Power burn remains a key component of natural gas demand. In past articles, we have examined power burn by region and state, but here we will look at it by pipeline. Over the last 20 years, natural gas power plant development was driven first by the speculative power plant boom in the early 2000s. This boom was followed by the development of natural-gas-fired power plants in proximity to low-cost shale gas supplies.

Here we look at how much gas power plant development has occurred and which pipes have been the biggest beneficiaries of power plant capacity and generation growth.

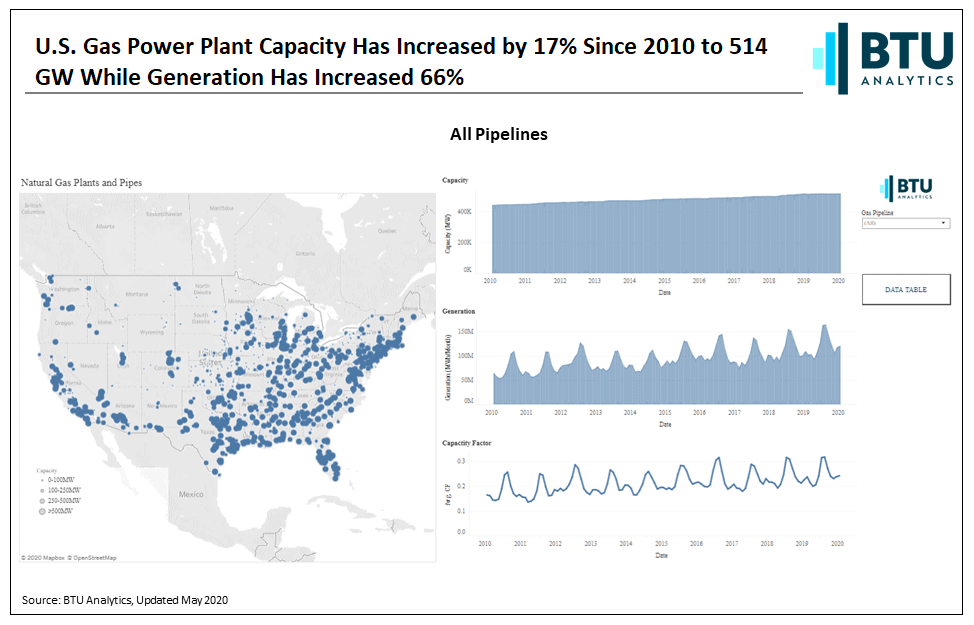

U.S. Gas Power Plant Capacity Since 2010

As shown above, U.S. gas power plant capacity has increased by 17% since 2010. The combination of low natural gas prices driving coal displacement and new high-efficiency gas plants has increased natural-gas-fired generation by 66% over the same time frame. The charts display data from BTU Analytics’ Power View platform, which allows us to view all-natural gas plants in the U.S. as well as filter natural gas plants based on the natural gas pipeline serving the power plant.

