While all publicly traded U.S companies report EPS on a GAAP (generally accepted accounting principles) basis, many U.S. companies also choose to report EPS on a non-GAAP basis. There are mixed opinions in the market about the use of non-GAAP EPS. Supporters of the practice argue that it provides the market with a more accurate picture of earnings from the day-to-day operations of companies, as items that companies deem to be one-time events or non-operating in nature are typically excluded from the non-GAAP EPS numbers. Critics of the practice argue that there is no industry-standard definition of non-GAAP EPS, and companies can take advantage of the lack of standards to exclude items (more often than not) that have a negative impact on earnings to boost non-GAAP EPS.

As of today, all of the companies in the Dow Jones Industrial Average (DJIA) have reported actual EPS for Q1 2017. What percentage of these companies reported non-GAAP EPS for Q1 2017? What was the average difference and median difference between non-GAAP EPS and GAAP EPS for companies in the DJIA for Q1 2017? How did these differences compare to recent quarters?

Quarterly Comparisons

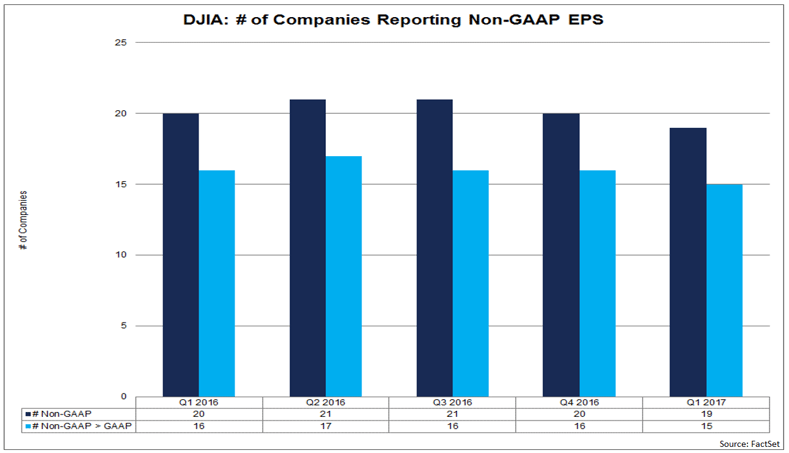

For Q1 2017, 19 (or 63%) of the 30 companies in the DJIA reported non-GAAP EPS in addition to GAAP EPS for the first quarter. Of these 19 companies, 15 (or 79%) reported non-GAAP EPS that exceeded GAAP EPS. Over the past four quarters (Q1 2016–Q4 2016) on average, 68.3% of the companies in the DJIA reported non-GAAP EPS in addition to GAAP EPS, and 79.3% of these companies reported non-GAAP EPS that exceeded GAAP EPS.

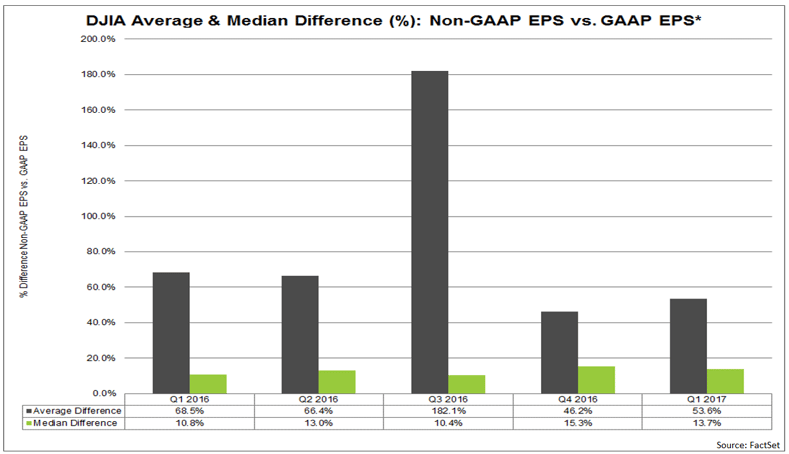

For Q1 2017, the average difference between non-GAAP EPS and GAAP EPS for all 19 companies was 53.6%, while the median difference between non-GAAP EPS and GAAP EPS for all 19 companies was 13.7%. Over the past four quarters, the average difference between non-GAAP EPS and GAAP EPS was 90.8%, while the median difference between non-GAAP EPS and GAAP EPS was 11.9%

Thus, slightly fewer companies in the DJIA reported non-GAAP EPS in Q1 2017 relative to the average of the past four quarters. However, the percentage of companies that reported non-GAAP EPS above GAAP EPS for Q1 2017 was consistent with the average over the past four quarters. The average difference between non-GAAP and GAAP EPS for Q1 2017 was below the average over the past four quarters, while the median difference between non-GAAP and GAAP EPS in Q1 2017 was above the median of the past four quarters

Company Highlights

| Company |

Ticker |

Non-GAAP EPS |

GAAP EPS |

Difference |

| Visa Inc. Class A |

V |

0.86 |

0.18 |

377.8% |

| Caterpillar Inc. |

CAT |

1.28 |

0.32 |

300.0% |

| General Electric Company |

GE |

0.21 |

0.10 |

110.0% |

| Coca-Cola Company |

KO |

0.43 |

0.27 |

59.3% |

| Merck & Co., Inc. |

MRK |

0.88 |

0.56 |

57.1% |