Institutional investors’ interest in Environmental, Social, and Governance (ESG) criteria has grown considerably over the past few years, but some remain concerned that the inclusion of ESG factors in their investment process comes at the cost of weaker risk-adjusted returns. Analysts at MSCI find that this performance trade-off does not always necessarily occur.

We’ve previously presented several approaches for integrating Environmental, Social and Governance (ESG) considerations into the portfolio construction process. The strategies we focused on aimed to raise the ESG standards of the resulting model portfolios, without necessarily betting on the existence of long-run alpha associated with the ESG ratings. The portfolios experienced very low tracking error with respect to a global benchmark, the MSCI World Index.

The small deviations in terms of style, industry, and country tilts that we permitted for our model portfolios, coupled with high risk aversion, led to minimal differences in performance during the relatively short sample period. At the same time, we previously found that these low-risk portfolios (relative to the benchmark) realized a notable improvement in the ESG profile of the portfolios.

We then extended our earlier work along several dimensions:

First, we extend the time series by two more years to improve statistical confidence in the results. Second, we deliberately treat ESG data as an indicator of potential outperformance (or alpha) in the portfolio construction process. Finally, we study higher risk strategies, as implied by our alpha-seeking stance. These higher risk strategies allow for larger active weights, and can help uncover the relationship of ESG ratings with other factors. We are thus able to study more closely the effect of intended and unintended bets on portfolio performance.

In a second paper, Can ESG Add Alpha, we analyzed two strategies that use MSCI ESG Ratings. Both strategies assume a link between ESG ratings and future returns, but differ implicitly in the time horizon for the strategy.

ESG Tilt Strategy

The “ESG Tilt” strategy assumes that ESG scores are linked to future stock performance; companies that integrate ESG considerations into their operations are able to avoid some financial losses related to ESG issues, such as environmental fines or labor disputes. On the upside, such companies are also able to more quickly take advantage of new ESG-related opportunities, e.g., clean technologies. These potential advantages are expected to influence the strategy’s performance over the long run, but it is clear that tilting towards higher ESG scores should immediately raise the portfolio’s overall ESG profile.

ESG Momentum Strategy

The second strategy, “ESG Momentum”, is more short term in nature. The Momentum model portfolio assumes that future stock performance is linked to the change in the ESG quality of the company. An improvement in ESG scores signals that a company is better equipped to avoid ESG-related risks; this reduction in potential future liabilities is quickly discounted by market participants and built into the share price. This strategy not only takes a shorter-term perspective than the Tilt strategy, but also does not explicitly aim to raise the ESG profile of the resulting portfolio because stocks with the largest increase in ESG scores are not necessarily the best-rated stocks at the time.

Performance

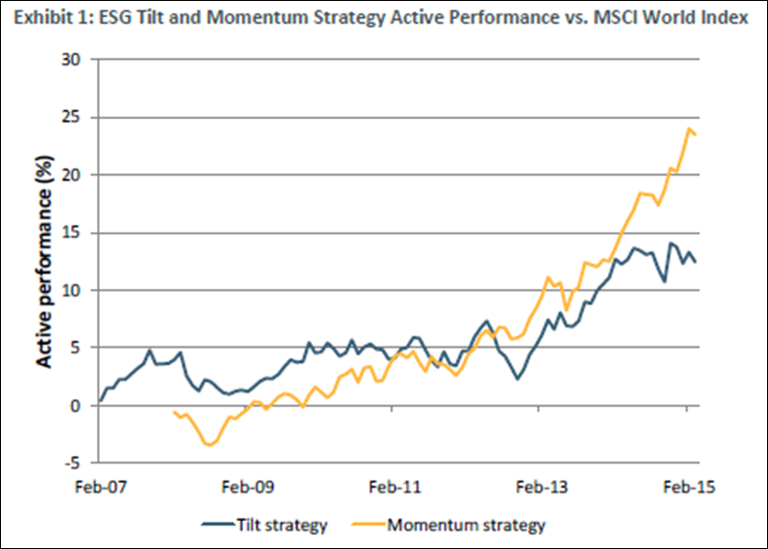

The performance of these higher risk portfolios relative to the MSCI World benchmark is displayed below. The annualized active returns of the Tilt and Momentum strategies were 1.1% and 2.2%, respectively. The Momentum strategy performed consistently well through the sample period (which starts one year later), while the Tilt strategy saw roughly two-thirds of its outperformance come in the last two years of the eight-year sample period.

Both global model portfolios outperformed the MSCI World Index over the sample period while also increasing their ESG profile. When looking at the sources of outperformance, we found that in both cases a significant portion came from stock-specific sources which could indirectly be attributed to the ESG signals. This observation was clearest with the Momentum strategy.

Join us Tuesday, September 15 as we host MSCI’s Linda-Eling Lee and Zoltan Nagy for a live webcast to discuss the performance outcome of both strategies. Register now.

Linda-Eling Lee, Global Head of ESG Research at MSCI, and Zoltan Nagy, Executive Director at MSCI, will present the two strategies discussed here and the key performance highlights from the recent MSCI paper, Can ESG Add Alpha?

Download the complete paper here.