There are two primary types of M&A transactions in the Power & Utilities (P&U) space – corporate deals and asset transactions. Corporate deals have tended to be larger, e.g., the recent agreement by Dominion Energy to sell three gas distribution subsidiaries to Enbridge for $14 billion, including assumed debt. However, transactions like these occur less frequently. On the other hand, asset transactions, which have become more prevalent the past several years, can involve the sale of a single power plant or a portfolio of plants. As such, the valuations of these transactions can vary widely based on the number of plants involved and other factors. Given that asset level transactions will continue to provide an important source of funding for P&U companies, trends in asset valuation remain a key consideration in the space.

Again, knowing asset valuation trends is particularly important for the P&U space. However, not every asset level transaction discloses a purchase price, and even fewer provide financial metrics like EBITDA or cash available for distribution (CAFD). For those transactions that do show a price, there can be considerable variation in valuation depending on fuel type. The below chart shows $/kW valuations from a cross section of global deals from the past several years by fuel type. The valuations have ranged from a high of $9,632/kW for a UK offshore wind transaction in 2018 to $80/kW for the sale of some older fossil fuel assets in Northern Ireland in 2019. The highest valuations have been for renewables, like Offshore Wind, Hydro and Geothermal assets followed by Solar and Onshore Wind. For example, the largest power plant transaction involving U.S. or Canadian plants in the past two years was the sale of the Con Edison Clean Energy business to RWE AG of Germany for $6.8 billion with solar listed as the Primary Fuel Type. Not surprisingly, fossil-fuel plants typically sell at a much lower valuation than renewables or nuclear.

Insight/2023/12.2023/12.19.2023_Energy/power-asset-deal-valuation.png?width=914&height=617&name=power-asset-deal-valuation.png)

Source: FactSet

Finding Transaction Data on the Workstation

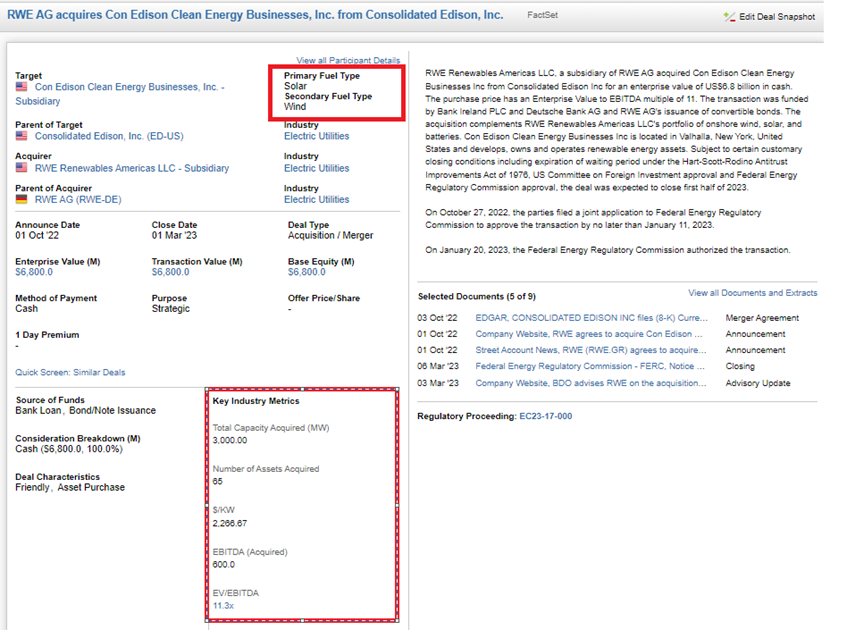

On a Deal Report in the FactSet Workstation, a user can find industry-specific details on asset transactions that will show valuation on a $/kW basis and, if available, EV to EBITDA as well. For example, in that Con Edison Clean Energy/RWE transaction, the Primary Fuel Type was solar and the Transaction Value was $6.8 billion. Con Ed’s portfolio totaled ~3,000 MW of generating capacity, which translates to a valuation of $2,267/kW. RWE disclosed that the EBITDA for the Con Ed portfolio was $600 million, implying an 11.2x EBITDA multiple.

