Last month, BNP Paribas paid a $140 million fine and began a five-year probation for violating U.S. sanctions, bumping up its record penalty to nearly $9 billion for moving money through the U.S. financial system on behalf of sanctioned entities.

BNP Paribas pled guilty in the criminal case, which involved several years of illicit transactions to sanctioned Sudanese, Iranian, and Cuban entities. Since the 2014 case, U.S. authorities have stepped up investigations of banks and other institutions to find other transactions with links to those designated as known terrorists, international narcotics traffickers, and threats to national security. In 2014, the Office of Foreign Assets Control (OFAC), under the U.S. Department of the Treasury, collected more than $1.2 billion in penalties and settlements, up from $200 million in 2010. Violators also face bans from the U.S. banking system or from processing U.S. dollar transactions.

Every transaction that a U.S. financial institution engages in is subject to regulations set by OFAC, from multi-million dollar transactions by international banks to mortgages paid by local credit unions and purchases made by wealth managers on behalf of individual clients. As individuals, countries, and entities move on and off the sanctions lists and because OFAC expects the assets of those on sanctions lists to be frozen immediately, firms must check cross-check their records regularly to remain in compliance.

While OFAC does not specify a frequency that must be met for compliance, its regulations suggest to “screen account beneficiaries upon account opening, while updating account information, when performing periodic screening and, most definitely, upon disbursing funds.” While this can be a tedious process, FactSet makes screening easier by offering an aggregated sanctions data feed to support a range of compliance functions, including client on-boarding, know your customer, anti-money laundering, due diligence, and transactions monitoring.

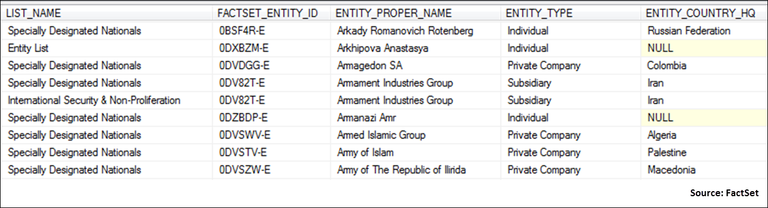

FactSet’s data feed combines eight disparate OFAC sanctions lists and includes details for more than 7,700 entities, people, and aircraft. Aliases for individuals are also included for due diligence. Used in conjunction with other feeds such as ownership or supply chain, the data can connect sanctioned entities to the equities they own and whether those equities are suppliers to other sanctioned names.

The prohibitions and treatments for individuals and entities on OFAC's other sanctions lists are different from those on the Specially Designated Nationals list, although OFAC warns that “there may be similar consequences if your firm takes a long time in recognizing a sanctions list match.”

FactSet’s Sanctions DataFeed includes these OFAC sanctions lists:

- Specially Designated Nationals

- Entity List

- Denied Persons List

- Defense Trade Controls

- Foreign Sanctions Evaders

- International Security & Non-Proliferation

- Unverified List

- Sectoral Sanctions Identifications