For the second quarter, 75 companies in the S&P 500 have issued negative EPS guidance and 37 companies in the S&P 500 have issued positive EPS guidance.

While the number of companies issuing negative EPS is slightly below the five-year average (79), the number of companies issuing positive EPS guidance is well above the five-year average (27). If 37 is the final number for the quarter, it will mark the highest number of S&P 500 companies issuing positive EPS guidance since Q1 2012 (also 37).

-the-number-of-companies-issuing-positive-EPS-guidance-is-well-above-the-five-year%20average.png?width=1024&name=While-the-number-of-companies-issuing-negative-EPS-is-slightly-below-the%20five-year-average-(79)-the-number-of-companies-issuing-positive-EPS-guidance-is-well-above-the-five-year%20average.png)

Driving Sectors

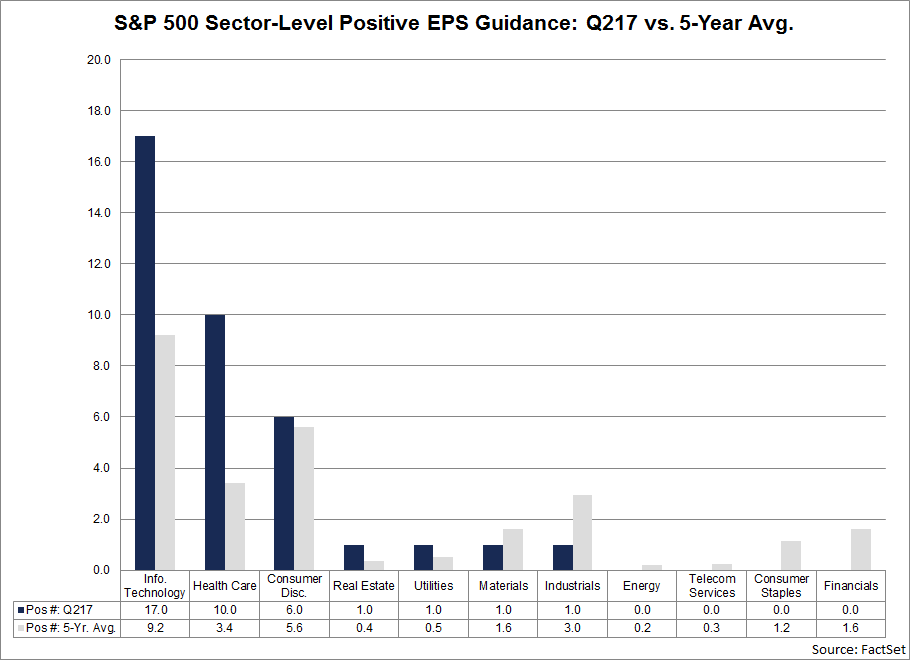

What is driving the high number of positive preannouncements for the second quarter? At the sector level, the Information Technology and Health Care sectors have the highest number of companies issuing positive EPS guidance for the quarter.

In the Information Technology sector, 17 companies have issued positive EPS guidance for the second quarter. This number is well above the five-year average for the sector (nine). If 17 is the final number for the quarter, it will mark the third highest number of companies issuing positive EPS guidance for this sector since FactSet began tracking EPS guidance in 2006. Nine of these 17 companies are in the Semiconductor & Semiconductor Equipment industry. This industry is projected to report the highest earnings growth (40%) of the seven industries in this sector.

In the Health Care sector, 10 companies have issued positive EPS guidance for the second quarter. This number is well above the 5-year average for the sector (3). If 10 is the final number for the quarter, it will mark the highest number of companies issuing positive EPS guidance for this sector since FactSet began tracking EPS guidance in 2006. Five of these 10 companies are in the Health Care Equipment & Supplies industry. This industry is projected to report the highest earnings growth (10%) of the six industries in this sector.

The term “guidance” (or preannouncement) is defined as a projection or estimate for EPS provided by a company in advance of the company reporting actual results. Guidance is classified as negative if the estimate (or mid-point of a range estimates) provided by a company is lower than the mean EPS estimate the day before the guidance was issued. Guidance is classified as positive if the estimate (or mid-point of a range of estimates) provided by the company is higher than the mean EPS estimate the day before the guidance was issued.