By Jon Bowman | March 21, 2024

The Arizona utility regulatory environment has long been seen as one of the most difficult in the country for investor-owned utilities (IOUs) to navigate. As with all utility regulatory jurisdictions, the process of setting rates for IOUs is complicated and involves many interrelated variables; but key contributors to this challenging environment may include:

Arizona Compared to Other States

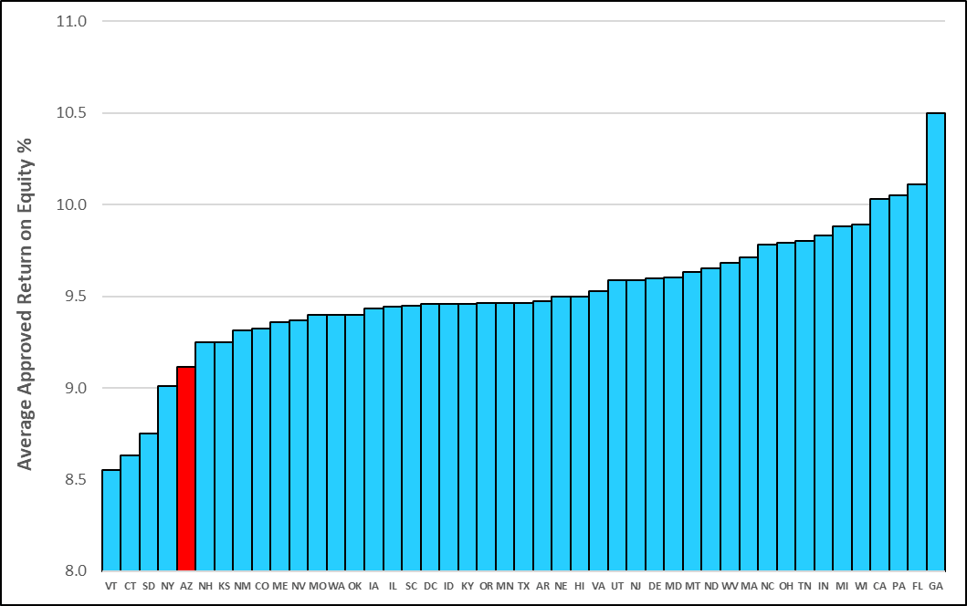

As highlighted in the Q4 2023 FactSet Rate Case Update, average allowed ROEs at Arizona utilities have been lower than those granted in all but four states in the last five years.

Figure 1: Five-Year Average (Through 2023) Approved Return on Equity by State

Note(s): Totals Include Base Rate Cases Only (Single Issue Riders, Formula Rate Filings, and Passthrough Bill Clauses are excluded), Data Through 12/31/2023

