Chris Voigt, Consultant, contributed to this report.

The Walt Disney Company released its third quarter results in early August, and the stock took an initial tumble of 1.1%. Though the company reported a marginal EPS beat, many are concerned with the performance of ESPN, which Disney owns. Since August 10, research reports on Disney have included the keyword “ESPN” 212 times. By contrast, mentions of the ABC Network (also owned by Disney) have only occurred 110 times over that same time period. This seems to be a clear indication that analysts are playing close attention to the sports television station.

A FactSet StreetAccount Street Takeaway from August 10 highlights this concern:

"Several analysts believe the company's announced investment in BAMTech for $1.00B largely overshadowed the Q3 print; as constructive notes suggested the closer relationship with the video streaming service is a strategic positive that improves the company's delivery options, allowing the launch later this year of direct-to-consumer ESPN offering. While some concern was expressed around execution and cannibalization risk, most surveyed were incrementally positive around Disney's efforts to address concerns regarding ESPN's core linear business."

But are concerns surrounding ESPN warranted? To answer this question, it is critical to quantify and qualify the importance of ESPN in relation to Disney’s other business lines. When one thinks about Disney as a whole, the company’s movies and theme parks are usually the first things that spring to mind. Though ESPN is owned by Disney, it is not usually the first property mentioned when looking at Disney’s extensive network of business lines and relationships.

Why then, is ESPN’s performance being scrutinized? Is the perception of Disney wrong, is ESPN the driving force behind this $151.8 billion company? Since the market open on August 10, Disney is down approximately 6.03% (as of EOD September 26), compared to a decline of about 1.09% for the S&P 500 over that same time period.

It is clear from the graph above that there is some correlation between analysts’ concern over ESPN and Disney’s stock price. But are investors being too hard on the company? To figure this out, it is imperative to analyze the various business lines and understand how those individual verticals add-up to the company’s top-line sales.

Getting the Full Picture

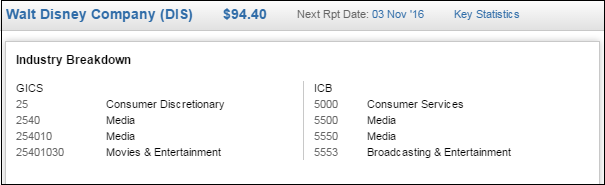

According to GICS, Disney’s main focus is in Movies & Entertainment, but is it fair to put the entire enterprise in that bucket? With so many different business lines, it’s hard to imagine that Disney falls neatly into this group. While theme parks and movies may be the first images conjured with the mention of Disney, with a far more extensive ownership network, his classification does not seem to be wholly accurate. It would be hard to agree that the company’s GICS classification provides a comprehensive answer regarding DIS and its main area of business, especially given that Movies & Entertainment is such a broad category, anyway.

The immediate problem, then, is that a company as diverse as Disney may defy categorization in a single group. To figure out how to weight the various business lines of the company, it is imperative to view each business line’s revenue and see which contributes the most to the company’s top-line.

