Exxon Mobil and Chevron will be focus companies for the market this week, as both companies are scheduled to report earnings on Friday, July 28. The current mean EPS estimate for Exxon Mobil for Q2 2017 is $0.84, which is below the mean EPS estimate of $0.89 on June 30 and below the mean EPS estimate of $0.99 on March 31. The current mean EPS estimate for Chevron for Q2 2017 is $0.86, which is below the mean EPS estimate of $0.98 on June 30 and below the mean EPS estimate of $1.13 on March 31.

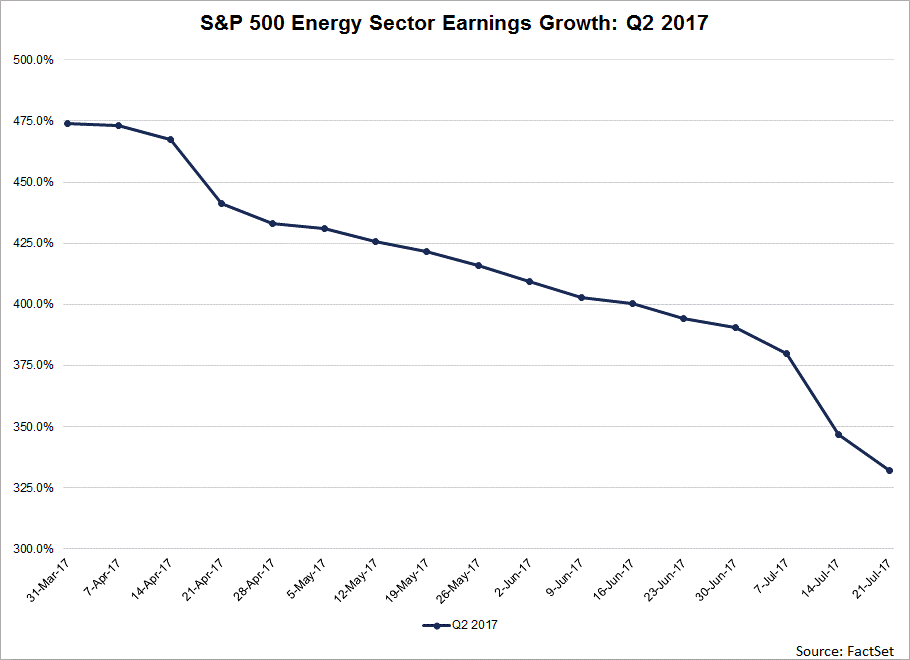

Exxon Mobil and Chevron are not the only companies in the S&P 500 Energy sector that have seen EPS estimates for the second quarter decrease since the end of the second quarter. In fact, 25 of the 34 companies in the sector (74%) have recorded a decline in their mean EPS estimate for the second quarter since June 30. As a result, the earnings growth rate for this sector has fallen to 332.1% today from 390.5% on June 30. This marks the largest drop in earnings growth of all eleven sectors since the end of the second quarter.

Despite the drop in earnings growth, the Energy sector is still expected to be the largest contributor to earnings growth for the S&P 500 as a whole. Excluding the Energy sector, the blended earnings growth rate for the S&P 500 falls to 4.8% from 7.2%.

However, upside earnings surprises reported by companies in other sectors (particularly the Financials sector) have more than offset the impact of the decrease in earnings in the Energy sector over the past few weeks. Since June 30, the blended earnings growth rate for the S&P 500 for Q2 has increased to 7.2% from 6.6%.

Analysts have also cut full-year EPS estimates for the Energy sector during this time. Overall, 29 of the 34 companies in this sector (85%) have recorded a decline in their mean EPS estimate for CY 2017 since June 30. As a result, the estimated earnings growth rate for this sector for CY 2017 has fallen to 236.4% today from 275.6% on June 30. The estimated earnings growth rate for the S&P 500 for CY 2017 has fallen to 9.3% from 9.8% during this same time frame.

Pressure at the Pump

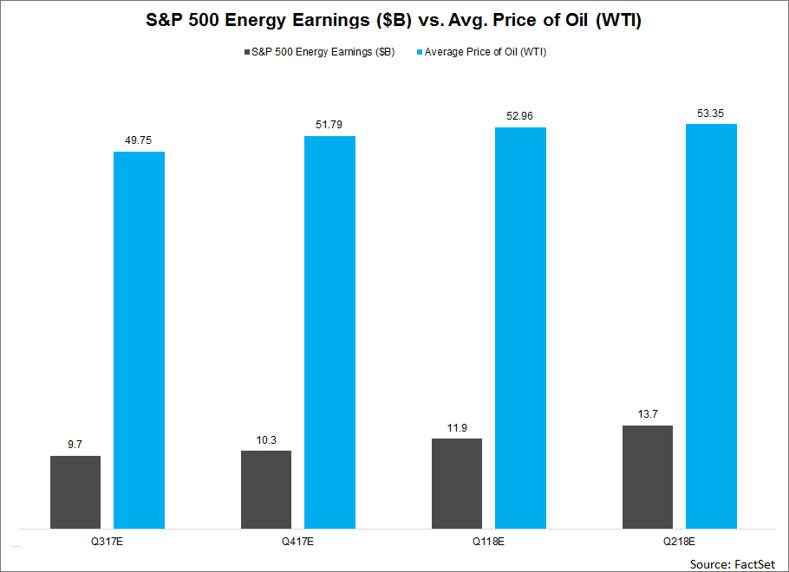

It is interesting to note that as of July 20, the price of oil closed at $46.92. Analysts are still calling for the average price of oil to be above this closing price in the second half of 2017. If oil prices do not increase as expected, analysts will likely continue to lower earnings estimates for this sector for all of 2017 (as they have already done this month).