Source: FactSet

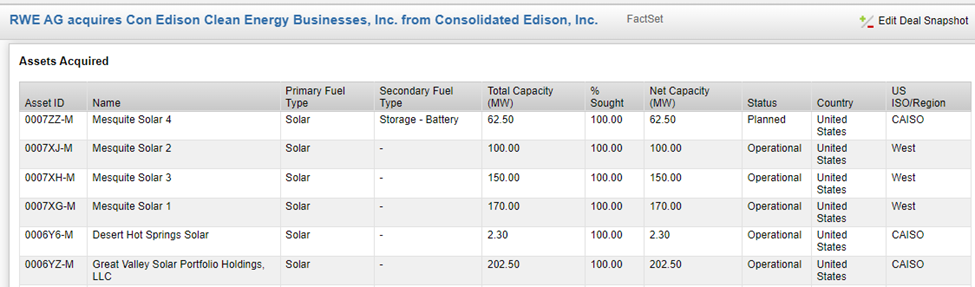

A user can also scroll through the Deals Report to see the power plants involved in the transaction and details such as fuel type, capacity and location. The Con Ed portfolio consisted of 65 plants, which we show a subset of below.

Source: FactSet

Other Factors that Influence Transaction Valuation

Several factors besides fuel type and the number of plants involved influence transaction volumes in the P&U space, namely: contractual status, technology, and plant status. If a plant has a long-term contract with favorable pricing, it will typically trade at a higher multiple than one with a shorter contract or one that is merchant (uncontracted).

Technology (combined cycle vs simple cycle for gas or offshore vs onshore for wind), power market location, and operational history also play a role in valuation. An example of the latter is the COSO Geothermal plant in California, which had to restructure due to a steady decline in geothermal resource output. It was subsequently purchased by Atlantica Sustainable Infrastructure for $1,259/kW, a lower-than-typical valuation for a geothermal plant.

Another consideration that can have a significant impact is the plant’s status. For example, in October 2023, TotalEnergies announced the sale of a 44% interest in the Attentive offshore wind project under development off the coast of New York and New Jersey for total cash consideration of $420 million, or only $318/kW. However, that plant has yet to start construction, and the buyers will be responsible for their share of plant CapEx, which impacted the upfront valuation. By contrast, Ørsted has sold interests in several offshore wind farms in the UK at valuations in excess of $5,000/kW.

Recent Decline in Asset Valuations in High Interest Rate Environment

Power asset valuations had been reasonably stable in the years leading up to 2023; however, declining transaction valuations emerged as an overhang for the sector this year as interest rates rose. The aforementioned RWE acquisition of the Con Edison Clean Energy Business in October 2022 for $2,157/kW and 11.3x EBITDA had a strong valuation. Conversely, the American Electric Power sale of its contracted, unregulated renewables business to Invenergy in February 2023 was for a less-robust valuation of $1,099/kW. Moreover, the Duke Energy Commercial Renewables sale to Brookfield Renewable in July 2023 was only $824/kW. Part of that differential may be explained by the composition of those portfolios since the Con Edison Clean Energy Business is primarily solar, while the other two portfolios principally consist of onshore wind plants.

Takeaways

Asset level transactions, such power plant M&A, will continue to provide an important source of funding for utilities and plant developers as they look for ways to finance the energy transition in the face of weaker equity valuations. Looking at valuations from prior transactions can be a helpful guide in assessing what similar types of assets might fetch. In that vein, it is important to distinguish between fuel type, technology, plant status and location among other factors.

Jon Bowman contributed to this article.

This blog post is for informational purposes only. The information contained in this blog post is not legal, tax, or investment advice. FactSet does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.

Winter Storm Fern’s Impacts on Power Markets

This Insight looks at Winter Storm Fern's impact on U.S. grids, power markets, and prices after it hit at the end of January and...

By Nate Miller | Energy

NIPSCO Proposes Special Contract for Amazon Data Centers in Indiana

This Insight highlights an Indiana Utility Regulatory Commission docket in which Amazon and a utility are developing generation...

By Eric Yussman | Energy

PJM States Urge Action as Delays Threaten Reliability

PJM's notoriously long and unpredictable process of interconnecting to the grid has chilled new investment despite an extended...

U.S. Energy Sector Braces for Winter Storm Fern

Winter Storm Fern is expected to sweep across the U.S. over the coming weekend and could affect millions of people and much of...

By FactSet Insight | Energy

The information contained in this article is not investment advice. FactSet does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.