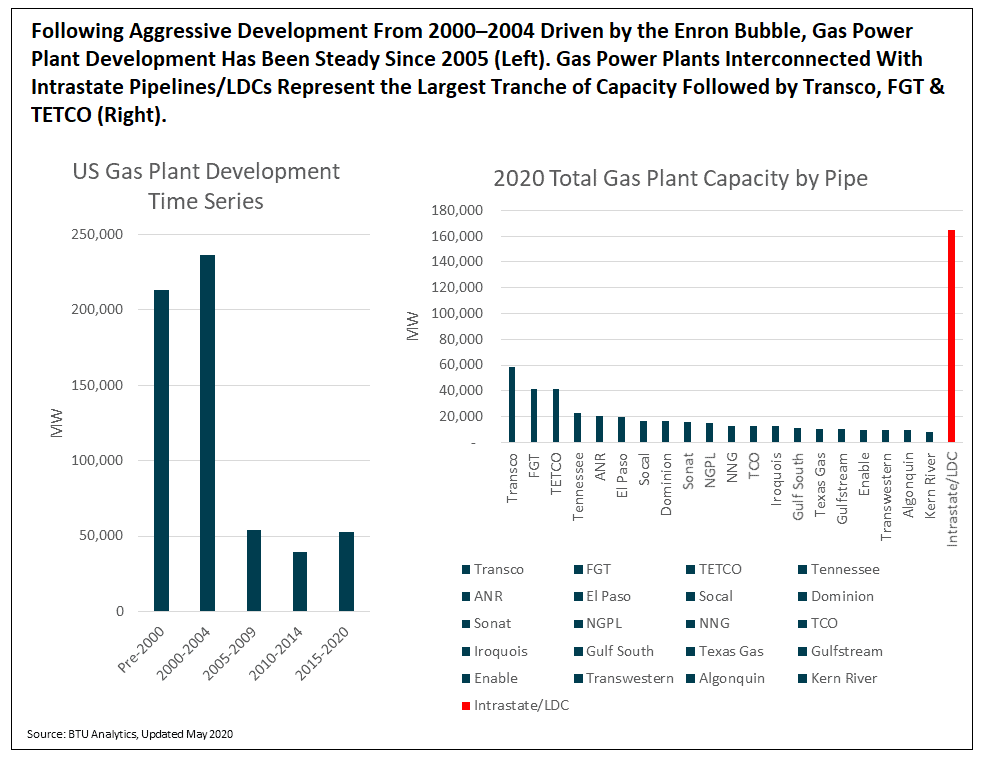

Gas Power Plant Development Snapshot

The chart above on the left shows gas power plant development in five-year increments and the boom in 2000-2004 when gas plant capacity more than doubled thanks to low gas prices and widespread development by Enron, Duke, El Paso, and Dynegy. What followed was consistent development from 2005 through 2020, driven by low-cost shale gas. One recurring theme has been gas plant development in supply areas proximate to large sources of electric load. The Marcellus in Appalachia was well positioned and advantaged Appalachian connected pipelines.

The chart above on the right shows the 20 pipelines sorted by total gas plant capacity in 2020, with Marcellus-connected pipes of Transco, TETCO, Tennessee, ANR, and Dominion rounding out the top 10. Note that in BTU’s Power View, gas plants that are interconnected to intrastate pipelines and LDCs are grouped together and represent the largest tranche of capacity.

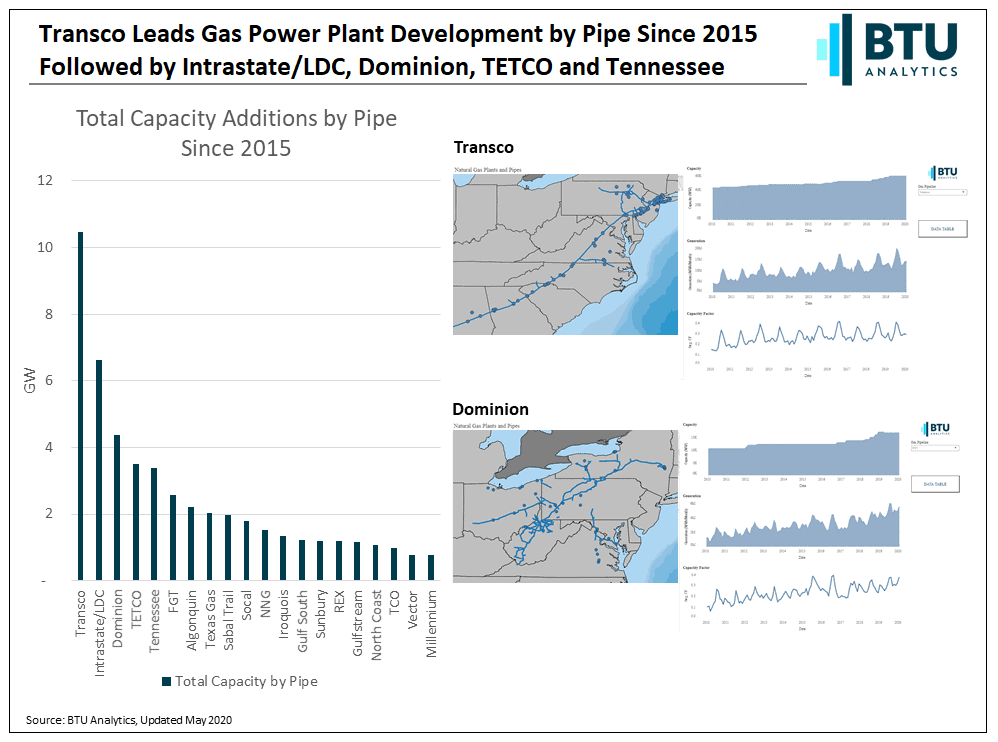

The impact of the Marcellus and its proximity to major sources of power load can be seen further when looking at the incremental total capacity increases by pipe from 2015 to 2020. Again, Transco takes the top spot, but other Marcellus-connected pipes in the top five spots include Dominion, TETCO, and Tennessee, as shown in the chart above on the left. In the chart above on the right, we see that capacity for Transco and Dominion increased by 22% and 37%, respectively, and generation increased by 36% and 41%, respectively, on each pipe. You can learn more about BTU Analytics’ Power View here.

This article was originally published on the BTU Analytics website.

This blog post is for informational purposes only. The information contained in this blog post is not legal, tax, or investment advice. FactSet does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.