Source: BTU Analytics – a FactSet Company

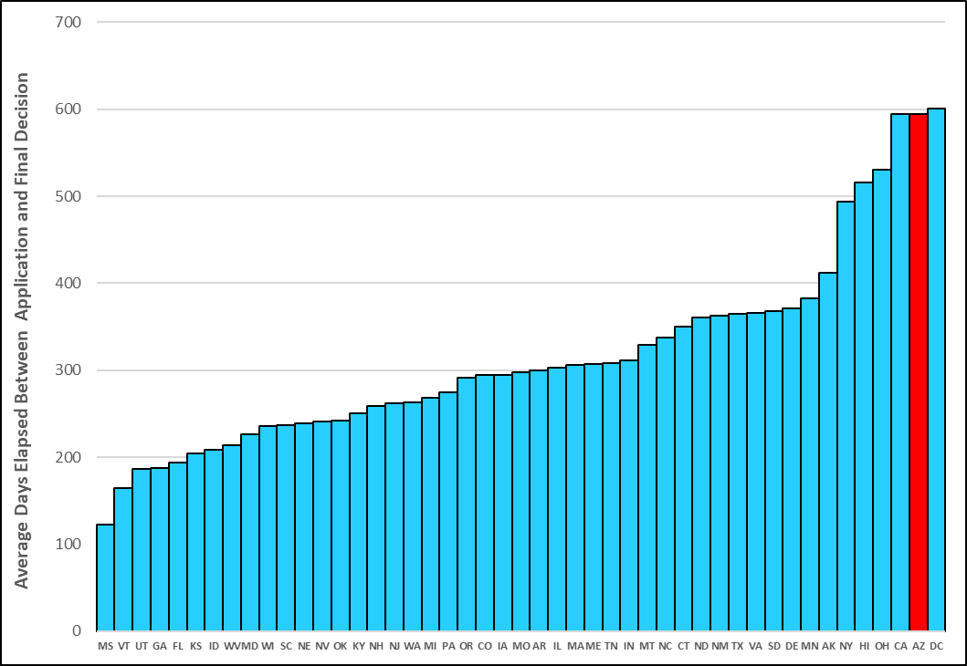

In addition, regulatory lag (defined here as the duration between a utility’s initial rate case filing and the date of the commission’s final decision) averaged ~590 days over the same five-year period, making Arizona’s average rate case duration longer than any U.S. jurisdiction other than the District of Columbia.

Figure 2: Five-Year Average (Through 2023) Regulatory Lag by State

Note(s): Totals Include Base Rate Cases Only (Single Issue Riders, Formula Rate Filings, and Passthrough Bill Clauses are excluded), Data Through 12/31/2023

Source: BTU Analytics – a FactSet Company

The Low Point

The relationship between the ACC and the utilities it regulates arguably reached its nadir with the November 2021 final order in an Arizona Public Service (APS) rate case (ACC Docket E-01345A-19-0236.) The results of this case are summarized in Table 1 below.

Table 1: November 2021 APS Rate Case Outcome

|

Docket |

APS Requested Rev Increase ($MM) |

ACC Approved Rev Increase ($MM) |

ACC Approved Effective ROE % |

Regulatory Lag (Days) |

|

E-01345A-19-0236 |

$184 |

-$120 |

8.85 |

740 |

Note(s): Effective ROE % Includes 0.15% Allowed Return on Fair Value Increment

Source: BTU Analytics – a FactSet Company, Arizona Corporation Commission

In its initial application, APS had sought a total increase in base rate revenues of ~$184MM with an allowed return on equity of 10.15%. The ACC decision (issued more than two years after the date of the initial application) instead ordered a revenue decrease of ~$120MM with an allowed effective ROE of less than 9% (as compared to a nationwide average of ~9.56% allowed ROE in electric rate cases decided in 2021.) The ACC decision included a ~$216MM prudency disallowance for expenses related to the federally mandated addition of SCR equipment at the Four Corners Power Plant, as well as a 20-basis-point reduction on allowed ROE due to APS’ “customer service performance.” The extremely poor outcome of this case lead to APS suing the ACC and the parties reaching a settlement in June 2023, which allowed APS to raise rates to restore the disallowed SCR expenses and removed the 0.2% penalty to ROE.

The Turnaround

While the 2021 APS decision, subsequent court case, and ultimate settlement provides a stark example of the regulatory dysfunction manifested in the recent past, three subsequent ACC rate-case decisions may indicate a change in course towards a more traditional interpretation of the regulatory compact. These cases collectively involved all three ACC regulated electric utilities: Arizona Public Service (APS), Tucson Electric Power (TEP), and UNS Electric (UNS). The outcomes of these cases are summarized in the table below.

Table 2: ACC Decisions in Electric Case

|

Docket |

Utility |

Decision Date |

ACC App Effective ROE % |

Req Revenue Increase ($MM) |

App Rev Increase ($MM) |

App Rev Increase % of Req |

|

E-01345A-22-0144 |

APS |

3/5/2024 |

9.8 |

$664 |

$492 |

74.1% |

|

E-01933A-22-0107 |

TEP |

8/25/2023 |

9.55 |

$136 |

$100 |

73.5% |

|

E-04204A-22-0251 |

UNS |

1/30/2024 |

9.75 |

$16 |

$10 |

62.5% |

Note(s): Effective ROE % Includes 0.15% Allowed Return on Fair Value Increment

Source: BTU Analytics – a FactSet Company, Arizona Corporation Commission

In all three of these decisions (each issued in the last eight months), the ACC approved ROE levels closely in line with the ~9.6% approved nationwide average in electric rate cases decided in 2023. In addition, the ACC approved revenue increases were ~74% of the total amount requested collectively by the three utilities – again, favorably aligned with national averages in 2023 electric rate cases.

