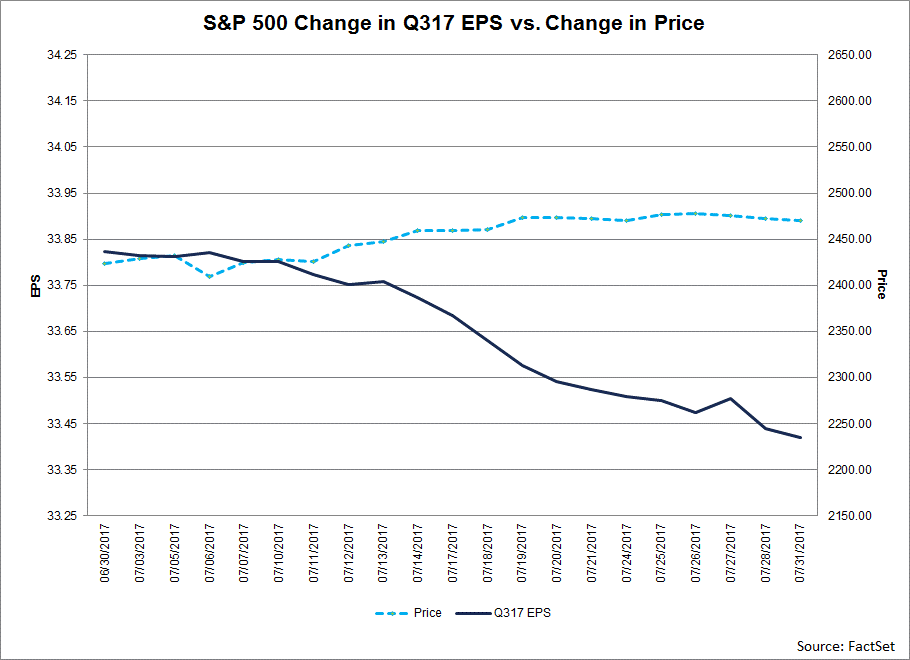

During the month of July, analysts lowered earnings estimates for companies in the S&P 500 for the third quarter. The Q3 bottom-up EPS estimate (which is an aggregation of the EPS estimates for all the companies in the index) dropped by 1.2% (to $33.42 from $33.82) during this period. How significant is a 1.2% decline in the bottom-up EPS estimate during the first month of a quarter? How does this decrease compare to recent quarters?

During the past year (four quarters), the average decline in the bottom-up EPS estimate during the first month of a quarter has been 1.4%. During the past five years (20 quarters), the average decline in the bottom-up EPS estimate during the first month of a quarter has been 2.3%. During the past 10 years (40 quarters), the average decline in the bottom-up EPS estimate during the first month of a quarter has been 2.5%. Thus, the decline in the bottom-up EPS estimate recorded during the first month of the third quarter was smaller than the one-year, five-year, and 10-year averages.

The third quarter marked a tie with Q4 2016 (-1.2%) for the second smallest decline in the bottom-up EPS estimate for the index for the first month of a quarter since Q2 2014 (-0.2%). The only quarter that recorded a smaller decline in the bottom-up EPS estimate over the first month of the quarter since Q2 2014 was last quarter (-0.8%).

Sector Analysis

At the sector level, seven of the 11 sectors recorded a decline in their bottom-up EPS estimates during the first month of the quarter that was smaller than the five-year average and the 10-year average for that sector.

The only sector that witnessed a decline in the bottom-up EPS estimate during this time that exceeded both the five-year average and the 10-year average for the first month of the quarter was the Energy sector. This sector recorded a decrease in the bottom-up EPS estimate of 17.3% (to $3.56 from $4.31) during the month of July. The five-year average decline for this sector for the first month of the quarter is -9.2%, while the 10-year average decline for this sector for the same period is -5.6%.

As the bottom-up EPS estimate for the index declined during the first month of the quarter, the value of the S&P 500 increased during this same period. From June 30 through July 31, the value of the index increased by 1.9% (to 2470.30 from 2423.41). This quarter marked the 13th time in the past 20 quarters in which the bottom-up EPS estimate decreased during the first month of the quarter while the value of the index increased over this same period.