Just looking at the best execution and post-trade reporting components, it is a struggle to embrace coverage across all of the trading venues (MTFs, OTFs, and SIs) and fulfill the requirements for granular data reporting on a security and counterparty level.

It's somewhat ironic to realize that while we are preoccupied with obtaining all of the necessary information and various data points on instruments, entities, funds and people, it is the industry's lack of common symbology that creates the biggest headache. While we are certainly making significant steps forward, we still have far to go. Legal Entity Identifier (LEI), ISIN, Aii, Bloomberg's FIGIs and many others compete for dominance, but when are we going to have an industry standard that's not only free, but helps answer key questions? The solution must:

- Provide common symbology across asset classes

- Offer great coverage

- Expose linkages and relationships

There are currently 400,000+ LEIs registered to date. With millions of entities participating on the financial markets, at this rate it will be many years before LEIs become comprehensive enough.

It is also interesting to see how the same international regulations are regionally enforced. Solvency II is a great example of regulation that was meant to harmonize multiple local regulations and provide common standards across the insurance industry in the EU. Instead, we are still seeing discrepancies in its implementation across countries. The same can be said about Basel III, with the separation between U.S. and non-U.S.

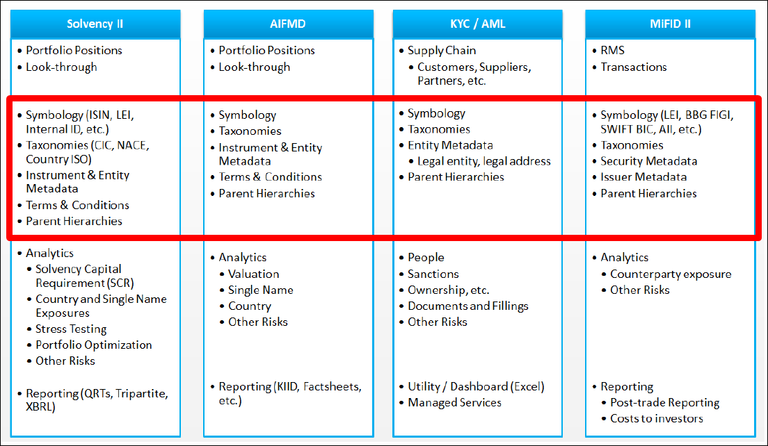

The list of issues can go on, but through analyzing data requirements across regulations, it suddenly becomes clear that it is certainly possible to draw a parallel and observe the commonalities. This is not a suggestion that regulations are the same; merely that there are themes common across many. (All address various risks!)

That commonality is realization that symbology, taxonomies, instrument and entity reference data, relationship, and hierarchies should be addressed and aggregated at the enterprise level.

Once data management is achieved, firms will have the luxury to leverage their compliance workflows and systems to their fullest. Is this view in-sync with what regulators think?

BCBS 239, "risk data aggregation at enterprise level," principles proposed by the Basel Committee offer an excellent glimpse into how regulators ultimately see successful and effective risk management implementation at firms, as a "hub-and-spoke" model. Once firms excel at data connectivity and aggregation, only then can they begin to evaluate the missing and unique datasets required to ultimately pass the test.

In the world of social media, cyber-security, crowd-sourcing, artificial intelligence, and machine learning, we no longer have a problem of having too little data to analyze. The amount of data we produce daily is now measured in quintillions. The real challenge is how to turn this "big data" into "smart data."

The start-up community is embracing the new cool term: "RegTech". And while they are looking for innovative ideas, the reality is that the ones getting ahead are those that continuously renovate their existing processes. Perhaps the innovation needed for regulatory reporting is strategic investment into the proper "hub" that supports common symbology, taxonomies, reference data, relationships, and the subsequent and continuous evaluations of missing "spokes" to gain access to new datasets required for regulatory compliance.