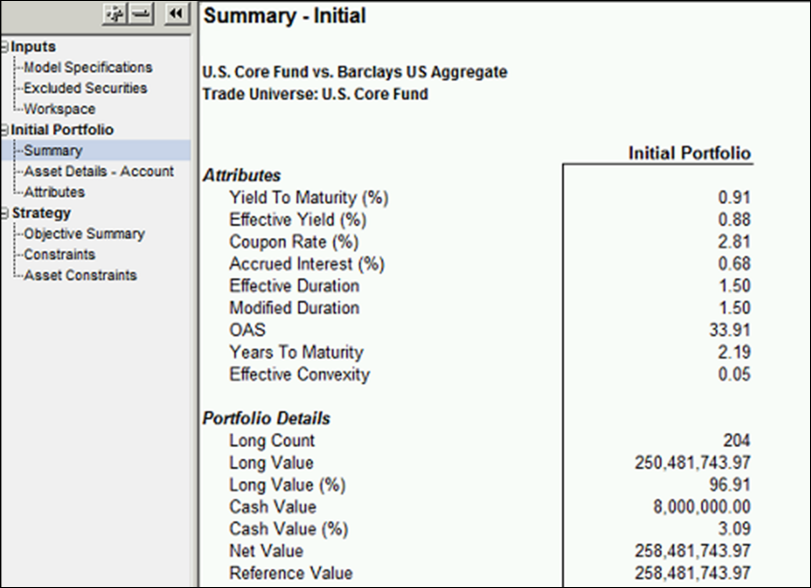

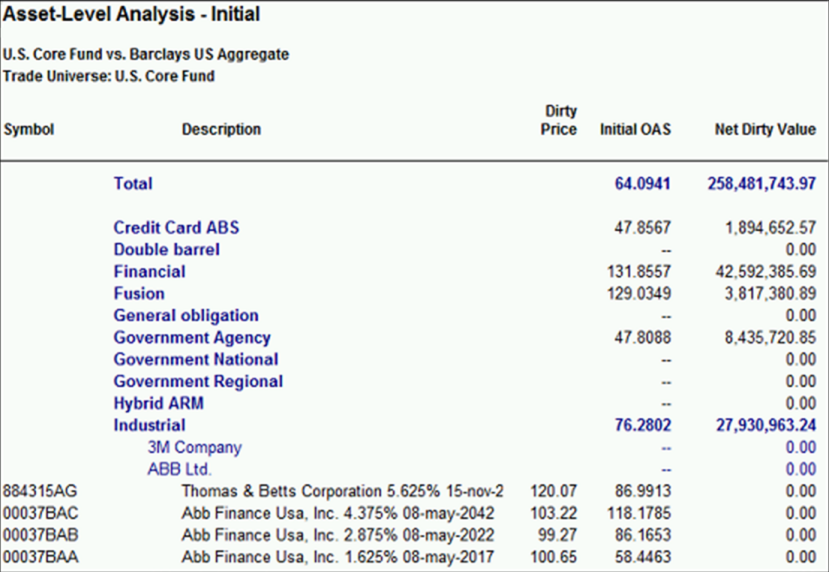

The Axioma Portfolio Rebalancer, now available on FactSet, is a fixed income optimization tool that tells you which bonds to trade in order to realize your investment objectives. Based on your own custom-defined objectives and constraints, the Rebalancer provides a list of recommended trades that will advance your investment goals. For example, given a specific portfolio, the tool can be directed to produce a recommended final portfolio whose duration matches its benchmark while keeping the active S&P rating weight within 1% of the benchmark.

Define objectives and constraints on a benchmark-relative or absolute basis and include fixed income attributes such as duration, yield, or spread. Constraints also include both fixed income attributes and weighting schemes, including sector, rating, and limit holding.