Over the next three years, thousands of visitors will be flying into Brazil to attend two major global sporting events, the 2014 World Cup and the 2016 Olympics. Many of those visitors will be surprised by what they see from the air—a huge and growing number of windfarms situated along the coast. Wind energy is a rapidly growing energy source in Brazil. The EPE, Brazil’s Energy Research Company, announced last month that wind and solar energy sources were leading entries in the energy auction for 2016, which allows energy suppliers to sign long-term contracts with electricity distribution companies.

Already taking advantage of its extensive river system, Brazil has become a world leader in the generation of hydropower. According to the U.S. Energy Information Administration, hydroelectricity accounted for nearly 80% of Brazil’s electricity generation in 2010. But this dependence has its risks; the Brazilian government has been trying to diversify electricity production away from hydropower in recent years due to the risk of the supply in times of drought, as occurred in 2001-2002. There are also numerous environmental concerns about preservation of the Amazon forest and the dislocation of communities associated with hydropower.

This summer, the Brazilian government announced that it was launching an energy plan that looks to increase the role of renewable energy sources significantly over the next seven years. Development of the bioenergy, wind, and solar sectors were key points in the plan, with the goal to generate nearly 70% of its energy from renewable energy sources by the year 2020, up from 55% today.

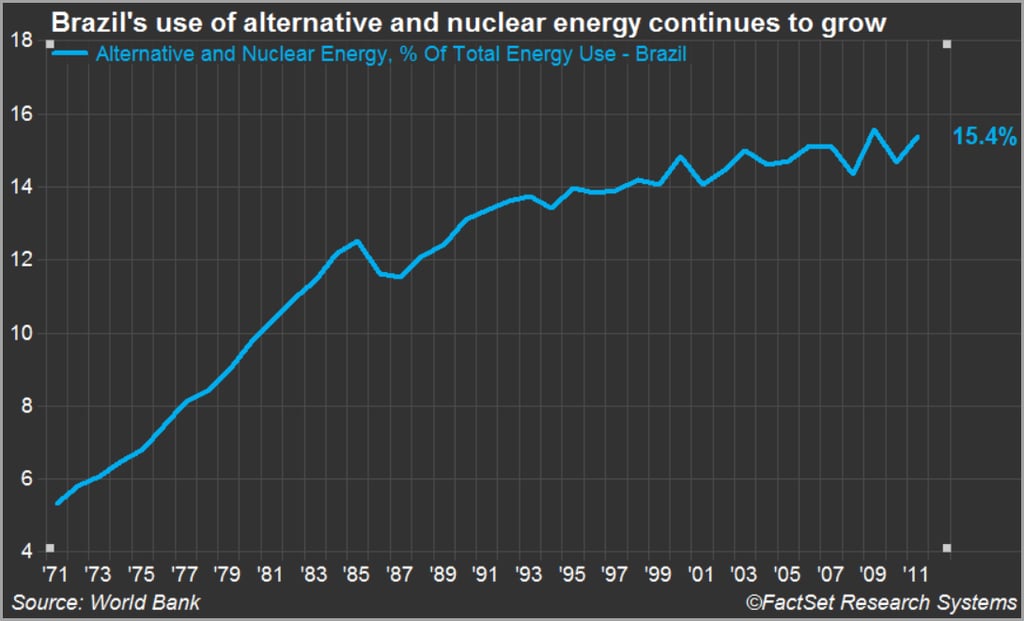

Brazil has been a world leader in the development of alternative energy sources since the mid-1970s, when the global oil crisis led the government to create the National Alcohol Program, the goal of which was to phase out automobile fuels derived from fossil fuels in favor of ethanol produced from sugar cane. Sugar cane is a crop that is both cheap and abundant to grow in Brazil, and the refining technology yields a very efficient form of ethanol. Currently all cars in Brazil are fueled with some percentage of ethanol fuel, and some can run on 100% ethanol. The impact of these efforts has been remarkable. According to the World Bank’s World Development Indicators (WDI), alternative and nuclear energy accounted for 15.4% of total energy use in 2011, compared to 12.0% in the United States and 8.7% for the world as a whole.

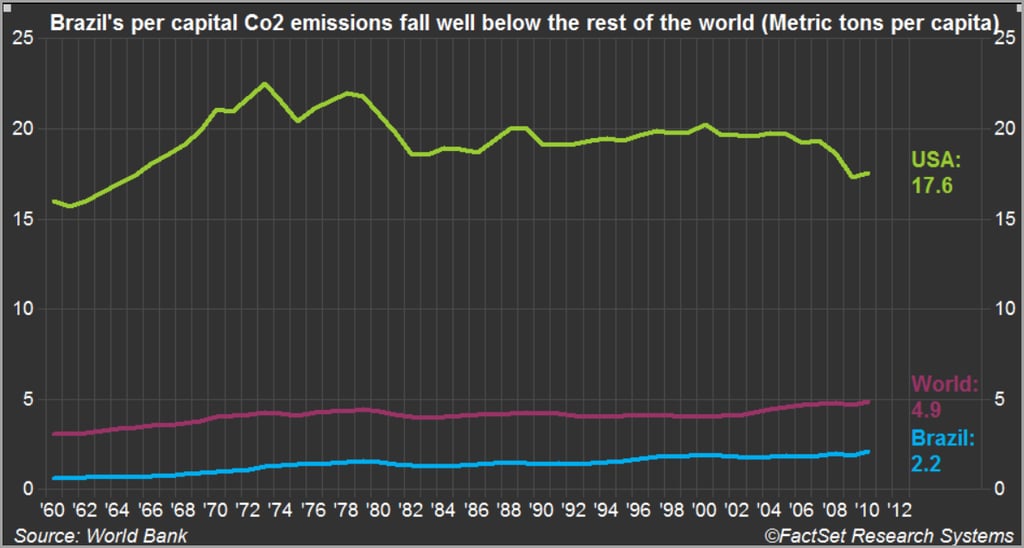

This calculated move away from petroleum products comes as a surprise knowing that Brazil is one of the world’s largest oil producers (number 11 according to 2012 OPEC data), and one of the world’s largest energy consumers. According to the WDI, Brazil’s carbon dioxide emissions have doubled over the last 20 years, but on a per capita basis Brazil’s 2010 Co2 emissions were just 2.2 metric tons per person, compared to 4.9 for the world and a whopping 17.6 for the United States.

Brazil’s concerted efforts to develop more sustainable sources of energy have spurred innovation across several industries, driving economic growth. While Brazil’s specific environment and economy have generated solutions unique to them, there are many elements that can be copied by other countries.