It was another strong year for shareholder activism in 2016. Activists launched 319 high impact campaigns against U.S. incorporated companies, which marked the third highest annual count since 2009, after 2015 (377 campaigns) and 2014 (344 campaigns). High impact activism refers to activist situations that involve market-moving objectives: board control, board representation, to maximize shareholder value, to remove officer(s)/director(s), or a public short/bear raid.

It is no longer just big names like Pershing Square, Icahn Associates, and Starboard Value who are pursuing activist investing. In fact, over the past few years, these well-known activist investors have actually been responsible for a decreasing percentage of the total number of activists launching campaigns. FactSet used the SharkWatch 50 list to highlight this trend. The SharkWatch 50 is a compilation of the 50 most significant activist investors as chosen by FactSet. Inclusion in the group is based upon a number of factors, including the number of publicly disclosed activist campaigns waged (with an emphasis on recent activity), as well as the ability to affect change at targeted companies.

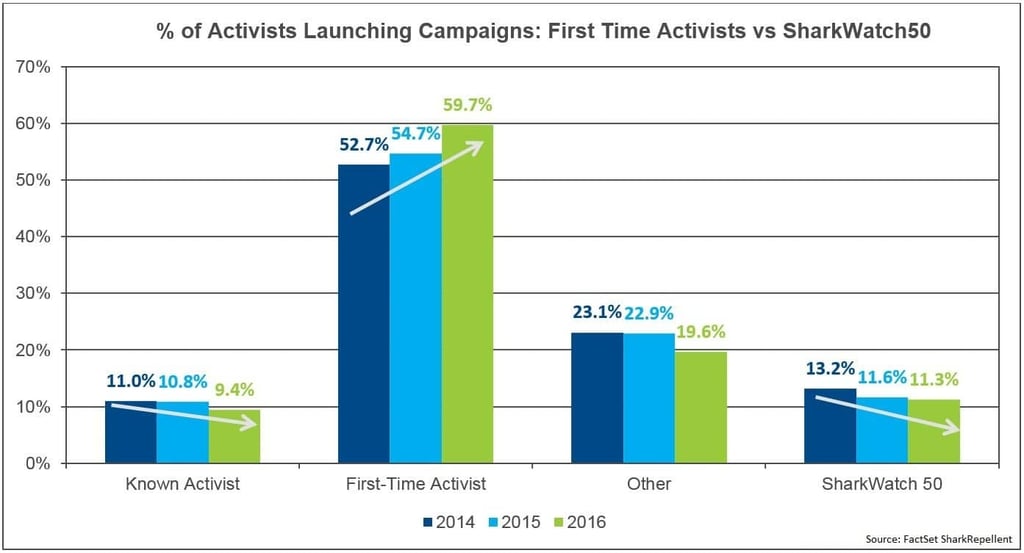

In 2014, the SharkWatch 50 represented 13.2% of activists who launched campaigns against U.S. incorporated companies during the year. At the end of 2016, this group made up only 11.3% of activists who announced campaigns. Looking at campaign volume, a SharkWatch 50 member was a dissident (or part of the dissident group) in over 41% of activist campaigns during 2014 and 2015, compared to just 31% in 2016.

A similar trend can be seen when analyzing “Known Activists." FactSet defines Known Activists as non-SharkWatch 50 activists that have launched five or more high impact campaigns since inception. Examples of Known Activists include BLR Capital Partners, SpringOwl Associates, and Atlantic Investment Management. In 2014, Known Activists represented 11% of activists who launched campaigns during the year. At the end of 2016, this percentage dropped to 9.4%.

The Rise of First-Time Activists

On the other end of the spectrum, “First-Time Activists” have made up a growing portion of the total activists announcing campaigns. FactSet defines First-Time Activists as those who have now previously been involved in a public high impact activist situation. In 2014, First-Time Activists represented approximately 53% of activists launching campaigns during the year. That number increased to nearly 55% in 2015, and then jumped to approximately 60% by the end of 2016. Examples of First-Time Activists in 2016, along with the company they targeted, were Newtyn Management and CSW Industrials, Potrero Capital Research and Datawatch Corp., and venBio Select Advisor and Immunomedics.

The targeted companies of these campaigns tend to have smaller market values. Looking at activist campaigns for each of the last three years, the median market cap of the target for First-Time Activists has been lower than the median market cap of the target for Known Activists and SharkWatch 50 activists. One of the reasons for this is that First-Time Activists typically have lower equity assets under management. With lower amounts of equity assets, it is difficult to influence change at large or mega caps given the amount of funds required to accumulate a meaningful stake. Keep in mind that this may not always be the case.

One of the most interesting campaigns of the year occurred in early January, when First-Time Activists Altimeter Capital Management and PAR Capital Management disclosed a combined 5.5% stake in United Continental Holdings, as well as their intent to nominate six candidates for election to the airline’s board. In the end, a settlement was made and the activists were granted two board seats.

When most people hear the word activism in the context of investing, they tend to immediately think of names like Carl Icahn, Bill Ackman, or Dan Loeb. While there will certainly be some highly publicized campaigns announced by one of these names against a large or mega cap stock in the future, it will also be important to monitor the growing number of institutions engaging in activist investing for the first time.