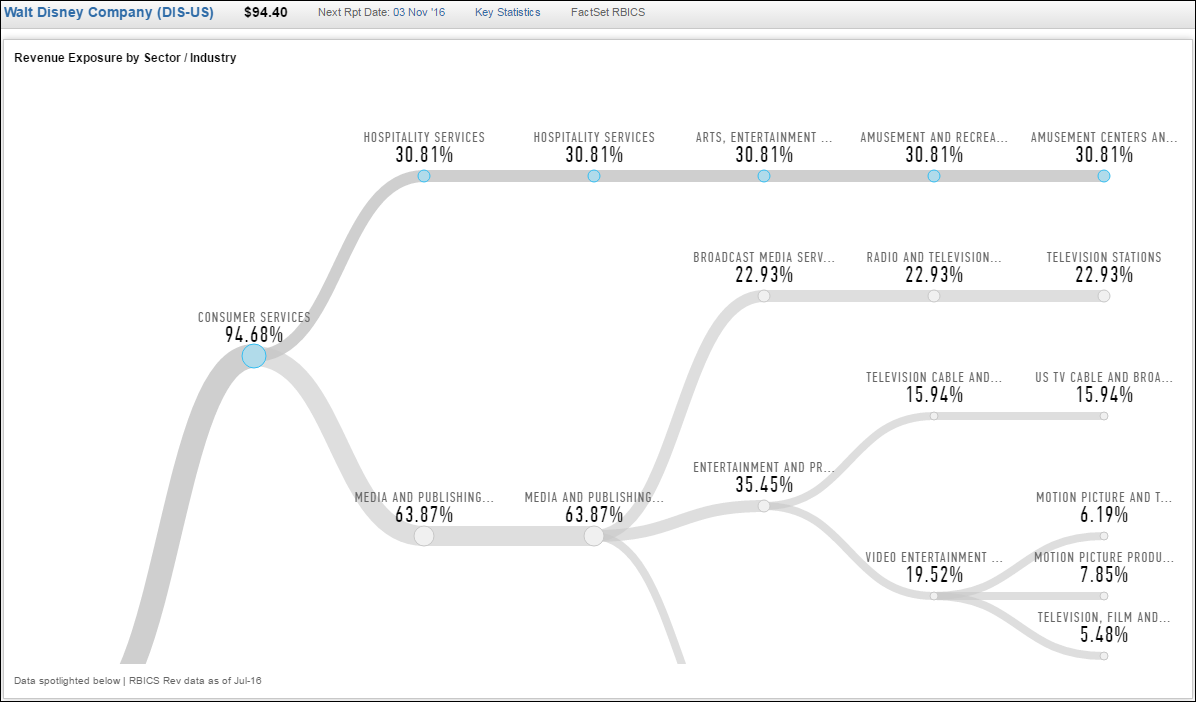

Using traditional methods of sector and industry classification, we are unable to uncover the true diversity of a company. But using FactSet RBICS with revenue, we can quickly see all of Disney’s lines of business and their respective contribution to the company’s overall revenue figure.

The graphic above illustrates how revenue analysis is critical when comparing the key contributors to a company’s sales figure. While media and entertainment continue to be strong contributors for Disney, the single largest contributor to the company overall are its theme parks. The theme park segment alone contributes about 30.81% of the company’s overall revenue, whereas Television Stations (ABC) and US TV Cable and Broadcast Networks (ESPN) contribute about 22.93% and 15.94%, respectively.

Despite the increased attention given to ESPN in recent years, it’s clear that other areas of Disney’s business contribute far more to its performance. Understanding the performance of these segments is at the core of the fundamental process of stock analysis. Companies are much more diverse now than in the past, and it’s increasingly critical for investors to have clarity into the operations of these diverse companies to capitalize on their performance.

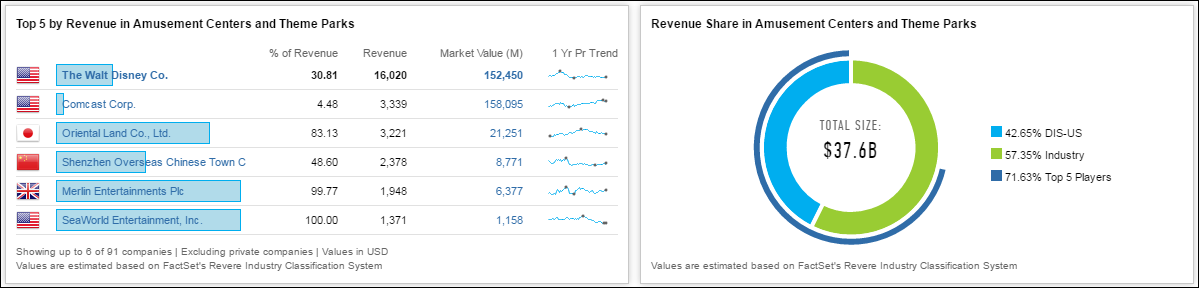

To take this analysis even further, we can show where Disney stands in relation to its peers in the Amusement Centers and Theme Parks subindustry, which is a new opportunity, as FactSet RBICS is the first to standardize these groups across the entire universe of securities.

Based our analysis, Disney’s theme parks are clearly dominant relative to their peers. With contributions of around $16 billion alone, Disney’s theme parks command a whopping 42.65% of the $37.6 billion subindustry as a whole.

Additionally, we can use this data to find “pure plays” (companies that generate 100% of their revenue from a specific business line) in a given subindustry, such as SeaWorld Entertainment, Inc. While it is clear from this exercise that ESPN does matter to Disney’s top-line, it cannot be denied that DIS’ other business lines have their place in the conversation, as well. But at a fundamental level, should we be paying more attention to ESPN than to Disney’s amusement parks? No.