On October 7, Hurricane Matthew hit the southeast coast of the United States. The damage and destruction from the hurricane will impact the earnings of many sectors and industries (e.g., retailers, restaurants, hotels) in the region in the fourth quarter. One industry that will likely see a negative impact to earnings due to the storm is Insurance, as a number of companies in this industry will likely report catastrophe losses for Q4 2016 due to the storm. How much will Hurricane Matthew impact earnings for the S&P 500 Insurance industry in Q4?

At this point in time, no companies in the S&P 500 Insurance industry have provided estimates for the potential losses due to Hurricane Matthew. For Hurricane Sandy back in 2012, most insurance companies did not announce estimates for catastrophic losses until four to six weeks after the storm had passed.

Contrasting Catastrophes

Hurricane Sandy (which hit the east coast of the US in October of 2012) caused the S&P 500 Insurance industry to record a much larger decline in earnings for Q4 2012 than expected prior to the storm. For Q4 2012, the Insurance industry reported a year-over-year decline in earnings of -31.2%, compared to an estimated earnings decline of -4.2% on September 30 (prior to the storm). Within the Insurance industry, the Property & Casualty and Multi-line Insurance sub-industries reported the largest decreases in earnings due to the storm. The Property & Casualty sub-industry reported a year-over-year decline in earnings of -45% for Q4 2012, compared to an estimated decline of -4% on September 30, 2012. The Multi-line Insurance sub-industry reported a year-over-year decline in earnings of -78% for Q4 2012, compared to an estimated decline of -16% on September 30, 2012.

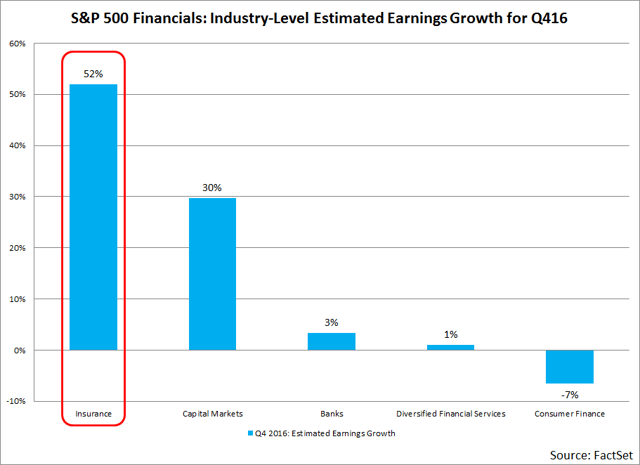

The Financials sector is expected to report earnings growth of 15.3% for the fourth quarter. The Insurance industry is currently projected to report the largest earnings growth (52%) of all five industries in the Financials sector for Q4 2016. This industry is also projected to be the largest contributor to earnings growth for the entire Financials sector for the fourth quarter. At the company level, AIG is expected to be the largest contributor to earnings growth for both the Insurance industry and the entire Financials sector for Q4 2016, due to an easy comparison to a year-ago loss. The company is expected to report EPS of $1.24 for Q4 2016, compared to actual EPS of -$1.10 in Q4 2015. AIG is classified as a Multi-Line Insurance company. Thus, any substantial downward revisions to EPS estimates for AIG due to catastrophic losses for Hurricane Matthew will have a significant impact on the overall earnings growth expectations for the Financials sector for Q4.

Read more about earnings trends in this edition of FactSet Earnings Insight. Visit www.factset.com/earningsinsight to launch the latest report.