Environmental, social, and governance (ESG) factors are among the most significant drivers of change in the world today with major implications for businesses and long-term investors. Global markets are increasingly focusing on factors that drive long-term enterprise value, and intangibles now represent the lion’s share of this value. Investors regard many ESG matters as critical elements of corporate resilience with a growing focus on corporate behavior, climate change, technological evolution, social equity, and human capital management.

For asset managers, the challenge is in managing the proliferation of ESG data sources as the market continues to focus on driving progress toward consistent, comparable, and decision-useful ESG information. At the same time, a responsible investment framework must facilitate a greater understanding of not only the ESG factors driving enterprise value today, but those most likely to do so tomorrow and into the future. This is the concept of dynamic materiality.

Here we describe how the Public Sector Pension Investment Board (PSP), one of Canada’s largest pension investment managers, leveraged FactSet to develop an ESG Composite score that enables PSP’s investment teams to integrate ESG information with data-driven insights. The ESG Composite score incorporates the five dimensions and 26 general issue categories that make up the standards of the Sustainability Accounting Standards Board (SASB) which are used, in addition to traditional financial considerations, to analyze corporate performance. The results of this technical integration shed a new light on the pathways to enterprise value creation using the lens of dynamic materiality.

ESG and Financial Performance

The academic literature on the relationship between ESG and financial performance is extensive. But it is only recently that concrete evidence has emerged on the importance of materiality in determining which ESG factors are most integral to investment decision-making. The analysis of ESG materiality has led to some innovative findings on the dynamic nature of materiality, with some research suggesting that financial materiality is not a “state of being” but a “process of becoming.” Therefore, it is critical for investors to recognize that ESG considerations that may not be viewed as financially material today can become material in the future. Understanding how sustainability issues become financially material can have implications for investors and capital allocation decisions.

Therefore, a data-driven solution must be designed to continually evolve to account for these emerging ESG risks and opportunities.

Developing an ESG Composite Score

To garner insights into the ESG performance of its public markets portfolio and identify opportunities to mitigate risk and create value, PSP leveraged innovative data solutions to develop a proprietary scoring methodology, the ESG Composite score. This score can both systematically identify material ESG risks and opportunities and dynamically measure the relative importance of these categories based on an artificial intelligence screening tool that monitors the materiality of these ESG risks and opportunities through an algorithm that captures stakeholder sentiment.

Using a data-driven scoring solution designed to scale PSP’s ESG integration process and monitor portfolio holdings over time, the ESG Composite score helped translate data previously available in hundreds of pages in traditional research and sustainability reports into quantitative data that could be centralized and aggregated. By enhancing PSP’s ESG integration approach to quantitatively assess company performance on material ESG factors, the scalability of ESG integration reached a whole new level. This yielded three key benefits:

- The ability to accelerate convergence between fundamental and ESG analyses

- Access to real-time information on factors impacting intangibles and enterprise value for the first time

- The facilitation of benchmarking, both at the issuer and portfolio levels, to systematically measure ESG performance and provide a complementary dimension to fundamental analysis, capturing trend and momentum akin to analysis traditionally performed on financial information

The ability to generate data-driven insights helped identify new investment ideas, support issuer selection, and contribute to alpha generation, ultimately delivering enhanced knowledge sharing across the organization.

The ESG Composite Methodology

The main objective supporting the development of a proprietary ESG Composite score was to build an industry-based ratings system informed by independent standards and focused on an investor-centric materiality definition across strategies and public markets.

