While often debated on its efficacy, the Fama-French Factor modeling system for public equities is a longstanding methodology for finding premiums. Could a similar type of factor system work in private markets? Or at least reveal opportunities for further review?

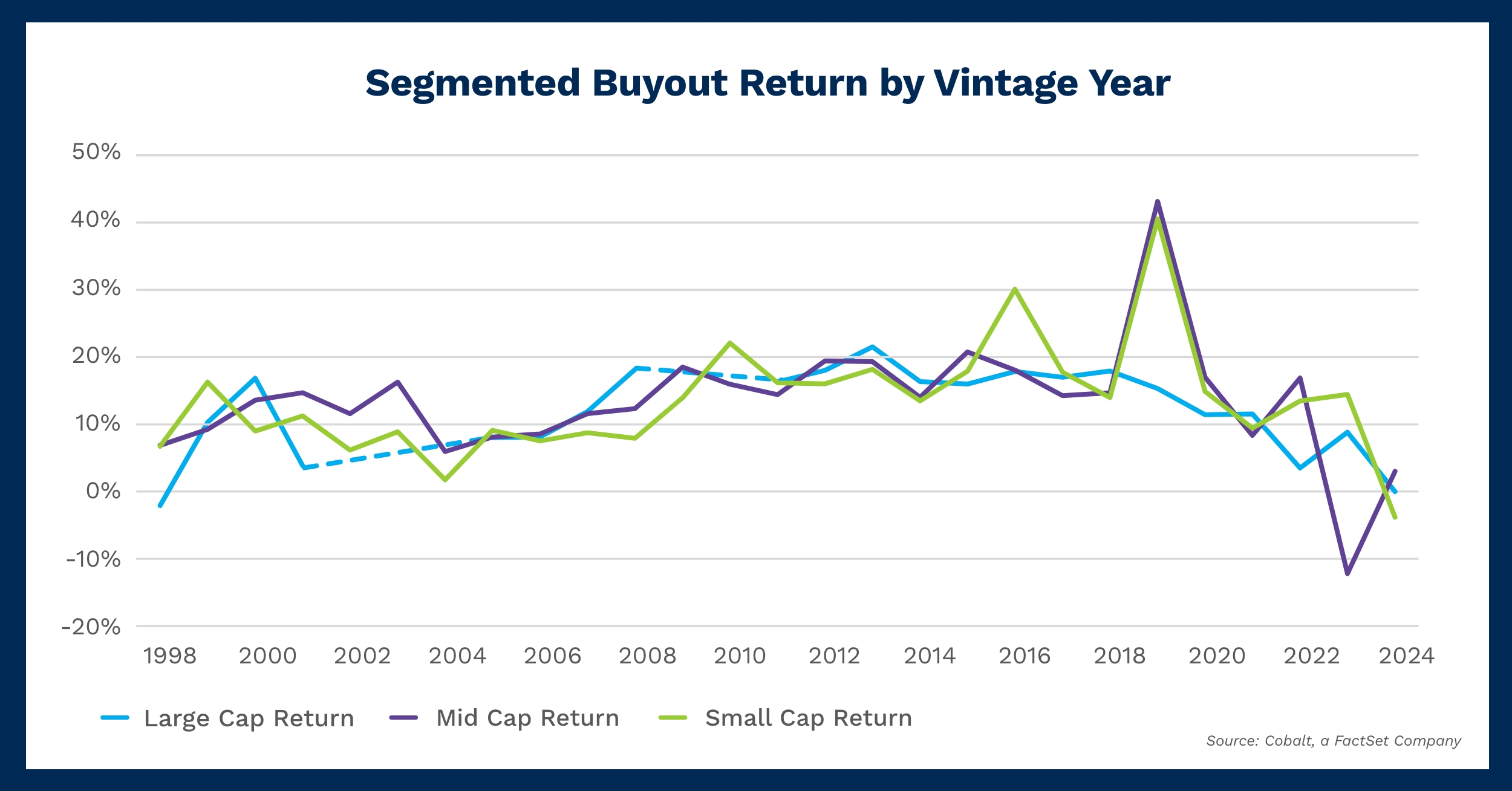

We examined the size factor, starting with this question: Is there a difference in performance between large and small funds? We analyzed the returns on North America buyout using Cobalt data to provide the largest sample size, and then we split the sample into three fund sizes: small, mid, and large cap (defined in Cobalt as $5M-$750M, $750M-$5,000M, and $5,000M and above, respectively) to see if any clear difference in return could be found.

Key Takeaways

All three strategies feature remarkably similar average returns over the dataset, with large and mid caps both returning around 13% and small cap returning 11%. The three styles also follow similar trajectories over the sample period, tending to correlate their returns in most years.

There are clear disconnects between the styles, however. Large and mid caps seem to outperform on average, though as size decreases volatility seems to increase. That is likely due to the smaller investment sizes encouraging them to invest into more barbell return style opportunities a la venture capital. Large cap clearly demonstrates the smoothest return as its large size of investment incentives are viewed as a safer, more consistent investment.

Looking Ahead

As a whole, buyout has historically been a very safe bet. Even while it slid in the mid-2000s, the returns were always positive, and the investment style inherently lended itself to long-term stability. As we head into a period of instability globally, this likely gives many investors some degree of comfort.

However, as we come back to the original premise, we see that if we anticipate entering a period of volatility, then a fund-size-based volatility trade may be worth further investigation given the disparity in return distributions seen across the past 20 years.

This blog post is for informational purposes only. The information contained in this blog post is not legal, tax, or investment advice. FactSet does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.