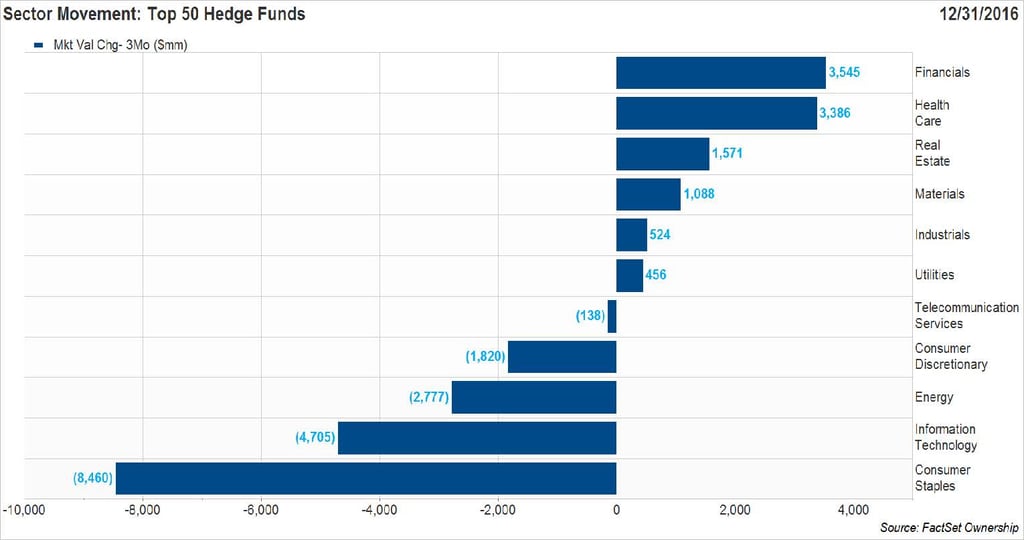

The 50 largest hedge funds decreased their equity exposure by 1% in Q4 2016. This marked a reversal from Q3, when equity exposure increased by 2.9%. Six of the 11 GICS sectors experienced aggregate purchases during the quarter, with the Financials and Health Care sectors leading the inflows. On the opposite end, the Consumer Staples and Information Technology groups were the largest aggregate sales of all sectors.

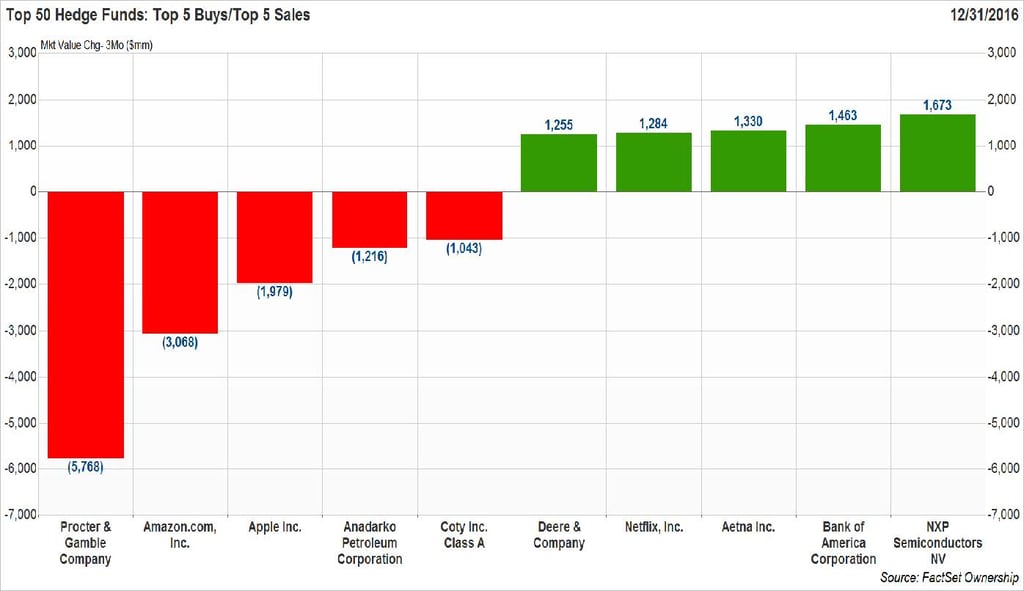

At the company level, NXP Semiconductors NV and Bank of America were the top buys in the fourth quarter, while Procter & Gamble and Amazon were the top sales.

Hedge Funds Buy Financials and Health Care

The top 50 hedge funds bought $3.5 billion worth of stock in the Financials group during the fourth quarter, which represented the largest aggregate purchase of all 11 GICS sectors. Bank of America was the top buy in the group, with funds adding $1.5 billion worth of the bank’s stock. It was also the second largest purchase overall in Q4. Within the sector, the buys were widespread, with funds adding over $1 billion to each of the Diversified Financials, Insurance, and Banks industry groups. S&P Global and Marsh & McLennan were the largest hedge fund purchases in the Financials sector, after Bank of America.

The Health Care sector was the second largest aggregate purchase at the sector level. This was in stark contrast to Q2 and Q3, when the group represented the largest aggregate sale. During this streak, the Pharmaceuticals, Biotechnology, and Life Sciences industry group drove a majority of the outflows. This trend continued in the fourth quarter as hedge funds sold off $1.3 billion worth of stock in the group. However, the selloff in this group was outweighed by the $4.4 billion that was added to companies in the Health Care Equipment & Services industry group. Aetna led the inflows with $1.3 billion worth of stock being purchased by hedge funds. Aetna was the third largest aggregate purchase overall among the top 50 hedge funds. Additionally, hedge funds bought over $500 million worth of shares in UnitedHealth Group, Anthem, and Medtronic.

Hedge Funds Sell Consumer Staples and Information Technology

After being the largest aggregate purchase at the sector level in Q3, the Consumer Staples sector was the largest aggregate sale in Q4. During the third quarter, Millennium Management was a primary driver of the sector inflows, as the hedge fund made large purchases of Procter & Gamble and Coty. The fund was the leader of the sector outflows in Q4, as it exited its stake in P&G and reduced its position in Coty. Procter & Gamble was the largest sale among the top 50 hedge funds during the quarter and Coty was the fifth largest sale. Within the Consumer Staples sector, the top 50 hedge funds also removed over $600 million worth of shares from Anheuser-Busch and Monster Beverage. Hedge funds removed $8.5 billion worth of stock from companies in the Consumer Staples sector, making it the largest sale at the sector level during Q4.

The Information Technology sector was the second largest aggregate sale in Q4, with hedge funds removing $4.7 billion worth of stock. Apple and eBay were the top sales in the sector. The top 50 hedge funds sold off $2 billion worth of stock in Apple and $1 billion worth of stock in eBay. Apple was the third largest aggregate sale overall in Q4 and eBay was the seventh largest aggregate sale overall. Some of the other top sales within the Information Technology sector were Mastercard, Autodesk, Alphabet Class C, Facebook, and VMware.

Despite the large amount of outflows in the Information Technology sector, the top purchase during the quarter still came from this sector. The top 50 hedge funds bought $1.7 billion worth of stock in NXP Semiconductors NV, which represented the largest purchase in Q4. Farallon Capital Management, OZ Management, Carlson Capital, CNH Partners, Soroban Capital Partners, and D.E. Shaw & Co were several of the funds that contributed to the inflows.