"Transcendent liquidity" is a somewhat silly-sounding phrase coined by the equally silly Matt Hougan, CEO of ETF.com, to discuss the odd situation in fixed-income ETFs—specifically, fixed-income ETFs tracking narrow corners of the market like high-yield bonds.

But it's increasingly the focus of regulators and skeptical investors like Carl Icahn. Simply put: Flagship funds like the iShares iBoxx High Yield Corporate Bond ETF trade like water, while their underlying holdings don't. Is this a real problem, or a unicorn?

The problem with even analyzing this question starts with definitions. When most people talk about ETF liquidity, they're actually conflating two different things: tradability and fairness.

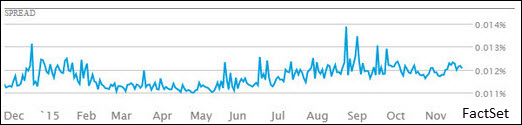

Tradability is actually a pretty simple concept: How well will the market let me get in or out of an ETF? And for narrow fixed-income ETFs (I'm limiting myself to corporates, in this analysis), most investors should be paying attention to the fairly obvious metrics, e.g., things like median daily dollar volume and time-weighted average spreads. By these metrics, a fund like HYG looks like the easiest thing to trade ever:

On a value basis, the average spread for HYG on a bad day of the past year is under 2 basis points. It's consistently a penny wide on a handle around $80, with nearly $1 billion changing hands on most days. That puts it among the most liquid securities in the world. And that easy liquidity is precisely what has the SEC—and some investors—concerned.

But that's tradability, not fairness. Fairness is a unique concept to ETF trading. We don't talk about whether the execution you got in Apple was "fair." You might get a poor execution, or you might sell on a dip, but there's no question that your properly settled trade in Apple is "fair."

That's because Apple stock is always worth precisely what you pay for it. That's the entire function of the market—to determine the fair price for Apple based on the collective wisdom of buyers and sellers.

Of course, even Apple can get a bad print, and there are rules for breaking really erroneous trades, but for the most part, if Apple's down 10%, nobody considers it anything other than a bad day for Apple.

In an ETF, however, there is an inherent "fair" price—the net asset value of the ETF at the time you trade it—intraday NAV or iNAV. If the ETF only holds Apple and Microsoft, that fair price is easy to calculate, and is in fact disseminated every 15 seconds by the exchange.

But when the underlying securities are illiquid for some reason (hard to value, time-zone disconnects or just obscure), assessing the "fair" price becomes difficult, if not impossible.

If the securities in the ETF are all listed in Tokyo, then your execution at noon in New York will necessarily not be exactly the NAV of the ETF, because none of those holdings is currently trading.

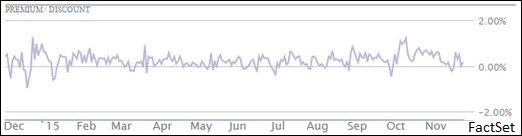

In the case of something like corporate bonds, the issue isn't one of time zone, it's one of market structure. Corporate bonds are an over-the-counter, dealer-based market. That means the iNAV of a fund like HYG is based not on the last trade for each bond it holds (which could literally be days old), but on a pricing services estimate of how much each bond is worth. That leads to the appearance of premiums or discounts that swing to +/- 1%.

HYG premia:

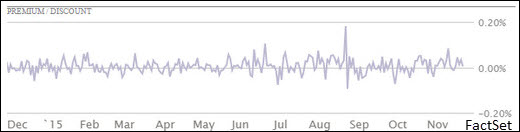

Compare that with the handful of basis points typical in the SPDR S&P 500 ETF.

SPY premia:

Importantly, this is over the last year, which has been a pretty calm market for HYG. During crisis periods, HYG can spike a premium or discount of more than 10%. The reason is pretty simple: profit motive.

ETFs only trade in line with their underlying securities because authorized participants (APs) can make or dispose of new shares through the creation and redemption process. If there is a premium, they can sell at that premium and make new shares by delivering the underlying. They can do the opposite if the ETF is at a discount: buying the cheap ETF shares and returning them to the issuer for a basket of underlying securities. In each case, they're buying low and selling high.

But if the underlying market can't actually handle the volume implied in making or redeeming shares, the APs will let the price drift until the gap is so wide they're positive they can make money. And because there are multiple APs all trying to book a profit, when the gap widens and stays wide, it points to costs and risks that may not be obvious just looking at the numbers.

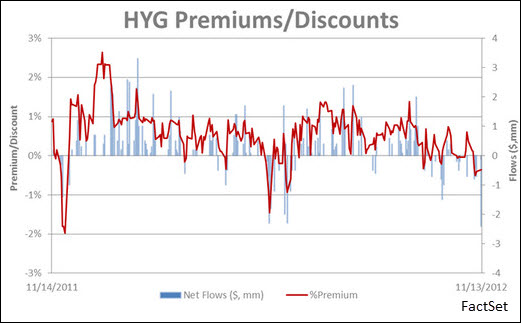

In the case of corporate bonds, the reality is that the underlying markets simply can't absorb large amounts of creation and redemption activity, so the flow of money into or out of the ETFs will almost always force a premium or discount. Take a look at 2012 in HYG—a period where we had a nice clean opinion shift on junk bonds to analyze:

You can see in the fall of 2011, everyone wanted out, and the fund traded to a 2% discount. Then everyone wanted back in for months, and it consistently traded at premiums as high as 2.5%. Then in mid-2012, again, people wanted out, and boom, right back to a 1.5% discount.

