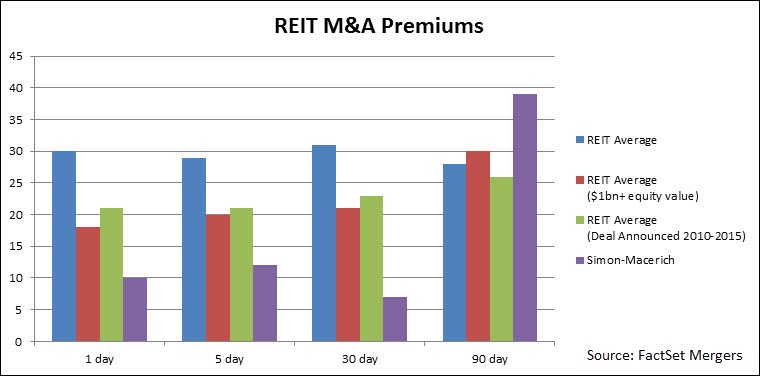

Last week, Simon Property group sweetened its unsolicited offer to The Macerich Company from $91 per share to $95.50 per share in cash and stock. Simon’s second offer, which it stated was its best and final offer, represents a 10% premium to the closing stock price the day before Simon Property first publicly disclosed its unsolicited bid and 37% dating back to the day before Simon Property first disclosed its 3.6% stake in Macerich. The Simon Property offer is below the average one-day premium for REITs of 30% but better than the premium of 28% dating back 90 days prior to the offer. The premium, however, is only a fraction of the additional cost of acquisition to Simon Property after the tactics implemented by Macerich, specifically the adoption of a poison pill and its classifying the board of directors.

The poison pill adopted by Macerich will trigger if Simon acquires more than 10% of Macerich’s outstanding shares. The trigger, which they reduced from 15%, gives the right to all current shareholders, except Simon, to purchase $275 worth of new Macerich shares at a 50% discount, which was an increase in the exercise price, or required purchase amount, of $112. Shareholders are incentivized to purchase the new shares so long as the discount to purchase is greater than the decrease in the market price of the shares after the market is flooded with all the new shares issued. The exercise of the rights by the shareholders creates an immediate loss to Simon on its current 3.6% investment in Macerich due to the drop in price per share and also adds to the number of shares outstanding that it must acquire to gain control of Macerich. Macerich also gets an infusion capital from the stock purchases, should it need a war chest to engage in a proxy fight.

The effect, if all rights were exercised, would be a 37% dilution in the Macerich price per share and a reduction in the voting rights of Simon's hypothetical 10% ownership to a 3% voting interest. Assuming Simon offered the same premium to purchase all outstanding shares after the execution of the poison pill, the additional cost to Simon would be over $10 billion, which is more than a 68% increase in the overall cost of the acquisition.

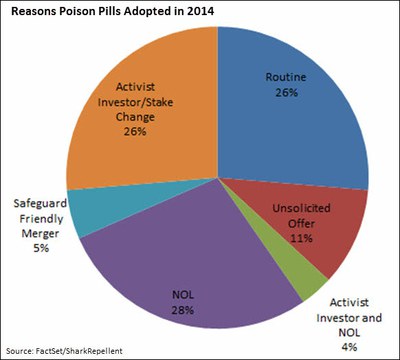

Macerich’s poison pill adoption is not a new tactic for companies that were targets of a hostile acquisition, but its terms send a particularly strong message in opposition to a takeover. Of all poison pills adopted in 2014, 11% were in response to an unsolicited offer. For all poison pills presently in force, 10% set the trigger at a 10% threshold, while a 15% trigger is the most common trigger. Presently, less than 2% of companies in the S&P 500 have poison pills in force at or below the 10% trigger threshold.

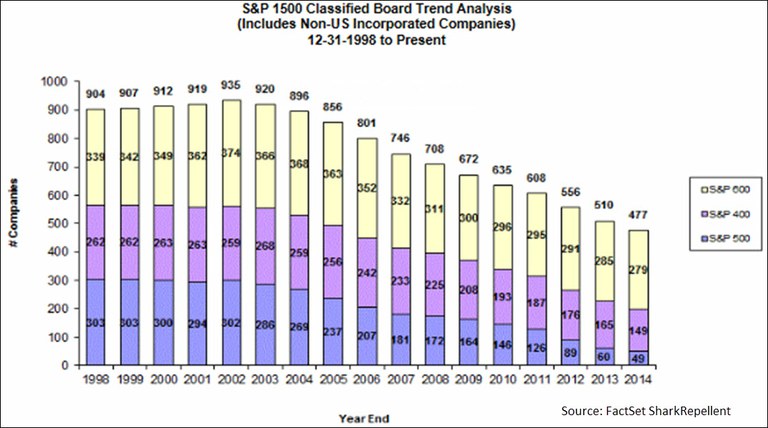

This would already make Macerich unpopular to corporate governance watchdogs, but the adoption of a classified board, especially without shareholder approval, is a move clearly against the trend. Since 2007, only five companies in the S&P 500 have added a classified board, and three subsequently have declassified the board. Macerich itself put declassification to a shareholder vote in 2008, and the proposal received 99% support of votes cast. The subtly of Macerich’s classification, and the reason it may avoid a large, negative reaction from shareholders, is the method of classifying the board was through an opt-in to Section 3-803 of the Maryland General Corporation Law rather than a specific amendment to the charter or bylaws of the company. Savvy investors may recognize the effect of the opt-in, but it will not be so clear even for those who monitor the SEC filings for changes in corporate governance.

The benefit of the classified board is that only a third of Macerich’s directors will be up for election at its next shareholder meeting. This discourages Simon from shifting tactics and attempting the acquisition through a proxy fight — first removing the current directors in favor of directors who view the merger favorably, then removing the poison pill, which is not set to expire until the 2016 annual meeting, and other takeover defenses, and then proceeding with a friendly acquisition. For Simon to gain real leverage on the board level, it would take two annual meetings to gain a majority of the board seats. Proxy fights may no longer include the cost of direct mailings to every shareholder, but there is a cost to a proxy fight, with an average cost for the dissident in 2014 proxy fights of around $500,000, plus the likely necessity of increasing its ownership position to vote for its own directors.

Simon recognizes the cost of waging a proxy fight, as well as the muted effect of a successful proxy fight when the company has a classified board, and stated in a publicly disclosed letter to Macerich that “out of respect for the shareholders of both companies, [Simon] have decided not to nominate directors” and instead put an expiration date on its offer set for April 1, 2015.

Prior to Simon’s offer, the two weaknesses in Macerich’s defense profile was annual elected directors and no poison pill in force. Macerich now has a bullet proof rating of 8.75 out of 10, compared to 2.17 for the S&P 500 and 3.40 for its industry peer group.

Simon Property is not entirely without options, however, as there are 16 other REITs in the S&P 500 that it could target, and four of those companies are within 20% of the market cap of Macerich. The average bullet proof rating for the 16 REIT companies is 2.42. Only one of those companies currently has a poison pill in force. Seven of those companies have faced previous activist campaigns, but only General Growth Properties was the target of a hostile/unsolicited offer, which also came from Simon Properties in 2010.