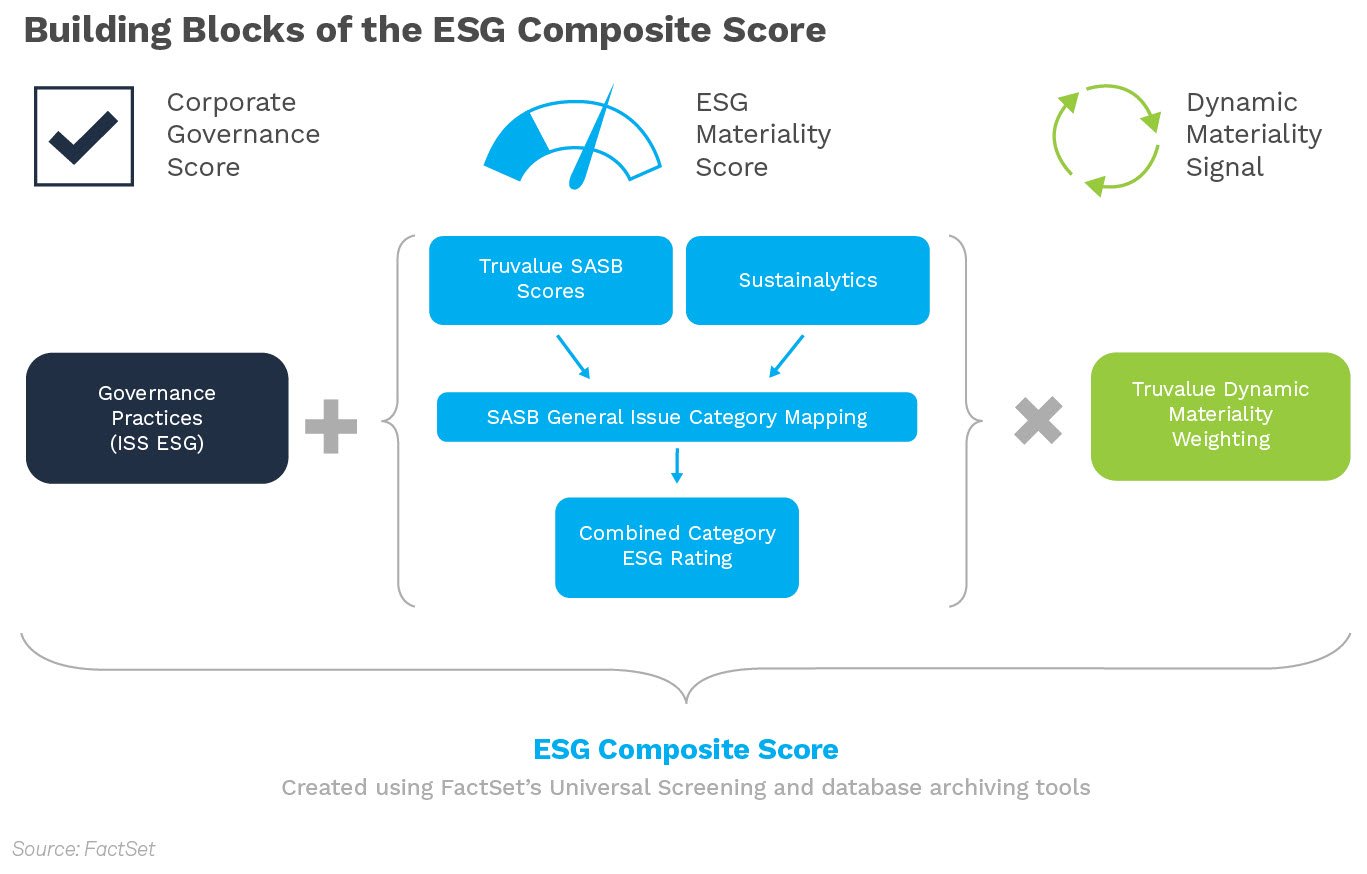

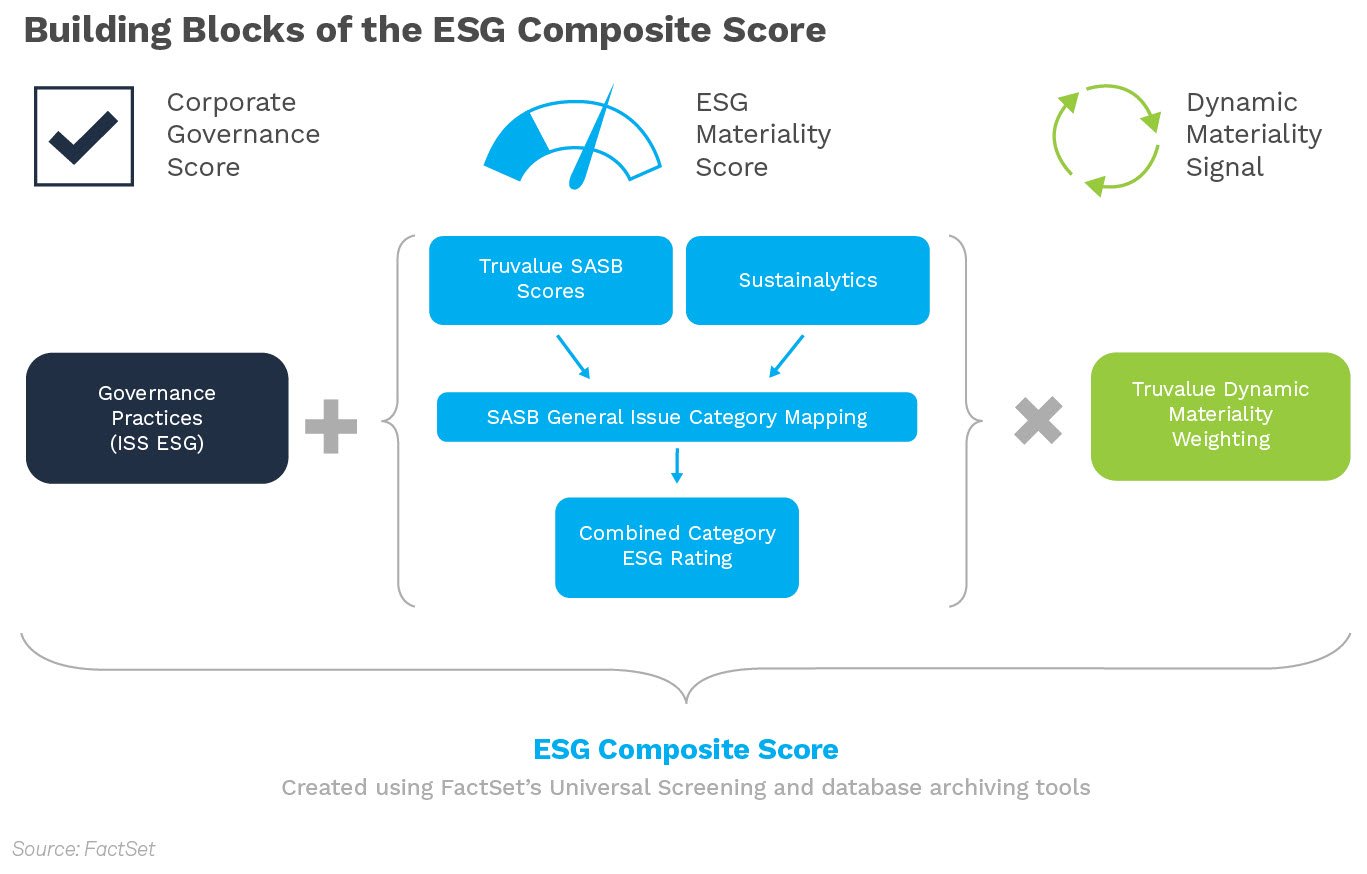

PSP’s proprietary ESG Composite score is composed of two building blocks: The Corporate Governance score and the ESG Materiality score. Corporate governance can be viewed as a control mechanism safeguarding the interests of shareholders and can also provide a strong signal on corporate culture and resilience. By leveraging ISS ESG’s Governance QualityScore, a database that draws on a library of over 200 governance factors across information from various sources of publicly disclosed corporate materials, qualitative insights from proxy voting activities could be transformed into critical inputs for the investment decision process.

The ESG Materiality score, the second building block of the ESG Composite score, is anchored on the SASB Standards classification. Focusing on SASB’s General Issue Category mapping, PSP aligned category scores from Truvalue Labs and Sustainalytics to map public issuers with the ESG categories most likely to materially affect enterprise value in their industry according to the SASB Standards. FactSet’s screening and warehousing tools were then used to create comparable scores from the two providers from which a weighted average score is calculated.

Finally, PSP used industry-relative ESG category performance and Truvalue’s proprietary Dynamic Materiality calculation to weight the ESG category scores. The critical step of incorporating dynamic materiality in real time eliminates the subjectivity of weighting decisions when combining the two scores to ensure that the most salient issues are receiving the most attention. The dynamic weighting and ESG scores are updated daily using data from FactSet’s screening tool, thereby capturing real-time changes in stakeholder sentiment.

The real paradigm shift in the ESG Composite scoring methodology came from the dynamic weighting of each material ESG category. The score was designed to quantitatively recreate PSP’s ESG due diligence process, but its implementation has helped PSP to identify new ideas and further inform investment theses.

Conclusion

Working with FactSet, PSP developed a proprietary ESG Composite score to systematically capture the impact of material ESG factors on enterprise value. In essence, this solution empowered PSP to use innovative ESG data to capture dynamic materiality and transform disclosure narrative into decision-useful insight. This journey showcases how the SASB Standards can help investors develop new tools that can further support ESG integration and inform the investment process.

For more information, refer to the SASB Standards/PSP case study Public Sector Pension Investment Board (PSP Investments): Integrating SASB Standards into Dynamic ESG Composite Score.

James Cardamone also contributed to this article. This article was originally published on the SASB web site.

The information contained in this article is not investment advice. FactSet does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.