In addition to the relatively favorable financial metrics, the ACC has also through these decisions indicated a willingness to address regulatory lag issues – at least indirectly. Both APS and UNS were authorized to begin collecting revenues via a new mechanism called the System Reliability Benefit (SRB). The SRB will allow these utilities to begin to realize a return on capital investments prior to formal approval via the usual rate case process. As a result, these utilities will now see less time elapse between capital spending and realizing a subsequent return on these investments. While a similar SRB mechanism was denied for TEP in the most recent case, the fact that both APS and TEP’s fellow Fortis subsidiary UNS received approval in its rate case augurs well for TEP’s ability to gain similar treatment in its next case.

Why Now, and Will It Last?

The most probable reason for the shift in ACC outcomes between late 2021 and these three cases is simply a near total change in commission makeup over the previous two years. Of the five current ACC commissioners, only one (Republican Commissioner Lea Marquez Peterson) remains from the commission that voted on the 2021 APS Decision.

Table 3: Current ACC Commissioners

|

Commissioner |

Affiliation |

End of Current Term |

|

Jim O’Connor (Chairperson) |

Republican |

2025 |

|

Lea Marquez Peterson |

Republican |

2025 |

|

Anna Tovar |

Democrat |

2025 |

|

Kevin Thompson |

Republican |

2027 |

|

Nick Meyers |

Republican |

2027 |

Source: BTU Analytics – a FactSet Company, Arizona Corporation Commission

Another potential factor is the low level of political diversity on the current commission. The ACC voted 4-1 in all three recent decisions with Democrat Commissioner Anna Tovar being the sole dissenter in each case. In contrast, the commission that voted on the 2021 APS decision was comprised of three Republicans and two Democrats, though it is important to note that Republican Commissioner Marquez Peterson joined the two Democrat commissioners in approving that decision, so party affiliation is not a completely reliable indicator of voting behavior.

Whatever the underlying factors, the most recent ACC rate case decisions provide evidence of an improving regulatory environment for Arizona utilities. However, it remains to be seen if the trend is sustainable. Most pertinently, three of the five commissioners are up for reelection in 2024. Of these, Commissioner Tovar has indicated that she will not be seeking reelection, Commissioner Marquez Peterson has filed paperwork to run again, and Chairperson O’Connor has not announced his intentions. It is therefore possible that the majority of the commission in 2025 will be newly seated, with the viewpoints and agendas of the new commissioners unknown. In addition, while rate case outcomes have been generally favorable in recent months, the current commission has started a rulemaking process to repeal Arizona’s Renewable Portfolio and Energy Efficiency Standards and to sunset the associated utility riders that funded compliance programs. While the eliminated surcharges are passthroughs from a utility revenue perspective, these developments do indicate a willingness in the current commission to tinker with existing surcharges and may signal that current mechanisms that are revenue positive for utilities (such as the Lost Fixed Cost Recovery charge, which compensates for sales lost due to DSM/EE programs) might also be endangered.

In short, while many recent developments in the Arizona regulatory environment seem positive from a utility perspective, it is difficult to know if the trend is sustainable. With the commission makeup constantly in flux and the fundamental issues that have caused the historical tension and dysfunction unresolved, it remains a distinct possibility that – notwithstanding statutory changes – any progress may be quickly undone by future commissions.

This blog post is for informational purposes only. The information contained in this blog post is not legal, tax, or investment advice. FactSet does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.

Mr. Jon Bowman is an Energy Analyst at FactSet. In this role, he focuses on natural gas economics and basis forecasting. Prior, he held several positions related to resource planning, forecasting, and pricing analysis in the utilities and manufacturing industries. Mr. Bowman earned a B.S. in Mathematics from Tulane University and an M.S. in Industrial Engineering from the University of Illinois at Urbana-Champaign.

Winter Storm Fern’s Impacts on Power Markets

This Insight looks at Winter Storm Fern's impact on U.S. grids, power markets, and prices after it hit at the end of January and...

By Nate Miller | Energy

NIPSCO Proposes Special Contract for Amazon Data Centers in Indiana

This Insight highlights an Indiana Utility Regulatory Commission docket in which Amazon and a utility are developing generation...

By Eric Yussman | Energy

PJM States Urge Action as Delays Threaten Reliability

PJM's notoriously long and unpredictable process of interconnecting to the grid has chilled new investment despite an extended...

U.S. Energy Sector Braces for Winter Storm Fern

Winter Storm Fern is expected to sweep across the U.S. over the coming weekend and could affect millions of people and much of...

By FactSet Insight | Energy

The information contained in this article is not investment advice. FactSet does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.