Diversity in the global economy has accelerated globalization, driving companies to expand beyond local markets to offer products and services on an international playing field. Accordingly, many companies have turned to international relationships throughout the length of their supply chains to remain competitive. This increasing complexity of global networks magnifies the need for investors to look beyond data about a company’s domicile, and assess the impact of regional economic developments on its global supply chain. Recent history has shown that even a seemingly local event can catalyze a global market shift.

It is evident that the need for accurate, timely data is paramount, not only for direct holdings but also for relevant third-party networks and the regions in which they operate. Complete analysis of a company’s true exposure requires the research and reporting process to dive deep into the inner workings of a company’s interdependencies. Investment professionals need consistent data to accurately assess risk and alpha on a larger, global scale.

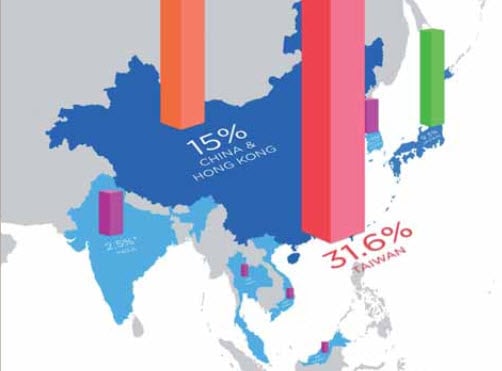

A portfolio manager might, for example, hold shares of US company Intel. A couple of decades ago, it would have been enough for this portfolio manager to simply monitor Intel’s US sales, earnings per share, and market value. However, 20 years ago, half of Intel’s revenue came from the US, compared to only 15% today. The majority of its revenue now comes from other countries such as Taiwan, which is responsible for 31% of revenue. As a result, investors now need to be aware of the impact the Taiwanese economy has on Intel’s stock performance and must monitor factors such as Taiwan’s gross domestic product (GDP), unemployment statistics, and other regional issues that might affect Intel.

Analysis of geopolitical risk also often relies on a very limited subset of data to evaluate true exposure to a particular region. For example, when comparing sales in Asia for two competing brands, how can investors be sure that both companies define Asia in the same way?

In order to overcome the challenges presented by the subjective and inconsistent manner in which companies typically disclose geographic revenues, FactSet provides a standard taxonomy across regions and industries to show revenue exposures that companies do not explicitly disclose. Each figure is proportional to the country and region’s relative GDP contribution. This type of granularity is invaluable to making better investment decisions.

Investment professionals must take global supply chain relationships into consideration when evaluating risk and assessing true exposure. Gaining the necessary depth of insight into an organization’s supply chain and geographical revenues is a crucial step in this effort. The ability to assess this information accurately will be a deciding factor in identifying the top performing investment managers of the future.