Exxon Mobil and Chevron will also be focus companies for the market next week, as both companies are scheduled to report earnings on October 28. The mean EPS estimate for Exxon Mobil for Q3 2016 is $0.59, compared to year-ago actual EPS of $1.01. The mean EPS estimate for Chevron is $0.39, compared to year-ago actual EPS of $1.25. If both companies report a decline in EPS, it will mark the seventh straight quarter that both Exxon Mobil and Chevron have reported a year-over-year decline in EPS.

Exxon Mobil and Chevron are not the only companies in the S&P 500 Energy sector expected to report a year-over-year decline in earnings for the third quarter. In fact 26 of the 37 companies in the sector (70%) have reported or are projected to report a year-over-year decline in EPS for the quarter. In aggregate, the Energy sector is reporting a year-over-year decline in earnings of -73%. If the sector reports a decline in earnings, it will mark the seventh straight quarter that the Energy sector has reported a year-over-year decline in earnings.

The Energy sector is also expected to be the largest contributor to the expected earnings decline for the entire S&P 500 for the third quarter. If this sector is excluded, the blended (combines actual results for companies that have reported and estimated results for companies yet to report) growth rate for the S&P 500 improves to 3.3% from -0.3%. The third quarter will likely mark the eighth straight quarter that the Energy sector has been the largest detractor to earnings growth for the S&P 500.

How Much Longer is the Energy Sector Expected to be a Drag on Earnings Growth for the S&P 500?

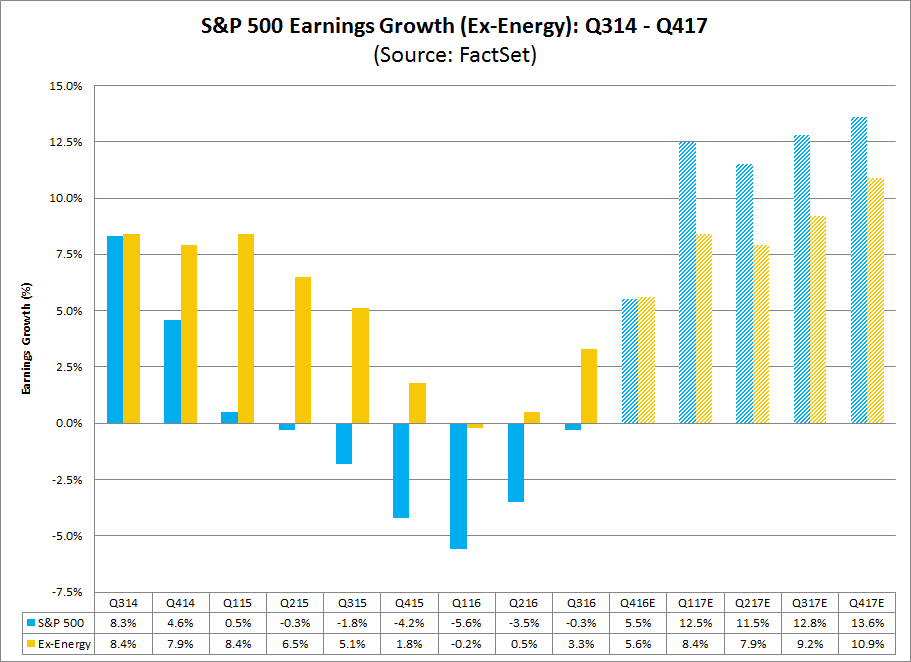

The chart below shows the overall earnings growth rates for the S&P 500 and the earnings growth rates excluding the Energy sector. It is interesting to note that the S&P 500 would have reported earnings growth in four of the past five quarters (not including Q3 2016) if the Energy sector was excluded.

Starting in Q1 2017, the Energy sector is expected to be a positive contributor to earnings growth for the S&P 500. What is driving the projected positive contribution of the Energy sector to overall earnings growth for the index in 2017? It is due to a combination of higher expected oil prices in 2017 and easier comparisons to weaker earnings in 2016. For more details, see Oil Prices, Energy Earnings Expected to Rise in 2017.