It's critical to note that all of these premiums and discounts happened while HYG continued to trade a penny wide. So there was enormous liquidity—it was just centered around a price that was "too high" or "too low."

This connect can have two explanations: Either the ETF is in fact "right" and is serving as the price discovery vehicle, or the NAV is "right" and the ETF is overpriced. It's not possible to prove without question which is going on, but I tend to side with the market. If billions of dollars are going to change hands at a price that's "too high," I think the billions of dollars are the market, and this is price discovery on an illiquid market.

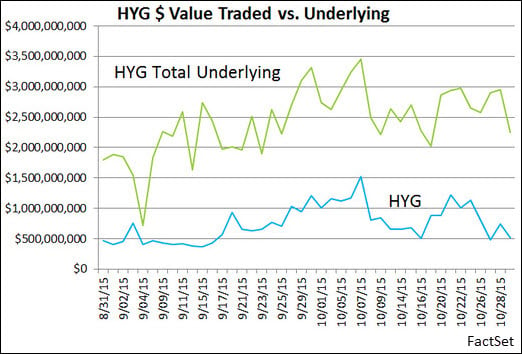

So just how illiquid are corporate bonds? Very. Consider the dollar value traded in HYG, and the dollar value traded in all of the underlying bonds it owns, combined, in a two-month window this fall:

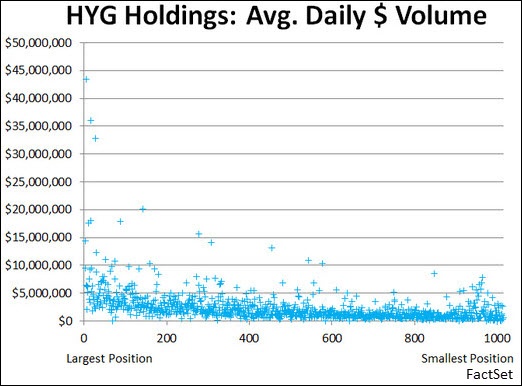

While it's not the case that HYG trades more than the overall portfolio consistently, it's definitely the case that HYG provides much more accessible liquidity than the underlying bonds—and that's what makes the SEC and skeptics nervous, because that on-screen liquidity can dry up. Looking under the hood, the average daily dollar volume in the underlying bonds is just $3.4 million:

In fact, if you look at the largest corporate bond ETFs, the picture doesn't get much better when you go into the investment-grade or short-duration space. The most liquid ETF, the iShares iBoxx $ Investment Grade Corporate Bond ETF, has underlying bonds that on average only trade $4.7 million per day, and short term bonds, represented by the Vanguard Short-Term Corporate Bond ETF, fare worst of all.

By comparison, the ETF on the equity side you'd expect to be truly illiquid—the iShares Russell 2000 ETF—has underlying holdings that are an order of magnitude more traded on a daily basis than the most liquid bonds issued by the largest companies in the world.

I've tossed an additional stat in the table above—days-to-trade. The SEC has proposed that mutual funds and ETFs manage the liquidity of their portfolios such that 85% of a fund consists of positions that could be liquidated within seven days without market impact. (An interesting test, especially for bond funds. After all, the whole point of bonds is to collect interest until maturity and get your capital back.)

Larger funds with big positions will obviously be more impacted than small funds, so when you combine the huge size of a fund like VCSH with the relative illiquidity of its holdings, it's hard to see how they pass the test.

Nobody would suggest that a fund would ever literally just try and dump an entire day's worth of volume into the market, day after day, and not impact prices. Instead, a trade impact model would map out a much longer time window to unwind a position. So the true time to unwind the average VCSH position might actually be more like 40 or 60 days (and on top of that, VCSH is just a share class of a larger mutual fund).

Does that mean every corporate bond fund closes? Probably not—I expect the SEC to revise their proposal several times before anything becomes the law of the land. However, it will likely highlight the real problem here—the broken nature of the bond market (and possibly make it worse, if significant assets must be liquidated to comply with the rules).

Already only about one-third of corporate bonds actually trade more than once every few months, and just 11% of the listed corporate bonds represent almost 60% of the actual dollars trading in corporate bonds, according to Tabb group.

The dealer market has collapsed, and all that's left are investors trading the same few bonds back and forth, leaving pricing services guessing with bigger and bigger margins of error on the real value of illiquid debt.

That's the real problem. And it's not one the SEC can fix by targeting "transcendent liquidity" in ETFs.

How Private Capital Is Powering the Johor-Singapore Special Economic Zone

This FactSet analysis provides insight into the early stage of the JS-SEZ progress with key data points. Stay informed on how...

How Transaction Cost Analysis Is Evolving from Compliance Tool to Trading Decision Support

Discover insights to further strengthen your TCA capabilities in this FactSet analysis. Consider how you can make the most of TCA...

The information contained in this article is not investment advice. FactSet does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.