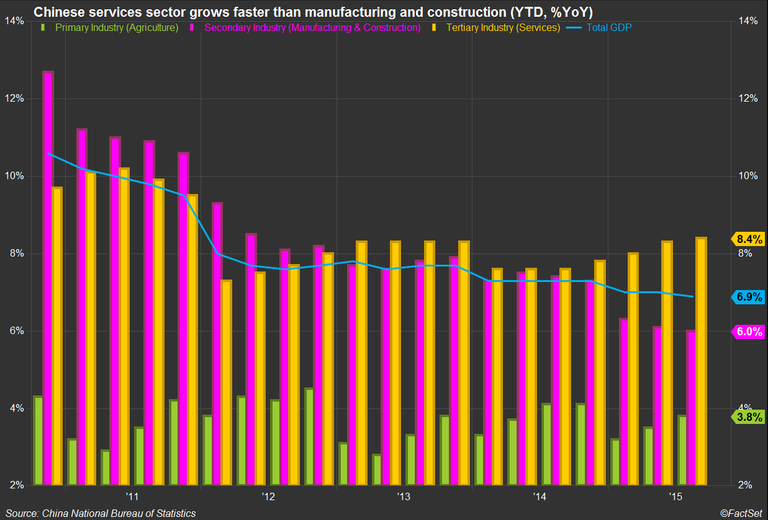

China has been one of the fastest growing economies in the world for a long time. It is the largest economy globally when measured on a purchasing power parity (PPP) basis and second largest on a GDP basis, just after the United States. However, China's real GDP growth has started to slow recently; the growth rate dropped to 6.9% year-over-year in the third quarter of 2015, below the government target of 7%. In October, fixed asset investment and industrial production continued their downward trends, while retail sales picked up modestly.

Launch this chart in FactSet.

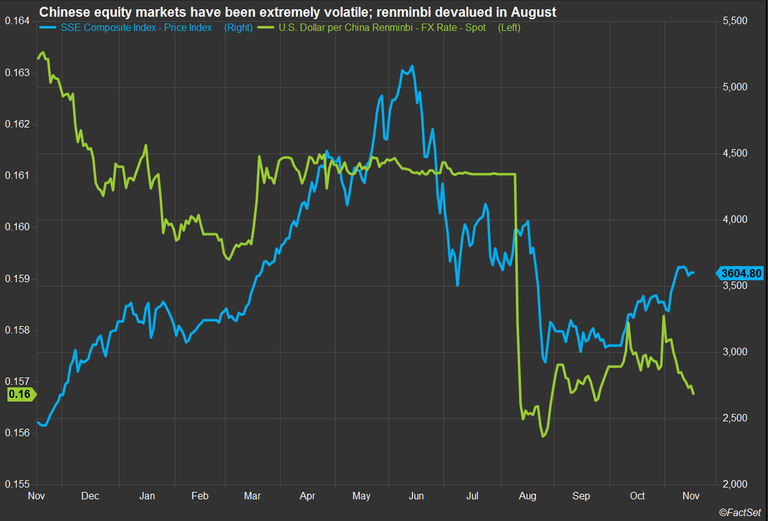

This year has also been extremely volatile for Chinese equity markets, with the Shanghai composite index declining more than 40% between June and August. This volatility has been exacerbated by the herding behavior of retail investors who account for about 85% of the trading volume in mainland China.

Launch this chart in FactSet.

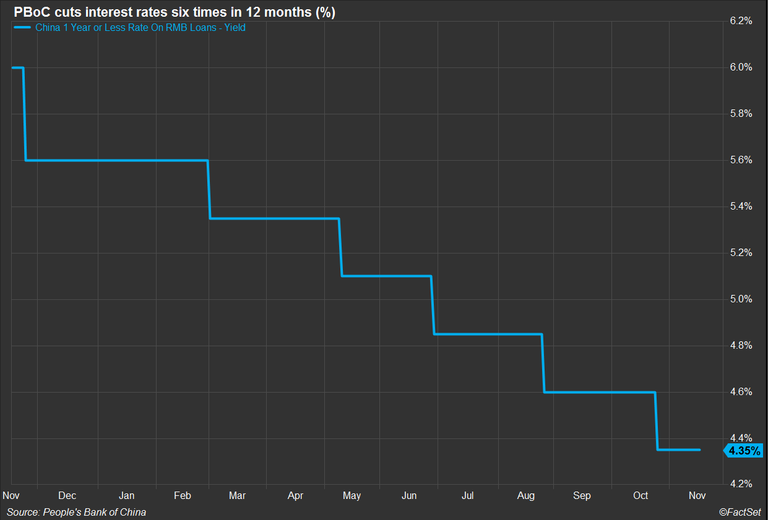

The Chinese government has implemented various measures to calm the markets and boost economic growth. The People's Bank of China has cut interest rates six times in the last 12 months and the current monetary policy rate stands at 4.35%. The central bank also devalued the Chinese renminbi in August, which led other emerging economies to follow suit, including Vietnam. In addition, trading on equities was restricted on multiple occasions, initial public offerings banned completely and more money injected to support margin trading.

Launch this chart in FactSet.

Chinese government authorities met at the end of October to discuss the 13th five-year plan, which sets the priorities of the Communist Party for 2016-2020. One of the main features was a reduction in the annual GDP growth target to 6.5%, compared to the 7.0% target in the 2011-2015 plan. Although still relatively high, the growth rate target was reduced to ease growth pressures as China continues to transition from an investment-led economy towards one driven by consumer spending and services. Growth in the secondary industry (construction and manufacturing) surged in 2009-2011 as the government implemented a capital spending program to support the economy following the global economic slowdown. However, since the beginning of 2013, growth in the tertiary industry (services) has outpaced the secondary industry, with services expanding by 8.4% year-over-year through the third quarter of 2015 versus 6.0% for construction and manufacturing.

Launch this chart in FactSet.

In addition to economic goals, the authorities also decided to relax China's one-child policy that was initially introduced in 1979. By allowing all couples to now have two children, the government hopes that the demographic shift will help the economy deal with the challenges of an aging society. Another aim of the latest five-year plan was to move towards a more open economy and liberalize the Chinese renminbi. Following the currency devaluation over the summer, the International Monetary Fund (IMF) has now indicated that it will consider including the yuan in the SDR (Special Drawing Rights) currency basket. If approved by the IMF's Executive Board at the end of November, it would be seen as a major step towards boosting the renminbi's status as an international reserve currency. This piece of the five-year plan may be coming to fruition in the near term, although it remains to be seen how the rest of the five-year plan turns out in practice.